More areas of the business are leveraging data and insight around customers than ever before. Today’s digital consumer puts more pressure on organizations to provide personal interactions across all industries, even when that individual is not interacting face-to-face. In order to accomplish that monumental feat, businesses are turning to their data assets to give them the insights they so desperately need. But that is no easy task. We find that most organizations lack trust in their data, typically due to outdated and ineffective data management practices. Businesses can no longer wait for others within the organization to improve the quality of their data. Many are looking to take more control themselves. In fact, according to a recent Experian study, 75 percent of respondents believe data quality responsibility should ultimately lie with the business with occasional help from IT. The rise of the business user is putting more pressure on the tools they leverage. While data quality is a continuous practice that requires constant care, it is certainly enabled by technology. That technology needs to be easy-to-use, intuitive, and provide value back to the business quickly. This week, the 2019 Gartner Magic Quadrant for Data Quality Tools was issued. The report provides an overview of the players in the space and the "key capabilities that organizations need in their tool portfolio, if they are to address the increasing importance and urgency of data quality." The business user is reshaping the data quality market. Now, rather than looking at just features and functions, new Experian research shows that the ease of use by business users and the ability to work with existing technology are more important. These tools need to be designed differently than they have in the past. 56% of businesses say their IT department doesn’t fully understand the data management needs of the business. That means that organizations need to put their data more in the hands of the people who leverage it every day. At Experian Data Quality, we believe in empowering business users to better understand their data assets in order to transform their businesses. We offer easy-to-implement, easy-to-use tools that are designed to help businesses maximize their data insight and build trust in their information. We want our clients to tackle their projects with speed and agility, giving them the confidence and clarity to put their data to good use. We are proud to be named a ‘Challenger’ once again in Gartner’s 2019 Magic Quadrant for Data Quality Tools. We believe in the changing nature of the business and are working to challenge the status-quo in our industry and for our clients. Access the Gartner 2019 Magic Quadrant for Data Quality Tools report.

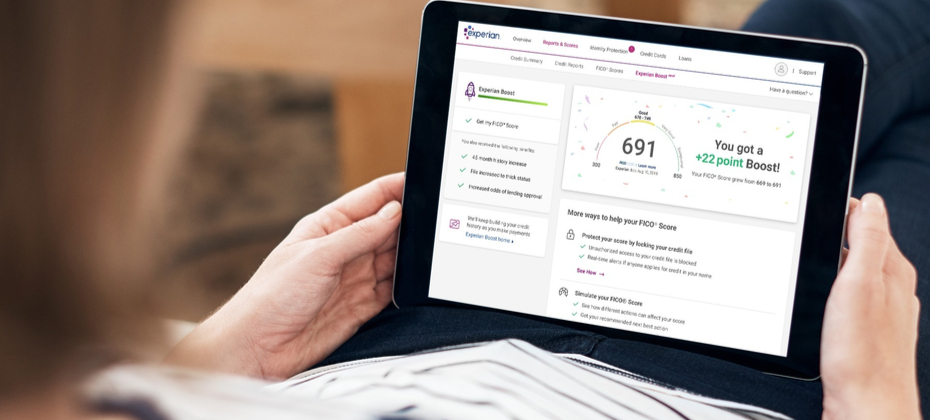

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don't have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we're bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

The Women in Experian Employee Resource Group recently celebrated International Women’s Week with a series of events, including executive panels, speakers and book club meetings. The theme of this year’s event is Better Balance = Better Experian, focusing not only on bringing awareness for gender balance, but also celebrating inclusion. The activities are part of Experian’s commitment to advancing a culture that not only respects differences, but actively celebrates them. We call this The Power of YOU. During the week, we announced that Merideth Wilson, Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, will be the lead ambassador for the Women in Experian (WiE) Employee Resource Group in North America. Throughout the year, Wilson and a global team of female leaders from across the business will plan initiatives designed to help women achieve their ambitions and build successful careers. In a Q and A this week, Wilson shared her thoughts and provided tips for women on how to be successful in the workplace. Q. Why is confidence so important for women to reach their career goals? A. Confidence is key for anyone wanting to reach their career goals, but I find it’s especially important for women to find their voice and be able to confidently express themselves. Women need to ask for what they want more often and be vocal about their career aspirations on a regular basis versus waiting for an annual review discussion, for example. Messages typically are delivered and received more successfully using a confident tone; authenticity in a person and one’s message is also very important. Q. What advice can you provide when it comes to accountability? A. Women have to hold ourselves accountable, both professionally and personally, and deliver/drive the results we say we will (or sign up for). Being accountable means taking personal responsibility for the outcome and removing the roadblocks in our way to achieving our goals. I often find that “credibility” is tied to “accountability,” and the importance of how we as women conduct ourselves in driving to the results cannot be overstated. Q. What are your thoughts on communication skills and being self-aware? A. Women need to know their audience. Effective communication often requires different styles and mediums depending on the situation and environment. One of the greatest communication skills a woman can have is the ability to confidently present in public. Public speaking is scary to many, but with practice it can be a woman’s best asset. Q. Explain how empathy and honesty can be key to career growth. A. Integrity, honesty and trustworthiness are three key traits to help propel a person’s career growth. It is nearly impossible to grow one’s career without the ability to truly relate to others with understanding, appreciation and respect for another person’s journey or perspective. Q. Why is it important to be inspirational and optimistic in the workplace? A. Good leaders inspire others to do more, be more and produce more. I find that people generally want to work with people they like, trust, admire and find upbeat. Bringing our full selves to work each day — in mind, body and spirit — helps contribute to a happy, productive and fun work environment for all, and it’s something we should aspire to each day. About Merideth Wilson Wilson is Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, a position she assumed in September 2014. In this role, she serves as the executive responsible for the Claims, Contract Manager, Patient Estimates and Medical Necessity solution suites and operations. Wilson joined Experian in January 2004 through the Medical Present Value, Inc. (MPV) acquisition. She has held various leadership positions in operations, product management and development, outsourcing services, client delivery, and strategic marketing and planning. Wilson earned a Master of Business Administration from Mercer University and a Bachelor of Business Administration from Baylor University.