Generative A.I. is rapidly transforming every industry as we know it and introduces a whole new world of opportunity and risk. At Experian, we already have many years of experience in machine learning, neural network embedding and artificial intelligence. Because of this, we’re established as a trusted leader in the space and are uniquely positioned to champion the ethical, responsible and compliant use of generative A.I. We manage the risk while advancing the opportunity. This was one of the key themes emerging from a recent panel discussion for Bloomberg’s Intelligent Automation Event in London that I participated in with Thomas Duecke, COO, Digital at BT Group, Marc Palmer, CTO at T-Systems and Amy Thomson, Bloomberg’s EMEA Technology Team Leader. At Experian, we support the responsible use of generative A.I. to accelerate new product offerings, drive operational productivity, increase financial inclusion, and foster an adaptive approach to using the technology. I’m personally very passionate about this as my team is dedicated to creating innovative solutions that enable clients to better automate processes across a variety of use cases including fraud prevention, lending and process optimization. We’re always looking for new data-driven solutions that can create meaningful change for consumers around the world. That’s why our teams are focused on advancements through generative A.I. and identifying use cases across many aspects of our internal operations as well as within our customer-facing portfolio of products and services. We’re encouraged by the opportunities generative A.I. can facilitate when it comes to productivity. It can allow us to automate processes that are mundane or labor-intensive and enable employees to focus more of their time and energy on creative decision making, problem solving, and more effective collaboration. We’ll continue to leverage our expertise and knowledge in broader intelligence fields to uncover the opportunities this next chapter will provide for our business, clients and consumers. Bloomberg Intelligent Automation

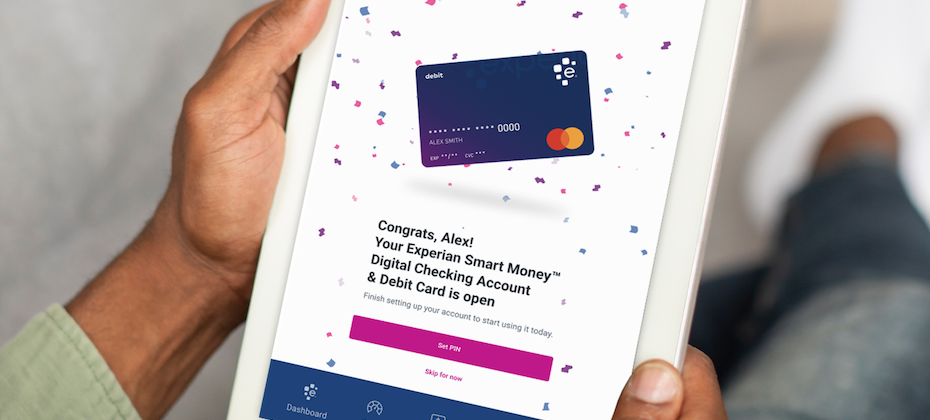

Our mission at Experian Consumer Services to achieve Financial Power for All™ drives our purpose and innovation. As part of this focus, we aim to help the more than 28 million1 consumers who are considered “credit invisible” with no or little credit history to gain fair and affordable access to credit. Continuing in our commitment to financially empower consumers, we are excited to announce today the launch of the Experian Smart Money™ Digital Checking Account & Debit Card2. What makes the Experian Smart Money Account unique is that it takes one of our most successful features ever in Experian Boost®3 to a new level of ease by embedding the feature in our new digital checking account. Experian Boost is a free game-changing feature launched in 2019 that allows consumers to contribute positive payments for eligible bills such as utilities and residential rent to their Experian® credit reports to potentially increase their credit scores. More than 14 million consumers have already connected to Experian Boost – via their existing checking account or credit card – with an average FICO® Score 84 increase of 13 points, among those who saw an increase. Now, the Experian Smart Money Account will drive efficiencies for consumers by allowing them to build credit more easily without debt and manage their day-to-day finances in one place. Helping consumers along their financial journeyWe understand that every consumer has different needs when it comes to their finances. When consumers engage with Experian, they can tap into many resources such as Experian Go™, which allows consumers to directly establish an Experian credit file for the first time and take off on their credit journey. For consumers who already have a credit profile and are looking to build their credit history and potentially increase their credit scores, they can leverage Experian Boost to contribute eligible payment history to their Experian credit file. Now with the Experian Smart Money Account, Experian is building upon these innovations and creating an even more robust credit and financial hub beneficial for various life stages. In fact, being credit visible and establishing a good credit score is essential for achieving many goals like moving into a new home, buying a car or securing employment. The positive impact we can have on consumers’ financial lives is what motivates us every day to create products and tools like the Experian Smart Money Account. Making ‘smart’ money movesWhile Experian is entering a different category of services, offering a digital checking account is a natural next step for us to help consumers reach their financial goals. The Experian Smart Money Account could most benefit consumers who are looking to build their credit profile. So, we believe our credit-building power makes this offering a positive complement to other financial products and services in the market. The Experian Smart Money™ Account accelerates, supports, and enriches consumer choice to build credit responsibly, which has a direct impact on the growth of credit-eligible populations. It benefits both consumers and broader financial institutions, and we are dedicated to playing a special role in the financial ecosystem helping consumers leverage debit and credit to their advantage. For more information about Experian Smart Money™ Account, visit www.experian.com/smartmoney. 1 Financial Inclusion and Access to Credit by Experian and Oliver Wyman, October 2021 2 The Experian Smart Money Debit Card™ is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. 3 Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. 4 Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

You may have recently read that Experian®, alongside the other two credit bureaus, permanently extended free weekly access to consumer credit reports through AnnualCreditReport.com. While I believe the move helps consumers more regularly review their credit reports, it only begins to scratch the surface of how we empower consumers to take control of their financial lives. People come to Experian looking for ways to improve their financial health. We have direct relationships with millions of consumers and listen to their wants and needs. That’s why we’ve transformed ourselves into the one stop shop for our members to address many facets of their financial journey. Whether it’s accessing credit education materials, monitoring their credit files, finding ways to save money or improving their credit history, consumers can come to Experian to find the tools and resources they need. Building creditFor instance, in 2019, we launched Experian Boost® –a first-of-its-kind feature that allows consumers to contribute positive payment information for eligible bills including utilities, telecom and even video streaming services, directly into their Experian credit file. Consumers can now also add positive residential rent payments through Experian Boost®1. More recently, we debuted Experian Go™—another first-of-its-kind feature designed to help “credit invisibles,” or people with no credit history, begin building credit. Credit invisibles who utilize the feature together with Experian Boost can establish an authenticated Experian credit report, tradelines and a credit history and, as a result, get access to financial offers. Staying on top of your informationBeyond our credit building offerings, we’ve long provided consumers the opportunity to access their Experian credit report and FICO® Score2, free-of-charge. By providing consumers access to their credit report and FICO® Score, we’re enabling them to better understand how they may look to lenders, identify potential fraud, determine the specific factors that are affecting their credit and how to improve it. In addition, our credit and dark web monitoring services help consumers detect whether their personal information is potentially available to fraudsters and protect against identity theft. Putting money back into your walletWe also recognize the value of saving money. As part of an Experian membership, we offer resources that can potentially help consumers save on the cost of their auto insurance and find the best credit card for their financial needs. We empower consumers to: Compare auto insurance policies. Consumers can comparison shop to potentially find a better rate on their current policy and save. The free Experian service delivers multiple, tailored rates from up to 40 leading and well-established auto insurance carriers, allowing consumers to quickly find and purchase an auto insurance coverage plan that meets their needs. Find the right credit card. Our free Marketplace makes it easy for consumers to compare different credit card options. We match consumers’ financial information against lender’s requirements to match them with the tailored offers. Every consumer deserves the opportunity to live their best financial life. Providing free resources to help consumers effectively navigate their financial journey is the best way to help them realize financial independence. While I’m proud of how we’ve helped consumers thus far, we will continue to innovate and offer consumers the tools to improve their financial wellbeing. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Results may vary and some may not see savings.