Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

Author One

There is no doubt data breaches have become a part of the Corporate and consumer consciousness. As data breaches have become more prevalent and companies are in need of assistance to prepare for and respond to a breach, industry analysts have taken notice of the experts in the marketplace like Experian. In its first report on data breach services, we are proud to have been named as a leader in The Forrester Wave™: Customer Data Breach Notification And Response Services, Q3 2015.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

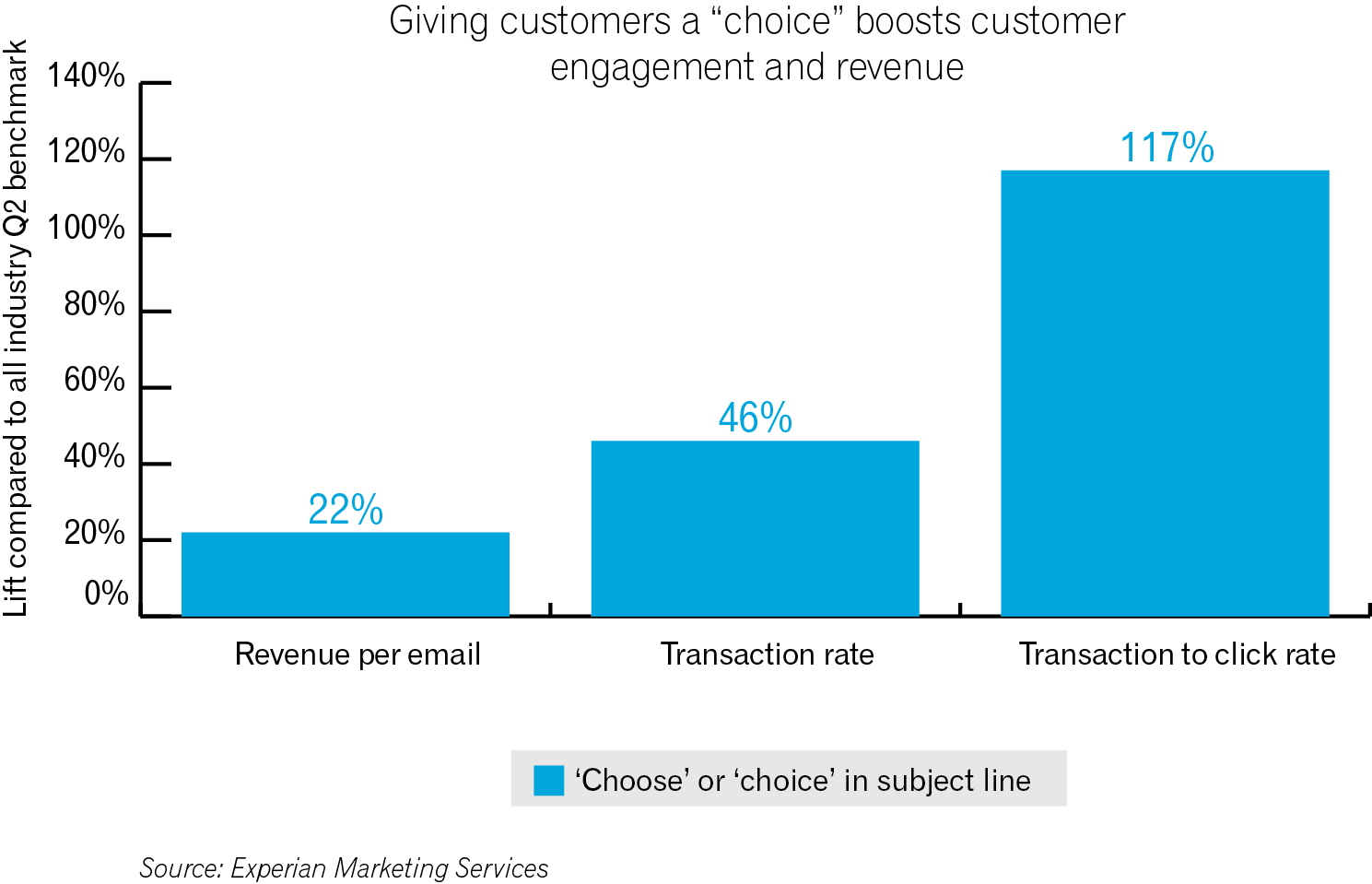

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

Forbes Magazine recently named Experian among the top 100 innovative companies in the world for the second year in a row.

Forbes has a rigorous selection methodology that places an emphasis on what organizations’ investors see as the most innovative today, but also the companies that investors believe will continue to be the most innovative in the future; Forbes calls this methodology the Innovation Premium. Put simply, it’s the expectation that a company will launch new products and services and enter new markets to generate growth.

Forbes Magazine recently named Experian among the top 100 innovative companies in the world for the second year in a row.

Forbes has a rigorous selection methodology that places an emphasis on what organizations’ investors see as the most innovative today, but also the companies that investors believe will continue to be the most innovative in the future; Forbes calls this methodology the Innovation Premium. Put simply, it’s the expectation that a company will launch new products and services and enter new markets to generate growth.

On July 16, the CFPB published its “first ever” monthly report providing a snapshot of complaints filed by consumers through the agency’s complaint portal. For full disclosure, Experian is one of the top three companies that received the most complaints from February through April 2015. But that is absolutely deceiving.

In this article…

First Heading

Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Second Heading

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Where can I get some?

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable. The generated Lorem Ipsum is therefore always free from repetition, injected humour, or non-characteristic words etc.

Author test

Buttons margin test