Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

Author One

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Consumers are can now be notified when their personal information is being used in an authentication transaction, allowing them to assess whether or not they recognize and expect their identity to be in review by a business. The service enables consumers to respond to the notification, and in cases of potential fraud, to be directed to seamless and effective resolution assistance.

![The Great Credit Divide: Men vs. Women [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

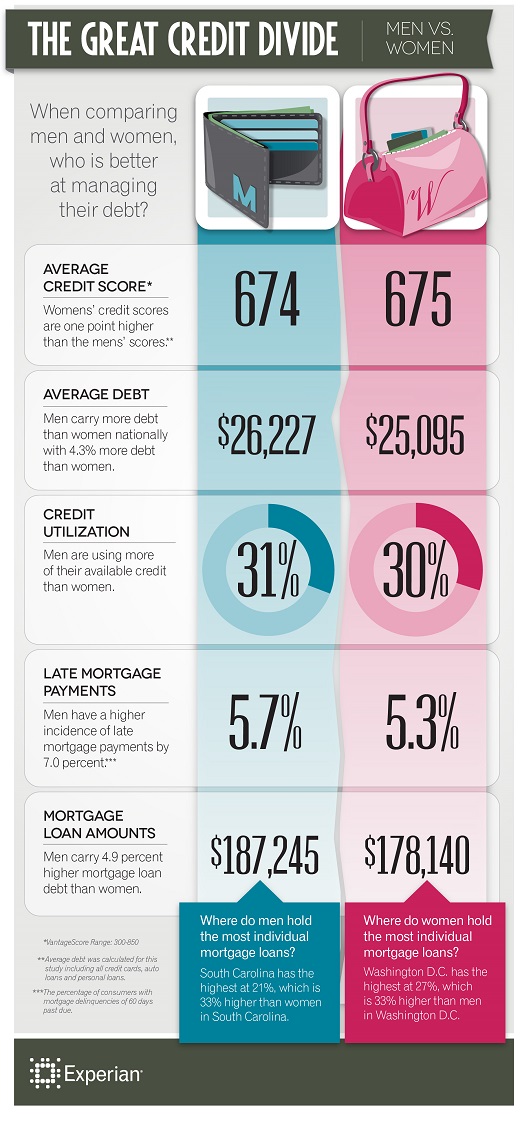

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

In this article…

First Heading

Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Second Heading

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Where can I get some?

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable. The generated Lorem Ipsum is therefore always free from repetition, injected humour, or non-characteristic words etc.

Author test

Buttons margin test