Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

Author One

Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

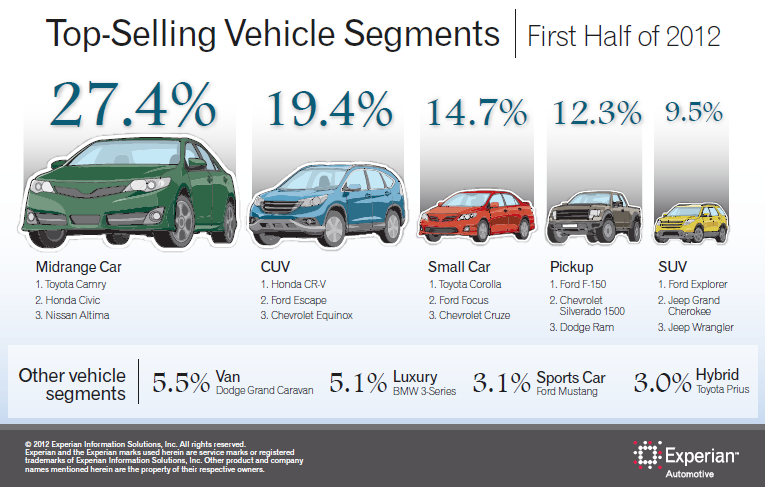

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Marketing Services reported that email volume has increased 10% in Q2 2012 versus Q2 2011

While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

In this article…

First Heading

Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Why do we use it?

It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using ‘Content here, content here’, making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Second Heading

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Where can I get some?

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable.

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don’t look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn’t anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable. The generated Lorem Ipsum is therefore always free from repetition, injected humour, or non-characteristic words etc.

Author test

Buttons margin test