Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Managing Holiday Debt the Smart Way

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text

The Marketing Guy

The Marketing Guy speaks the truth

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Guess That Credit Score

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

Check out the latest post

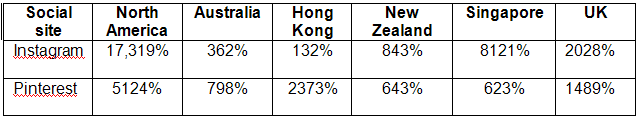

According to a new study by Experian Marketing Services, niche social networks significantly increased their market share of all visits to social sites, with Instagram and Pinterest leading the pack.

The following graph illustrates the global growth between July 2011 and July 2012, based on share of visits to all sites by country:

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

This is a pull quote

This is test

This is a heading

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for ‘lorem ipsum’ will uncover many web sites still in their infancy.

- Test 1

- Test 2

- Test 3

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

My Company Experian