At A Glance

At a Glance When an unknown printer took a galley of type and scrambled it to make a type 2ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release

I’m pleased to share that Experian has taken another important step in the transformation of our Consumer Services business, having signed an agreement to acquire CSIdentity Corporation (CSID).

Published: Apr 18, 2016 by Editor

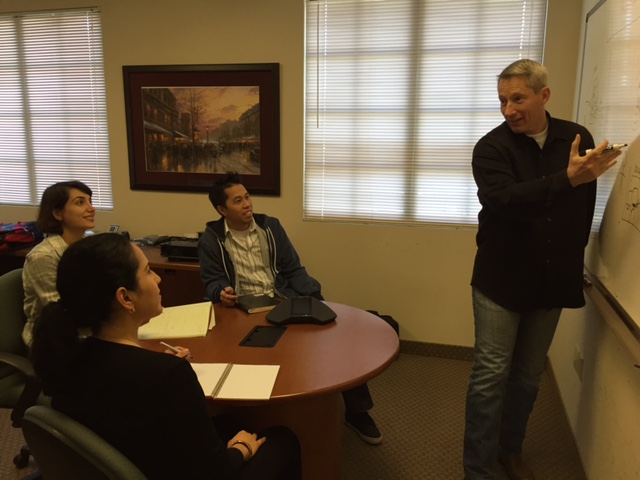

On Tuesday, Experian held a press conference and ribbon cutting ceremony with San Diego Mayor, Kevin Faulconer to announce and celebrate the expansion of the data and innovation lab in North America.

Published: Apr 14, 2016 by

Experian has expanded its growing North America DataLabs in San Diego to further innovation and enable leading data scientists to help clients and businesses solve strategic marketing and risk management problems through advanced data analysis processes, research and development.

Published: Apr 13, 2016 by

Experian Marketing Services released its 2016 Digital Marketer Report. The eighth annual study reveals the challenges, priorities and other key issues impacting marketers worldwide.

Published: Apr 06, 2016 by

![[Infographic]: Off-lease Vehicles Surge Back into the Market](http://www.experian.com/blogs/news/wp-content/uploads/2016/04/Feature-Leasing-Image1.png)

As automotive leasing trends to new heights, a rapid influx of off-lease vehicles are returning to market. Experian Automotive’s latest infographic explores the surge in off-lease vehicles, including which models and vehicle segments are most popular.

Published: Apr 06, 2016 by

Tru Optik, the only audience measurement and data management platform built for OTT and Connected TV, has partnered with Experian Marketing Services to offer a service providing real-time census-level viewer data for over-the-top (OTT) TV programs and ad exposure across all screens. Tru Optik clients will be able to measure and segment content and ad exposure based on lifestyle, demographic and purchase behavior powered by Experian’s ConsumerView marketing database.

Tru Optik, the only audience measurement and data management platform built for OTT and Connected TV, has partnered with Experian Marketing Services to offer a service providing real-time census-level viewer data for over-the-top (OTT) TV programs and ad exposure across all screens. Tru Optik clients will be able to measure and segment content and ad exposure based on lifestyle, demographic and purchase behavior powered by Experian’s ConsumerView marketing database.

Published: Mar 28, 2016 by

In recent years, leasing has strongly returned as an option for consumers to choose when looking to get into a new vehicle and maintain an affordable monthly payment. Experian Automotive’s latest infographic examines the lift in leasing, as well as key attributes in the auto finance market.

Published: Mar 21, 2016 by

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Published: Mar 16, 2016 by

Experian identified e-commerce fraud attacks across the United States for both shipping and billing locations among all states and ZIP Codes.

Published: Mar 03, 2016 by Editor

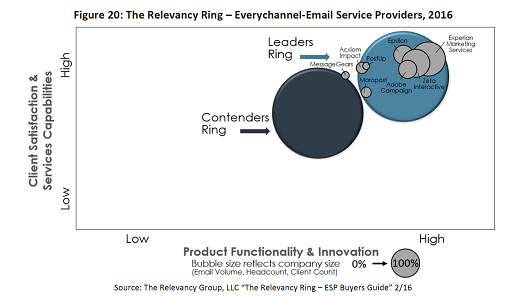

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

Published: Mar 02, 2016 by

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

Published: Mar 02, 2016 by

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

Published: Feb 23, 2016 by

Related Posts

We are thrilled that for the sixth consecutive year, Experian has earned a score of 100 on the Human Rights Campaign Foundation’s (HRCF) 2025 Corporate Equality Index (CEI). This recognition underscores our commitment to LGBTQ+ workplace equality. We are honored to join the ranks of 765 U.S. businesses that have been awarded the HRCF’s Equality 100 Award, celebrating our leadership in fostering an inclusive workplace. Experian’s dedication to supporting the LGBTQ+ community is reflected in several key initiatives: Name Change Process: We have a process for transgender and non-binary consumers to update their names on credit reports, ensuring their identities are accurately represented. LGBTQ+ Allyship 101 Training: This new training program is available to all Experian employees, promoting allyship and understanding within our workforce. Pride ERG Parenting Committee: Launched to support parents, grandparents and guardians of LGBTQ+ individuals, this committee provides valuable resources and community. Transgender Resource Guide: This guide supports employees who are transitioning at work, offering education and resources for colleagues and managers. Partnerships: We collaborate with organizations such as Out & Equal, GenderCool, The Trevor Project and Born This Way Foundation’s Channel Kindness to provide financial health, mental health and other resources to empower both our internal and external communities. At Experian, we are proud to be part of this movement towards greater equality and inclusion. We remain dedicated to fostering a workplace where every employee feels respected, valued and empowered to bring their authentic selves to work. Learn more about how we drive social impact in English, Portuguese and Spanish.

Published: Jan 17, 2025 by Michele Bodda, Aaron Ricci

Achieving Top Workplace recognition for 12 consecutive years is no small feat, yet Experian North America has done just that. Named a Top Workplace by the Orange County Register once again, this milestone reflects not just policies or benefits but what truly makes Experian exceptional: our people. As Hiq Lee, Chief People Officer at Experian North America, notes, this honor is a testament to the remarkable contributions of our team. Experian’s employees shape an environment where innovation, inclusivity, and purpose thrive. More Than Work What sets Experian apart is our engagement with the world and community. Through initiatives like the Experian Volunteer Leadership Network and partnerships with organizations such as the Octane Foundation for Innovation and the Hispanic Chamber of Commerce of Orange County Education Foundation, our impact extends beyond the workplace. In 2024, we earned additional recognitions, including being named one of the World’s Best Workplaces™ by Fortune and Great Place to Work®. We were also recognized as one of the Best Workplaces for Parents, Millennials, and in Technology. The Secret to Success Our success lies in focusing on people. Experian is a place where careers are built, ideas are encouraged, and employees feel valued. Initiatives such as, Employee Resource Groups foster belonging, Mental Health First Aiders provide support, and technology hackathons inspire creativity. Innovation at the Core Innovation continues to drive our success. By leveraging technologies like artificial intelligence and machine learning, we are redefining decision-making and fraud prevention. This commitment to innovation empowers businesses and consumers worldwide, aligning with our mission to promote financial inclusivity. Looking Ahead For Experian, being a Top Workplace for more than a decade isn’t a finish line—it’s a springboard. With an ongoing commitment to our employees and communities, we continue to evolve, creating better experiences for our team, clients, and the world.

Published: Dec 20, 2024 by Editor

Experian is celebrating the one-year anniversary of The Legacy League Game Show™, a dynamic and interactive event that has revolutionized financial literacy education for students at Historically Black Colleges and Universities (HBCUs) and Hispanic Serving Institutions (HSIs). This innovative program, part of the B.A.L.L. for Life™ initiative, combines the excitement of a game show with essential lessons on credit and financial management. We marked the occasion where it debuted in 2023: at EntreprenUTSA at the University of Texas San Antonio. The Legacy League Game Show™ has traveled to ten universities such as Morgan State and Shaw Universities and major events across the United States. The National Urban League describes the event as transformational; HomeFree-USA calls it a “model for how to teach anything to Gen Z and other generations.” Thousands of students have participated across the country, and more than 99% report an increase in their financial literacy after the experience. As someone whose family didn’t discuss money matters growing up, this impact is especially gratifying. In addition to making learning fun, The Legacy League Game Show™ addresses a critical issue: financial invisibility among young consumers, particularly within communities of color. Forty percent of consumers under 25 are credit invisible, with 26% of Hispanic and 28% of Black consumers affected, compared to 16% of their white and Asian peers. Special guests, including rapper and college basketball standout Flau’jae, comedian and actor Mike Merrill, Louisiana State University wide receiver Chris Hilton, Jr. and Grammy-nominated D Smoke have joined the game show, adding star power and excitement. Next year, The Legacy League Game Show™ will hit the road again, visiting more schools and events. We already have stops planned at the #IYKYK Pitch Competition in partnership with HomeFree-USA, the University of Illinois in collaboration with the Hispanic Alliance for Career Enhancement (HACE), and the UnidosUS National Conference. Check out the action from our 2024 stops by clicking here.Learn more about Experian’s commitment to underserved communities in The Power of YOU 2024: Diversity, equity, inclusion and social impact report.

Published: Dec 10, 2024 by Raudy Perez

Modernizing the conversation around credit and financial literacy is a key commitment for Experian, especially for young adults. That’s why we partner with organizations like the Singleton Foundation to produce “Your World on Money,” to meet young people where they are, with engaging, easy-to-understand video shorts about credit, budgeting, and saving and more. We’re thrilled this commitment and creativity has earned both Gold and Bronze Anthem Awards, which recognize excellence in social good, celebrate the impactful work of organizations and initiatives that are driving positive change. Financial literacy is often not taught in schools, and the language around credit and personal finance can be intimidating. By normalizing these conversations, we hope to inspire confidence and action, helping young adults make informed financial decisions as they navigate life’s milestones. Our United for Financial Health partnership with the Singleton Foundation continues with our new series, the Finance Couch, where college students join our experts on a coach in the middle of a Los Angeles campus to answer their money questions. And our Anthem Award-winning series, HeartBroke, helps couples whose relationships are tested with financial issues to determine if they can work through it or end up HeartBroke(n).

Published: Nov 19, 2024 by Abigail Lovell

Great Place to Work and Fortune have named Experian as one of the 25 World’s Best Workplaces™ 2024. This recognition highlights more than an award—it shows a commitment to our strong People First culture. Experian Chief People Officer Jacky Simmonds shares insights on how our people across the globe cultivate this culture, staying ahead of the curve through a unique blend of inclusivity, empathy, and a shared purpose. What does it mean to you, and to Experian, to be named among Fortune's World’s Best Places to Work? At Experian, we have long aspired to be one of the best companies in the world to work for, and over the past few years, we have made this a priority. Our journey has been marked by a commitment to putting our people first and fostering the collaborative and inclusive culture that sets us apart. This recognition reflects the common values that we share across our many countries and cultures and the dedication of our colleagues across our business. We spend so much of our time at work, so I think it’s important that every interaction – from the interview process to joining and every daily interaction – is a positive one where people are welcoming, supportive and generally just really nice people to work with. Reaching this milestone gives all of us at Experian some recognition, but also it is inspiring as we continue to strive to attract top talent who share our values, share our purpose and make every day an enjoyable one. How does Experian create an environment where employees feel empowered to innovate and contribute ideas that drive real impact? To fulfill our mission of bringing Financial Power to All™, we need as many voices, experiences and backgrounds as possible, so we can represent our clients’ differing needs. This culture of inclusion drives our innovations. We have employee-led initiatives, such as internal Hackathons that bring together these diverse perspectives to develop products and services like Experian Boost, Experian Go, Experian Smart Money Digital Checking Account, Experian Support Hub, and Transforme-se so we can serve the communities in which we live and work. How has Experian adapted to changing employee expectations since the pandemic, and what steps has the company taken to support employee well-being and work-life balance? We know that our people really value the ability to have flexible work model, so they can work to fulfill their role in a way that works for them. For some this is fully remote, for others it is hybrid so a balance of remote and in office, and for others in office, where their role requires it fully. We know from the feedback that we get that our people appreciate that we trust them and they have flexibility to deal with varying commitments that we all have outside of work. We also know that since the pandemic there has been an increased focused on wellbeing. Sponsored by our Chief Financial Officer, we embarked upon an initiative to invest in how we support people who may need additional support. We are very proud of our Mental Health First Aiders programme, which has trained around 400 colleagues across the world representing 23 countries and 28 languages and helping their teammates access resources. These volunteers receive consistent, ongoing and updated training. What specific initiatives or programmes at Experian do you believe set the company apart in terms of supporting professional growth and career development? We have invested in a number of things that we believe really make the difference. The first is developing great leaders at every level. Today’s leaders have many more challenges, many different age groups, a balance of remote and in person working, together with teams based in many different locations. Great leaders build great teams, so we think it’s important to invest in their development. That’s we built a leadership development portal – The Leadership Exchange – that has a wide range of resources to support them, including development programmes tailored to their needs. We also want to ensure that everyone at every level can develop their skills and progress their careers. So we launched our annual Global Careers Week, Experian University, and built a world-class digital curriculum so everyone can access the form of development they need based on their role or aspirations. There really is something for everyone. This way, we help our teams stay ahead of trends and ensure our business is equipped with the skills needed for the future. Looking forward, what are key goals or priorities for further enhancing Experian’s culture and employee experience? We’re truly proud of this amazing recognition, but we always strive to get better and acknowledge there’s always more to be done. We see an opportunity to make things easier in the way we leverage advanced technologies like AI to further enhance employee experience. For example, more personalised learning pathways, improved tools for productivity and collaboration. We make sure we don’t lose the human touch, but we also want to make the most of these innovations so we stay relevant with our largely tech populations. Being named one of the world’s best workplaces reflects Experian’s unwavering commitment to be recognized for having a great culture where people can do their best work with people they enjoy working with. Learn more about what makes Experian a World’s Best Workplace in the People section of our Annual Report and the Experian Power of YOU Report 2024: Driving social impact and diversity, equity and inclusion, available in English, Portuguese and Spanish.

Published: Nov 14, 2024 by

At Experian, we’re proud to observe Veterans Day and celebrate the contributions of our teammates and their families who have served in the U.S. Armed Forces. This year, we’re especially excited to be ranked #20 on Forbes’ 2024 Best Employers for Veterans list. The list is based on input from over 24,000 veterans who were surveyed by Statista. These veterans, from the Armed Forces, Reserves, and National Guard, work for companies with more than 1,000 employees. They rated their employers on factors like work atmosphere, salary, health benefits, career development, and programs specifically designed for veterans. We’re grateful for how our Veterans Employee Resource Group (ERG) supports the military community, from participating in events like Wreaths Across America, Carry the Load, and the Murph Challenge, to building wheelchair ramps for veterans’ homes. The Veterans ERG just completed its 20th ramp last month. With a goal of bringing Financial Power to All™, Experian provides free credit reporting to active-duty members and supports financial literacy and education through our partnerships with Support the Enlisted Project (STEP) and Operation HOPE. As part of our observance of Veterans Day, we invite veterans to join us for this week’s #CreditChat, “Transitioning to Civilian Life: Financial Considerations for Veterans” on Wednesday, November 14, from 3–4 p.m. ET. Thank you to all who have served our country. And we thank our veteran colleagues who bring their leadership, dedication and passion to Experian every day.

Published: Nov 11, 2024 by Editor

We believe that financial literacy leads to empowerment. That is why Experian supports initiatives and partners with community organizations to deliver financial education. We also develop products and services that give more control to consumers over their credit profile and financial health. As part of advancing our mission of Financial Power to All®, we are proud to announce we are helping more than 5,000 Hispanic individuals nationwide by relieving $10 million dollars of consumer debt. To provide families with this boost, we joined forces with ForgiveCo, a Public Benefit Corporation (PBC), to administer the acquisition and cancellation of qualifying consumer debt for the selected recipients. Beneficiaries will also receive a one-year premium Experian membership for free that offers access to their Experian credit report in English and Spanish[i], FICO® Score[ii], bilingual educational content, and other financial resources. We hope this effort helps raise awareness of the importance of financial literacy for everyone, and that Experian has resources to help individuals reach their financial dreams. To amplify the message, we collaborated with multi-platinum, award-winning singer and songwriter Prince Royce and you can see his video here. In fact, we have been making a concerted effort the last several years to evolve our educational resources and products to better support all underserved communities. Some of our other activities include the creation of the B.A.L.L. for Life initiative that connects African American and Hispanic youth with financial education, supporting scholarships for Asian Americans through the Ascend organization, providing custom resources for Out & Equal and Born This Way Foundation for the LGBTQ+ community, supporting the NextGen Innovation Lab for Disability:IN, and sponsoring credit counseling for the military community with Operation HOPE. For resources in Spanish, Experian offers a credit e-book and consumers can access a full suite of articles at the Ask Experian blog here. [i] Only Experian credit reports are available in Spanish. All other services associated with an Experian membership are available in English only. English fluency is required for full access to Experian’s products. [ii] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Published: Oct 22, 2024 by Jeff Softley

Even though 26 states now have a personal finance course as a requirement for high school graduation, 40 percent of college students do not feel they have enough knowledge about how to manage money. It’s a challenge that the Center for Financial Advancement® (CFA) Credit Academy addresses with participating Historically Black Colleges and Universities (HBCUs). A collaboration between Experian and HomeFree-USA, the program culminates in the #IYKYK (If You Know You Know) Pitch Competition and a couple hundred new knowledge ambassadors about financial health and credit. Here, competition finalists share their advice for students as they hit campus for a new school year: MALAYA MELTON, Alabama State University Advice I'll give to incoming freshmen is to try to apply for scholarships. It takes some of the burden off. For me, I took about two years making sure that I got the right amount of scholarships before coming to school, because I knew that I wouldn't be able to afford it. My family won't be able to afford it. So, try to be very serious about applying for scholarships, and apply to internships that also get you money that you can use towards school or your personal development. JAZMIN FELIZ ORELLANA, Bowie State University Don't take out loans if you don't have to. I think many freshmen forget that they'll have to pay off those loans once they graduate after a certain time, and that definitely can affect their credit, especially if they're not able to pay for it. OLUWATOSIN OYEKEYE, Alabama State University Save your money, save your money, save your money. It's okay to go to a college in your hometown. Save as much money as you can, because you really don't know where you'll need it. If you get that credit card, make sure that you're paying all the payments on time. Do not wait till the last minute to pay it. PHILIP OMO-TAIGA, North Carolina A&T State University Budgeting. I think that's really what plays into the whole thing of credit, which is there obviously to help you. But it can also go really, really bad. When you think about what it takes to find that healthy balance, you got to learn how to budget because you may go through a period where you're not working. So now it's like, "Okay, now I got to leverage this money that I maybe have saved up. Maybe think about my credit so that I'm not burying myself into a hole. I'm not working, so there's no way I can pay it down." I think when it comes to finding that healthy medium, budgeting is definitely key. CALVIN CHARLES III, Bowie State University A secure credit card. I think freshman year is a great way to enter college (with one) because you're going to have items and things that you are going to have to pay for anyway. Why not begin building your credit there? I can personally say my first credit card I opened at 18, so that gave me the years of credit history. ESANTE-JOY MCINTYRE, North Carolina A&T State University It is never really how you start, but it's how you finish. Freshman year I might not have that scholarship. But I promise you by sophomore year I had $10,000 from outside scholarships, I had $10,000 from doing pitch competitions, $5,000 from here, from there. So, don't give up on the idea of searching. If you are able to search, you'll find it. Those opportunities and resources are out there, and Experian is just a testament to that.

Published: Sep 16, 2024 by Victoria Lim

Amid some of the financial challenges that underserved communities experience, members across the financial services community remain committed to championing initiatives and programs that drive greater financial inclusion. In fact, collaboration has led to the inclusion of non-debt related payment information on consumers’ credit profiles, as well as digital services that make it easier to manage money. These efforts have helped to broaden access to fair and affordable financial resources for more individuals. While significant progress has been made, there is still more work to do. However, some of the misconceptions and myths about the financial services community are hindering further advancement. Debunking these myths will accelerate progress by building trust between the financial services community and consumers. Person withdrawing money from ATM contactless Myth #1: “Financial institutions have no interest in underserved consumers or credit invisibles.” The truth is, banks and credit unions want to say “yes” to more prospective borrowers, including individuals and families from underserved communities. Beyond being the right thing to do, it’s an opportunity to potentially build lifelong relationships with a relatively untapped market. A show of good faith to communities who have largely been ignored by the financial system could lead to customer loyalty that may extend to their family and friends. That’s why participants across the financial ecosystem have been proponents of including expanded data sources—such as on-time telecom, utility and video streaming service payments—on to consumer credit reports, as well as exploring other Fair Credit Reporting Act (FCRA)-regulated data sources, including payment data on short-term small dollar loans and expanded public records data. Making this data more accessible to lenders provides a more comprehensive view of a consumer’s ability and willingness to repay outstanding debt—an actionable solution to extending credit to consumers without lenders taking on additional risk. Myth #2: “There is a lack of trustworthy financial education resources.” The financial services community and affiliated organizations recognize that empowering people with financial knowledge and skillset are critical to consumers’ financial success. In fact, banks and credit unions are partnering with nonprofits and non-governmental organizations to better understand the unique challenges and opportunities within specific communities and provide relevant tools and resources. For example, Experian’s B.A.L.L. for Life (Be A Legacy Leader) program, launched in partnership with the National Urban League, serves as a catalyst for engaging with Black communities and low-income youth through live events and digital financial education. Subject matter experts, professional athletes, celebrities, and other influencers share their experiences and expertise, covering topics such as banking, credit, financial management and investing. In addition, to help people improve their financial management, Experian partners with the National Foundation for Credit Counseling (NFCC). The NFCC connects consumers with certified financial counselors to help them address various pain points, including debt management, homeownership, student loans or small business cash flow issues. Myth #3: “Underserved communities have few opportunities to build credit and enter the mainstream financial system.” People from underserved communities, as well as younger consumers and recent immigrants are often excluded from the mainstream financial system because they lack an extensive credit history. Historically, it’s created a vicious cycle; in order to get credit, you have to have credit. Fortunately, there has been a sea change in innovative solutions to address the specific needs of these populations. These include new credit scoring models and microfinancing which provide financial services to individuals who may have been excluded from traditional banking systems. In addition, by incorporating expanded data sources, such as telecom, utility and residential rental payments onto credit reports, lenders have more visibility into consumers who may have been excluded by traditional credit scoring methods.These programs help individuals and families from underserved communities establish and build a credit history that could enable loans, or the ability to rent an apartment or open their dream business. An example is Experian Boost®, a free feature that allows Experian members to contribute their history of making utility, cellphone, insurance, residential rent and video streaming service payments directly into their Experian credit profile. By incorporating nontraditional credit data like paying utility bills on time, online banking transactions, rental payments and verified income data, more people can establish a credit profile that can potentially qualify them for a loan. More Inclusion, Fewer Myths It’s encouraging that community organizations and banks are beginning to see the economic and social benefits of aligning on financial literacy and inclusion. As more initiatives come online, underserved populations will be able to establish a better financial foundation. Then, we can declare the myths to be history.

Published: Jul 23, 2024 by Sandy Anderson

Experian is wrapping up several inspiring days at the 2024 Disability:IN Conference. We are a proud Presenting partner, and as part of our support this year, we had the honor of being the key sponsor for the NextGen Innovation Lab Pitch Competition. This initiative brings together young adults to develop innovative products or services that benefit individuals with disabilities. It provides a platform for young minds to harness their creativity and technical skills to solve real-world challenges faced by the disability community. This year, we challenged these NextGen leaders to create a product or service specifically for young adults with disabilities that can help them build their credit or improve their financial literacy. Only 10% of working aged people with disabilities consider themselves to be financially healthy, according to a recent study. Eight enthusiastic and passionate teams shared their ideas and the top two vote-getters’ pitched live, “Shark Tank” style, in front of thousands of conference attendees. The winner: Team 7’s “Experian Expedition,” which enhances the accessibility of the existing Experian app and adds new experiences such as an accessible credit card that also features braille; voice-guided, American Sign Language and closed-captioned exercises; and an incentive program for young adults as they reach various financial health milestones with cash back and coupons. We congratulate Team 7 and all of the teams for their collaboration with Experian and each other. The ideas and services developed through the NextGen iLab have the potential to make a significant impact on the disability community, enhancing accessibility, independence, and quality of life for millions. Sponsoring the NextGen iLab is just one of the many ways Experian is committed to disability inclusion. For the third consecutive year, Experian has achieved a top score in the Disability Equality Index (DEI) 2024. This accolade underscores Experian's ongoing efforts towards inclusivity in our workplace, products and services that are accessible and beneficial to individuals of all abilities, including the Support Hub, Financial Resilience Center, Inclusion Works, and the CMO/CCO Coalition. We’re proud our efforts are recognized by Disability:IN and the American Association of People with Disabilities (AAPD). To learn more about Experian’s commitment to inclusion, check out our Power of YOU Report 2024: Driving social impact and diversity, equity and inclusion in English, Portuguese and Spanish.

Published: Jul 19, 2024 by Victoria Lim

Making a real difference in the world starts with embracing Diversity, Equity, and Inclusion (DEI) and accelerating social impact. It's not just the right thing to do, but it's also key to our mission of creating a better tomorrow, together. DEI isn't just a buzzword for us; it's at the heart of everything we do. Whether it's in our sustainability strategy or our day-to-day operations, we're committed to driving positive social impact and closing the financial wealth gap in underserved communities. It starts with our people. We’re proud to share their dedication and work in this year’s Experian Power of YOU Report 2024: Driving social impact and diversity, equity and inclusion in English, Portuguese and Spanish. Within these pages, you’ll see how we foster belonging with our teammates, and champion DEI beyond the walls of Experian. From developing products like Experian Smart Money to expanding Experian Boost in the United Kingdom, and launching Advance XScore in Peru, we're dedicated to making a difference in the world around us. To that end, you’ll see we’ve also included, for the first time, our new Positive Social Impact Framework, which will reinforce and help our clients, consumers and employees further understand how we are making a difference in our communities. At Experian, we strive to build a brighter, more inclusive future – for our employees, our clients, and our communities. Together, we can make a real difference.

Published: Jun 07, 2024 by Wil Lewis, Abigail Lovell

Caps and gowns. Pomp and circumstance. Loans and debt. As the class of 2024 celebrate their college graduations, more than 43 million of them leave school with a total national debt of more than $1.6 trillion. Some are on better financial footing than others – with no debts as they start their careers – because of early financial and credit education. These learnings fueled ideas for students from Historically Black Colleges and Universities (HBCUs) who competed in this year’s #IYKYK Pitch Competition (If You Know You Know), sponsored by HomeFree-USA and Experian. The challenge: to create solutions that help their peers become debt-free within five years of graduation. Here, finalists share some advice for graduates on how they can start their post-collegiate lives on solid financial footing: OLUWATOSIN OYEKEYE, Alabama State University You're not too young. I feel like most people think it's until you're married or you have kids before you should take your financial life seriously. From your first couple of first paychecks, look into where you can invest. If you don't want to live from paycheck to paycheck, look for ways to grow your money. Take your credit seriously. If you want to own a home, you want to buy a car, these things are important. It's not too early, it’s also not too late to start taking these things seriously. JAZMIN FELIZ ORELLANA, Bowie State University You don't have to start off with a credit card with a $10,000 limit. You can easily start off with a secured credit card. And that's actually one of my biggest pieces of advice. Get a credit card, be mindful with it, don't spend, don't max it out, but definitely just practice and start using it to see if you're actually able to maintain your credit. That's a piece of advice that definitely has worked with me, especially with building up my own credit, which I hope to get soon to 800. MARCUS HARRIS, North Carolina A&T University Always go out and explore opportunities that could first boost your credit and put you in a more financial-free state. For example, with Experian, they have an Experian Boost program that when you're in school, if you have rent, you rent an apartment, you could apply that. Or even the Netflix subscription, you can apply that to the Experian Boost program and therefore you can help build your credit over the time. TAYLOR PAYTON, Bowie State University To college students who are about to graduate, once they get that job offer with a lot of zeros behind it, be mindful of lifestyle influences. Just because you're making a certain amount of money does not mean you have to spend all of it. Be mindful not to keep up with the Joneses. CHIOMA KALU, Alabama State University There's something my sister used to say. She used to say, "Pay now, play later. Or if you play now, you pay later." I feel like if they focus during their youth when they can really do these things and really go out there, do the jobs, focus on paying off everything, getting that financial literacy, getting that financial freedom, and then at age 30 you're already set up for life. That makes more sense than just going through life, just ballin’, and then at the end of the day, if you have to pay when you're like 60? You're still paying student loans? Come on, now. CALVIN CHARLES III, Bowie State University Do not get caught up in social media. Just because you want to live in the city doesn't mean that that's what you have to do. And there's nothing wrong with roommates. They can allow you to reach your actual goals. Every meal does not have to be eaten out. Social media creates a lifestyle that you wish to live, and living in that moment is great, but you have to think about your future and building that wealth for yourself directly afterwards. All of these students were part of the Center for Financial Advancement Credit Academy. To learn more about this program that supports HBCU students, click here.

Published: May 31, 2024 by Victoria Lim