While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

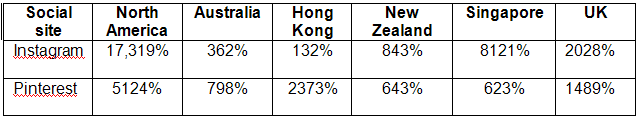

According to a new study by Experian Marketing Services, niche social networks significantly increased their market share of all visits to social sites, with Instagram and Pinterest leading the pack.

The following graph illustrates the global growth between July 2011 and July 2012, based on share of visits to all sites by country:

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

As 2014 nears an end it’s a good time for us all to start thinking about what we are going to do to keep our finances in good shape and moving along into 2015. At Experian, we are here to help you. During the coming weeks and months we will be providing more educational blogs, videos and Twitter #creditchats that will help you proactively manage, build and improve your credit. So let’s get started with one of the most common questions people ask me: How do I dispute information that I believe is being reported inaccurately?

According to the Experian Automotive industry market trends and loyalty report, Toyota finished third in overall corporate loyalty, with 45.7 percent of their customers who returned to market during Q1 2012 purchasing or leasing another Toyota vehicle. Toyota’s corporate loyalty ranking had dropped to 41.8 percent in Q2 2011, the first full quarter after the earthquake and tsunami. Honda’s corporate loyalty was 42.1 percent in Q1 2012, after falling to 36.4 percent in Q3 2011.

According to the Experian Automotive industry market trends and loyalty report, Toyota finished third in overall corporate loyalty, with 45.7 percent of their customers who returned to market during Q1 2012 purchasing or leasing another Toyota vehicle. Toyota’s corporate loyalty ranking had dropped to 41.8 percent in Q2 2011, the first full quarter after the earthquake and tsunami. Honda’s corporate loyalty was 42.1 percent in Q1 2012, after falling to 36.4 percent in Q3 2011.