sdfsad sddfs sdfsdf sdsf sd sfsdfsdf s

asdf sa dsdfdsf ds dsf sdfsdf sdfsd sdf

In this article…

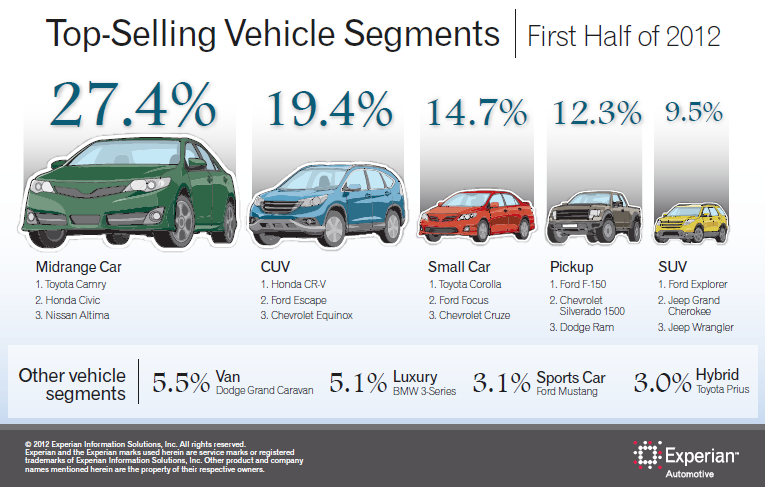

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Marketing Services reported that email volume has increased 10% in Q2 2012 versus Q2 2011

While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

While the runways boast couture and fashions that you rarely see walking down the street, some of the top cities in the U.S. are keeping comfortable in their sweats. For the second year in a row, the nation’s top per capita consumer of sweats is Philadelphia, PA while New York was seventh, Los Angeles ranked eighth, and Chicago was twentieth.

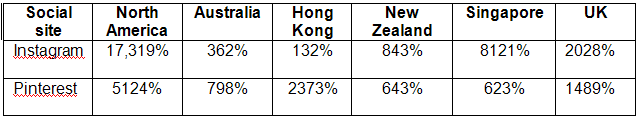

According to a new study by Experian Marketing Services, niche social networks significantly increased their market share of all visits to social sites, with Instagram and Pinterest leading the pack.

The following graph illustrates the global growth between July 2011 and July 2012, based on share of visits to all sites by country:

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

test