At Experian, we often say our people are our biggest superpower – and today, I’m thrilled to share that this belief has been recognised once again. Experian has been named one of the 2025 World’s Best Workplaces™ by Fortune and Great Place to Work® for the second year in a row.

This achievement reflects the culture we’ve built together – one that’s welcoming, inclusive, and rooted belonging. It’s a celebration of every colleague who brings their whole self to work, who lifts others up, and who powers opportunities for our clients, consumers, and communities.

We’ve made it our mission to create a workplace where everyone feels included, respected, and empowered. That’s why we’re proud to have earned top scores on the Corporate Equality Index and the Disability Equality Index, and to be recognised with the Outie Award for Workplace Excellence and Belonging.

These recognitions matter. But what matters most is how our people experience life at Experian. Whether it’s collaborating, innovating, or growing through world-class development of products, services and contributing to our communities, our culture is designed to help everyone thrive.

We’ve also made bold commitments to career development. Initiatives like Global Careers Week, the AI-driven performance coach Nadia, and the NextGen Forum – a global leadership development programme for emerging talent from across our regions – give our people the resources to take charge of their growth and build a “One Experian” mindset.

Being named one of the World’s Best Workplaces is a moment to celebrate but also a reminder to keep aiming higher. The world of work is evolving fast, and so are we. From embracing AI to enhancing our digital workplace experience, we’ll continue to push forward and listen to our people every step of the way.

Questions we will discuss:

- What does “retirement readiness” mean to you, and how can someone tell when they are financially ready to retire?

- Is there a magic number for retirement savings, and what factors should someone consider when setting a retirement goal?

- How can someone estimate their retirement expenses realistically?

- What are some common myths or misconceptions about how much money you need to retire?

- How should Gen Z, Millennials, and Gen Xers each approach retirement planning differently based on their stage of life?

- What are the biggest obstacles people face when trying to save for retirement, and how can they overcome them?

- How can you balance saving for retirement with paying off debt or supporting family today?

- What tools, calculators, or strategies can help people figure out if they’re on track for retirement?

- How can people prepare for unexpected costs or life changes that could impact their retirement plans?

- What’s one piece of advice you’d give someone just starting—or restarting—their retirement savings journey?

| Columns 1 | Column 2 | Column 3 | Column 4 |

|---|---|---|---|

| Row 1 Col 1 | |||

| Row 2 Col 1 | |||

| Row 3 Col 1 | |||

| Footer 1 | Footer 2 | Footer 3 | Footer 4 |

Credit Chat

Stretching your Dollars: Practical Tips to Cut Costs and Save More

February 5, 2025 3-4 PM ET

- What does “retirement readiness” mean to you, and how can someone tell when they are financially ready to retire?

- Is there a magic number for retirement savings, and what factors should someone consider when setting a retirement goal?

- How can someone estimate their retirement expenses realistically?

Greater transparency in buy now, pay later activity is key to helping consumers build their credit histories and supporting responsible lending. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that. We have members of the military right now right out of high school and there’s not a lot of experience managing their own money. They’re quickly thrust into a place where they don’t have a support system to do that.

Experian North AmericaScott Brown, Group President, Financial Services

Owning your own business is what many perceive to be as the American dream. And if you’ve been fortunate enough to make that dream a reality, then you’ve certainly heard how indispensable your business is to the country’s economy. But as invaluable as your small business is, many small business owners face daily challenges when it comes to sustainability, profitability and growth. For the last year, Experian and the Small Business Administration (SBA) have lent a helping hand to small businesses that are facing those types of challenges. As a part of their efforts, all Historically Underutilized Business Zone (HUBZone) firms and small businesses that are considered to be socially and economically disadvantaged under the SBA’s 8(a) business development program have full access to BusinessIQ Express.

Millions of Americans face economic hardships today due to the financial crisis. The Great Recession made a big impact on the financial lives of consumers. Unemployment was high and many struggled to make ends meet, forcing them to tap into their savings and live off credit to survive. Now that our economy is recovering, we believe that education is the key for consumers to unlock the door that leads to financial success and opportunity.

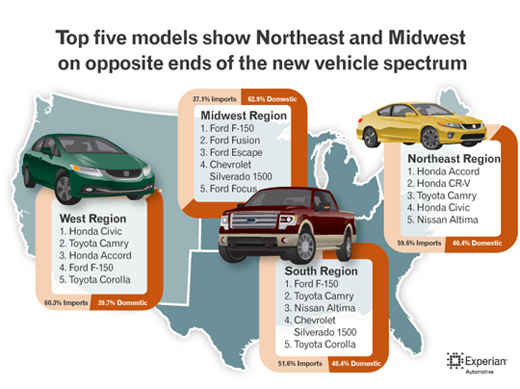

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

2024 Best Place to Work for Disability Inclusion