At A Glance

aag optionalthis is heading!

kjdaskldj

some company name herekdljsaldkjlska

Docker is an open-source project to easily create lightweight, portable, self-sufficient containers from any application. The same container that a developer builds and tests on a laptop can run at scale, in production, on VMs, bare metal, OpenStack clusters, public clouds and more.

Docker is an open-source project to easily create lightweight, portable, self-sufficient containers from any application. The same container that a developer builds and tests on a laptop can run at scale, in production, on VMs, bare metal, OpenStack clusters, public clouds and more.

thisis a contet t for medai text block!

Paragraph Block- is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Heading 2

Heading 3

Heading 4

Heading 5

- This is a list

- Item 1

- Item 2

- Sub list

- Sub list 2

- Sub list 3

- More list

- More list 2

- More list 3

- More more

- More more

This is the pull quote block Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s,

ExperianThis is the citation

This is the pull quote block Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s,

ExperianThis is the citation

| Table element | Table element | Table element |

| my table | my table | my table |

| Table element | Table element | Table element |

Media Text Block

of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum

My Small H5 Title

This guest post is from Donna Freedman (@DLFreedman). Donna is a former newspaper journalist and staff writer for MSN Money and Get Rich Slowly. Currently she writes for Money Talks News and for her own website, donnafreedman.com.

What do Baby Boomers and millennials have in common? Stereotyping, retirement issues and, sometimes, a residence. About that last: According to a Pew Research Center study called “The Boomerang Generation,” 29% of adults aged 20 to 34 live with their folks. Which leads us to a two-pronged stereotype: Boomers were overly indulgent parents who never let their kids suffer even a moment of The Sadz, which is why millennials are such an entitled, failure-to-launch cadre.

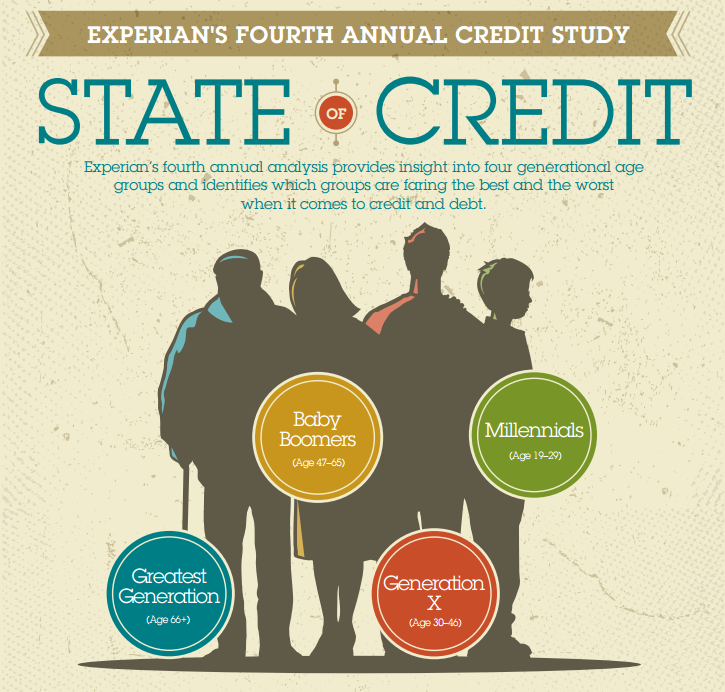

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments. Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.

The National Foundation for Credit Counseling® (NFCC) and Experian® jointly announced today that Experian committed 80,000 free, 12-month memberships to its freecreditscore.comTM product, in support of the NFCC’s Sharpen Your Financial Focus™ program. The NFCC program, launched in September of this year, includes a broad cross-section of supporters – Experian and others – who are committed to increasing the financial well-being of Americans.

In this article…

typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.