Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”

![A Glimpse at the Largest Metropolitan Areas’ State of Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

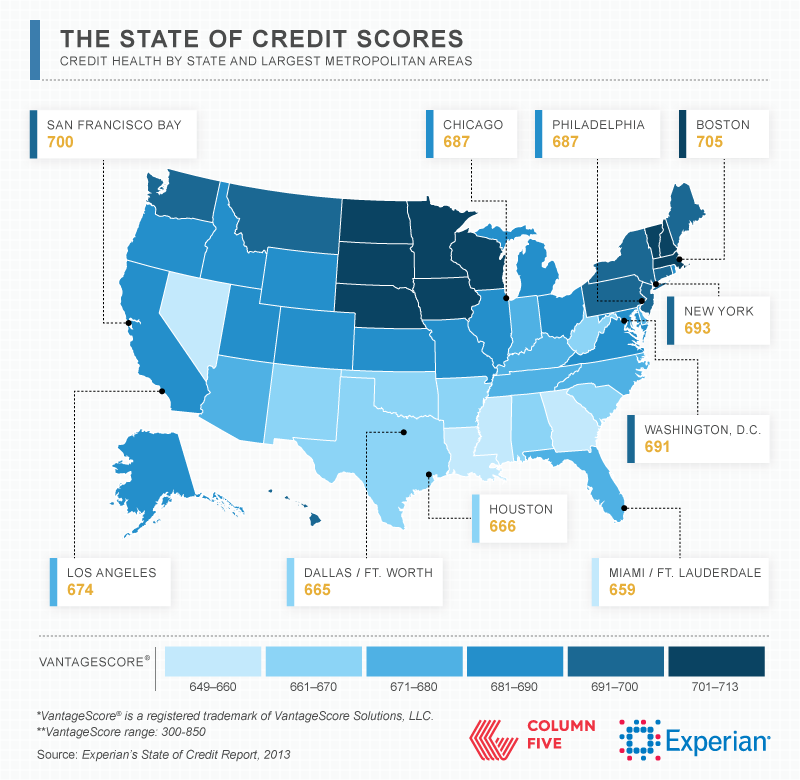

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.