Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

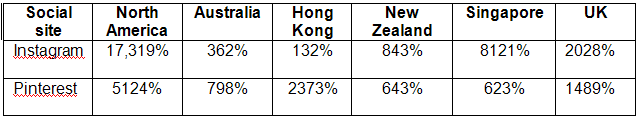

According to a new study by Experian Marketing Services, niche social networks significantly increased their market share of all visits to social sites, with Instagram and Pinterest leading the pack.

The following graph illustrates the global growth between July 2011 and July 2012, based on share of visits to all sites by country:

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Other niche social networks that have experienced significant gain include Stock Twits in the US, Redidt in Australia, and FanPop in the UK.

Published: Aug 11, 2012 by

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Experian Marketing Services is hosting its annual Digital Summit (today through Friday) at the Venetian Hotel in Las Vegas.

This premier digital marketing event, with the theme, “Customer Obsession: Empowering Meaningful Relationships,” features highly engaging and inspiring learning sessions, providing marketers with key insights and best practices for keeping their customers at the heart and center of everything they do.

Published: Jul 27, 2012 by

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

Experian®, the leading global information services company, today announced that its Precise ID platform has achieved Federal Identity Credential Access Management (FICAM) recognition at Assurance Level 3 for identity proofing.

Published: Jul 27, 2012 by

Related Posts

Today, we stand at the forefront of a digital revolution that is reshaping the financial services industry. And, against this backdrop, financial institutions are at vastly different levels of maturity; the world’s biggest banks are managing large-scale infrastructure migrations and making significant investments in AI while regional banks and credit unions are putting plans in place for modernization strategies, and fintechs are purpose-built and cloud native. To explore this more, I recently had the privilege of attending the annual Reuters NEXT live event in New York City. The event gathers globally recognized leaders across business, finance, technology, and government to tackle some of today’s most pressing issues. On the World Stage, I joined Del Irani, a talented anchor and broadcast journalist, to discuss the future of lending and the pivotal role of data and AI in building a more inclusive financial system. Improving financial access Our discussion highlighted the lack of access to traditional financial systems, and the impact it has on nearly 100 million people in North America alone. Globally, the problem affects over one billion people. These people, who are credit invisible, unscoreable, or have subprime credit scores, are unable to secure everyday financial products that many of us take for granted. What many don’t realize is, this is not a fringe subset of the population. Most of us, myself included, know someone who has faced the challenges of financial exclusion. Everyday Americans, including young people who are just starting out, new immigrants and people from diverse communities, often lack access to mainstream financial products. We discussed how traditional lending has a limited view of a consumer. Like looking through a keyhole, the lender’s understanding of the person in view is often incomplete and obstructed. However, with expanded data, technology, and advanced analytics, there is an opportunity to better understand the whole person, and as a result have a more inclusive financial system. At Experian, we have a unique ability to connect the power of traditional credit with alternative data, bringing a more holistic understanding of consumers and their behaviors. We are dedicated to leveraging our rich history in data and our expertise in technology to create the future of credit and ultimately bring financial power to everyone. The future of lending After spending two days with over 700 industry leaders from around the world, one thing is abundantly clear: much like the early days of the internet, today, we are at the cutting-edge of a technical revolution. Reflecting on my time at Reuters NEXT, I am particularly excited by the collective commitment to drive innovative, and smarter ways of working. We are only beginning to scratch the surface of how data and technology can transform financial services, and Experian is positioned to play a significant role. As we look to the future, I am excited about the ways we will create new opportunities for businesses and consumers alike.

Published: Dec 13, 2024 by Scott Brown

We believe that financial literacy leads to empowerment. That is why Experian supports initiatives and partners with community organizations to deliver financial education. We also develop products and services that give more control to consumers over their credit profile and financial health. As part of advancing our mission of Financial Power to All®, we are proud to announce we are helping more than 5,000 Hispanic individuals nationwide by relieving $10 million dollars of consumer debt. To provide families with this boost, we joined forces with ForgiveCo, a Public Benefit Corporation (PBC), to administer the acquisition and cancellation of qualifying consumer debt for the selected recipients. Beneficiaries will also receive a one-year premium Experian membership for free that offers access to their Experian credit report in English and Spanish[i], FICO® Score[ii], bilingual educational content, and other financial resources. We hope this effort helps raise awareness of the importance of financial literacy for everyone, and that Experian has resources to help individuals reach their financial dreams. To amplify the message, we collaborated with multi-platinum, award-winning singer and songwriter Prince Royce and you can see his video here. In fact, we have been making a concerted effort the last several years to evolve our educational resources and products to better support all underserved communities. Some of our other activities include the creation of the B.A.L.L. for Life initiative that connects African American and Hispanic youth with financial education, supporting scholarships for Asian Americans through the Ascend organization, providing custom resources for Out & Equal and Born This Way Foundation for the LGBTQ+ community, supporting the NextGen Innovation Lab for Disability:IN, and sponsoring credit counseling for the military community with Operation HOPE. For resources in Spanish, Experian offers a credit e-book and consumers can access a full suite of articles at the Ask Experian blog here. [i] Only Experian credit reports are available in Spanish. All other services associated with an Experian membership are available in English only. English fluency is required for full access to Experian’s products. [ii] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Published: Oct 22, 2024 by Jeff Softley

Amid some of the financial challenges that underserved communities experience, members across the financial services community remain committed to championing initiatives and programs that drive greater financial inclusion. In fact, collaboration has led to the inclusion of non-debt related payment information on consumers’ credit profiles, as well as digital services that make it easier to manage money. These efforts have helped to broaden access to fair and affordable financial resources for more individuals. While significant progress has been made, there is still more work to do. However, some of the misconceptions and myths about the financial services community are hindering further advancement. Debunking these myths will accelerate progress by building trust between the financial services community and consumers. Person withdrawing money from ATM contactless Myth #1: “Financial institutions have no interest in underserved consumers or credit invisibles.” The truth is, banks and credit unions want to say “yes” to more prospective borrowers, including individuals and families from underserved communities. Beyond being the right thing to do, it’s an opportunity to potentially build lifelong relationships with a relatively untapped market. A show of good faith to communities who have largely been ignored by the financial system could lead to customer loyalty that may extend to their family and friends. That’s why participants across the financial ecosystem have been proponents of including expanded data sources—such as on-time telecom, utility and video streaming service payments—on to consumer credit reports, as well as exploring other Fair Credit Reporting Act (FCRA)-regulated data sources, including payment data on short-term small dollar loans and expanded public records data. Making this data more accessible to lenders provides a more comprehensive view of a consumer’s ability and willingness to repay outstanding debt—an actionable solution to extending credit to consumers without lenders taking on additional risk. Myth #2: “There is a lack of trustworthy financial education resources.” The financial services community and affiliated organizations recognize that empowering people with financial knowledge and skillset are critical to consumers’ financial success. In fact, banks and credit unions are partnering with nonprofits and non-governmental organizations to better understand the unique challenges and opportunities within specific communities and provide relevant tools and resources. For example, Experian’s B.A.L.L. for Life (Be A Legacy Leader) program, launched in partnership with the National Urban League, serves as a catalyst for engaging with Black communities and low-income youth through live events and digital financial education. Subject matter experts, professional athletes, celebrities, and other influencers share their experiences and expertise, covering topics such as banking, credit, financial management and investing. In addition, to help people improve their financial management, Experian partners with the National Foundation for Credit Counseling (NFCC). The NFCC connects consumers with certified financial counselors to help them address various pain points, including debt management, homeownership, student loans or small business cash flow issues. Myth #3: “Underserved communities have few opportunities to build credit and enter the mainstream financial system.” People from underserved communities, as well as younger consumers and recent immigrants are often excluded from the mainstream financial system because they lack an extensive credit history. Historically, it’s created a vicious cycle; in order to get credit, you have to have credit. Fortunately, there has been a sea change in innovative solutions to address the specific needs of these populations. These include new credit scoring models and microfinancing which provide financial services to individuals who may have been excluded from traditional banking systems. In addition, by incorporating expanded data sources, such as telecom, utility and residential rental payments onto credit reports, lenders have more visibility into consumers who may have been excluded by traditional credit scoring methods.These programs help individuals and families from underserved communities establish and build a credit history that could enable loans, or the ability to rent an apartment or open their dream business. An example is Experian Boost®, a free feature that allows Experian members to contribute their history of making utility, cellphone, insurance, residential rent and video streaming service payments directly into their Experian credit profile. By incorporating nontraditional credit data like paying utility bills on time, online banking transactions, rental payments and verified income data, more people can establish a credit profile that can potentially qualify them for a loan. More Inclusion, Fewer Myths It’s encouraging that community organizations and banks are beginning to see the economic and social benefits of aligning on financial literacy and inclusion. As more initiatives come online, underserved populations will be able to establish a better financial foundation. Then, we can declare the myths to be history.

Published: Jul 23, 2024 by Sandy Anderson