Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

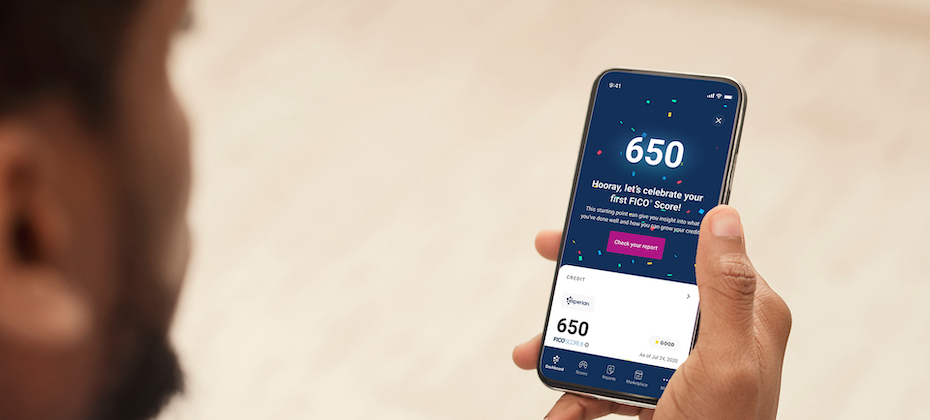

For the past several years, we’ve been on a journey to improve financial access for millions of people around the world. We’ve made it our job to help consumers get the best financial outcomes. This focus on consumers defines us and informs everything we do. In 2019, we reshaped how consumers access credit with Experian Boost™. Since then, nearly 9 million consumers have connected to the product. While we are proud of what we have and continue to accomplish with Experian Boost, we know there is more to be done to ensure more consumers can access fair and affordable credit. Improving outcomes for underserved consumers When credit is used responsibly, it can create new opportunities from getting a college degree, buying a car or home and starting or expanding a business. These are milestones that help people establish careers, build wealth and ultimately achieve greater financial freedom. Yet, there are millions of consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. In fact, our recent research shows there are at least 28 million credit invisibles in the U.S. with an additional 21 million consumers who are unscoreable by the credit score models most used by lenders today. Without an established credit history, these consumers struggle to qualify for everything from an auto loan to a mortgage and even an apartment or employment. This problem more frequently impacts communities of color with 28 percent of all Black and 26 percent of all Hispanic consumers currently unscoreable or credit invisible. Increasing financial inclusion depends on creating opportunities for underrepresented consumers to succeed. And this starts with ensuring all consumers have a financial identity. Bringing financial power to all with Experian Go The challenge is many consumers who are not in the credit ecosystem today are unsure where to start. Today, we reached a pivotal and exciting milestone in our commitment to consumers with the launch of Experian Go™. This new program opens the front door to the financial ecosystem for millions of consumers by helping them establish their financial identity and move from credit invisible to scoreable. Within minutes, credit invisibles can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost™[1], and instant access to financial offers through Experian Go. In fact, early analysis shows 91 percent of consumers with no credit history who connect to Experian Boost, a free feature that allows users to contribute their on-time cell phone, video streaming service, internet, and utility payments directly to their Experian credit report, can become scoreable in minutes with an average starting near-prime FICO® Score of 665[2]. Throughout the experience, we’ll provide ongoing credit education and access to tools like Experian Boost™ to make it easy for consumers to learn how to use and responsibly grow their credit histories. Until now, our industry has struggled to verify the identity of credit invisibles. Over the last several years, we’ve introduced new identity verification technologies to our toolbox. With Experian Go, we’re leveraging these technologies to verify a credit invisible’s identity and get them in the front door to start building credit. No other credit bureau or organization is doing this today. During our pilot, we helped more than 15,000 consumers establish their credit history. This is a great start. Now that Experian Go has launched, I look forward to helping millions more consumers get the credit they deserve. To learn more about Experian Go, visit www.experian.com/go. [1] Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. [2] Experian analysis based on an anonymized and statistically relevant sample of consumer credit reports with only Experian Boost tradelines included and FICO® Scores. December 2021.

I’m delighted to announce that Experian has been named as a Top Employer across five countries. Our teams in the UK, Germany, Brazil, Singapore and Australia were all recognised in the 2022 awards which is a fantastic achievement. At Experian we pride ourselves on having a great People First culture, it’s something we are all proud of and want to protect. We do this by supporting a dynamic, positive and inclusive working environment for our employees wherever they are in the world. Our people are passionate about the work that we do, using data, analytics and technology to help transform lives and create a better tomorrow for people and organisations. We see our people live that purpose everyday in their work and it is wonderful to see that pride, about the role we play – supporting clients, consumers economies and society – getting recognised once again.

The past few years have sparked a swift digital transformation that subsequently drove a rapid increase in fraud. In fact, fraudsters have gotten more creative, putting businesses and consumers at risk now more than ever. At Experian, we predict that more intricate challenges lie ahead and are dedicated to helping businesses combat fraud threats. Here’s what we expect in 2022: 1. Buy Now, Pay Never – The Buy Now, Pay Later (BNPL) space has grown massively recently. In fact, the number of BNPL users in the US has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 who are spending more than $20.8 billion . Without the right identity verification and fraud mitigation tools in place, fraudsters will take advantage of some BNPL companies and consumers in 2022. Experian predicts BNPL lenders will see an uptick in two types of fraud: identity theft and synthetic identity fraud, when a fraudster uses a combination of real and fake information to create an entirely new identity. This could result in significant losses for BNPL lenders. 2. Beware of Cryptocurrency Scams – Digital currencies, such as cryptocurrency, have become more conventional and scammers have caught on quickly. According to the FTC, investment cryptocurrency scam reports have skyrocketed, with nearly 7,000 people reporting losses totaling more than $80 million from October 2020 to March 2021 . In 2022, Experian predicts that fraudsters will set up cryptocurrency accounts to extract, store and funnel stolen funds, such as the billions of stimulus dollars that were swindled by fraudsters. 3. Double the Trouble for Ransomware Attacks – In the first six months of 2021, there was $590 million in ransomware-related activity, which exceeds the value of $416 million reported for the entirety of 2020 according to the U.S. Treasury's Financial Crimes Enforcement Network . Experian predicts that ransomware will be a significant fraud threat for companies in 2022 as fraudsters will look to not only ask for a hefty ransom to gain back control, but criminals will also steal data from the hacked company. This will not only result in companies losing sales because of the halt caused by the ransom attack, but it will also enable fraudsters to gain access and monetize stolen data such as employees’ personal information, HR records and more – leaving the company’s employees vulnerable to personal fraudulent attacks. 4. Love, Actually? – Because more consumers went on dating apps and social media to look for love during the pandemic, fraudsters saw an opportunity to create intimate, trusted relationships without the immediate need to meet in-person. The FBI found that from January 1, 2021 — July 31, 2021, the FBI Internet Crime Complaint Center received over 1,800 complaints, related to online romance scams, resulting in losses of approximately $133 million. Experian predicts that romance scams will continue to see an uptick as fraudsters take advantage of these relationships to ask for money or a “loan” to cover anything from travel costs to medical expenses. 5. Digital Elder Abuse Will Rise – According to Experian’s latest Global Insights Report, there has been a 25 percent increase in online activity since the start of Covid-19 as many, including the elderly, went online for everything from groceries to scheduling health care visits. This onslaught of digital newbies presents a new audience for fraudsters to attack. Experian predicts that consumers will get hit hard by fraudsters through social engineering (when a fraudster manipulates a person to divulge confidential or private information) and account takeover fraud (when a fraudster steals a username and password from one site to takeover other accounts). This could result in billions of dollars of losses in 2022. As a leader in fraud prevention and identity verification, Experian offers a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian's fraud management tools.