Lorem Ipsumis simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Today is Transgender Day of Visibility. A day to celebrate trans people around the world, highlighting their experiences, perspectives and also unfortunately spotlighting the discrimination and challenges they still face. A recent report from TotalJobs found that the number of trans workers in the UK surveyed who said they hid their gender identity at work has risen in the past 5 years – from 52% in 2016 to 65% in 2021. It also found that 43% of trans employees surveyed said they had left a job because the environment was unwelcoming, up from 36% in 2016. This should make us all sit up and want to take action. At Experian, we want colleagues of all gender identities to feel comfortable and safe bringing their whole selves to work. We’ve been working hard on how we can continue to improve the support we offer our trans and non-binary colleagues. We realise that choosing to be open about one’s gender identity is a very personal decision, but all trans and non-binary employees should feel safe at Experian if they choose to disclose. Last year we re-wrote our Transitioning at Work policy to ensure it is reflective and inclusive of the experiences and identities of employees who may use it. We offer paid leave to attend medical appointments and we also provide help in changing your records on our systems. Where an employee chooses to disclose information about their gender identity or status, we treat this information with the utmost confidentiality. We never share this information without the written consent of the individual. We encourage our employees to self-identify and recognise the issues in the current Gender Recognition Act. In September, we supported Stonewall’s Trans Right are Human Rights campaign, pushing for its reform. We continue to monitor the progress that has been made but also progress that is yet to come. It’s important you know that Experian will never ask for you to show a Gender Recognition Certificate (GRC) and we respect your right to privacy as to whether or not you have one. At Experian, we take an always listening, always learning approach to building awareness and acceptance. Creating safe spaces for meaningful dialogue is something we really strive for. It is the responsibility of all our employees to respect their colleagues and to create an inclusive workplace where everyone feels they can belong. We have zero tolerance for discrimination, bullying or harassment and take any incidents very seriously. Experian continues to work with the Experian Pride Network UK&I alongside LGBTQ+ charities Stonewall and Mermaids in the UK to further the inclusion of our trans and non-binary employees. We want all trans and non-binary employees at Experian to feel safe and be able to be themselves at work and we expect all colleagues to support each other to make that real.

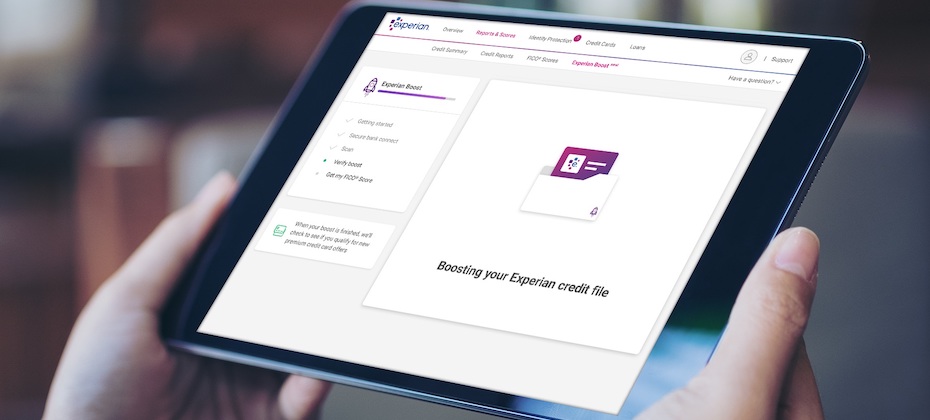

After launching Experian Boost, the first-of-its-kind tool that allows consumers to instantly increase their credit scores, in March 2019 we recently reached a significant milestone. Millions of consumers have boosted their credit scores to the tune of 50 million total points. This means many consumers have improved score bands, saved money with better interest rates, and maybe reached some of their financial goals such as gaining access to credit for a home. In fact, we know our Boost users have gained access to more than 1.7 billion total dollars in credit as a result of improving their credit score. The idea behind Experian Boost is to give consumers control over their credit – to enable them to make real, substantial progress in their financial health journey by getting “credit” for paying bills on time. Our ability to help consumers in a challenging economic climate is what drives us to continue to innovate. For example, we recently expanded Experian Boost to add positive payment history for video streaming services such as Netflix in addition to telecom and utility payments. The benefits to having control and using tools like Experian Boost do not end there. Consumers receive a boosted FICO® Score, which is used by a majority of lenders giving them a great opportunity for credit with better terms. In the first year after launching, we saw one million consumers add a credit card and nearly 250,000 consumers acquired an auto loan. Also, some consumers earned a credit score for the first time. What is also significant about Experian Boost is that this type of financial control and opportunity gives consumers a sense of empowerment, motivation and satisfaction that they can take a positive step in their financial journey. We’ve heard this firsthand from consumers through focus groups, and we even featured some consumers in our commercials who shared their positive experiences in front of the camera. This sentiment of empowerment among consumers is especially important right now as many are struggling financially due to the pandemic. We have many exciting new tools launching in 2021 and will continue to focus on empowering consumers to reach their financial goals. To learn more about Experian Boost, visit www.experian.com/boost.

Does checking my credit report hurt my credit score? How can I improve my credit score? What’s the difference between a credit score and a credit report? These are a few of the questions I most often hear about credit, and the answers to these fundamental questions are essential to financial well-being. Understanding credit scores and the factors that influence overall credit health is important any time, but this is especially true in our current environment. As part of our ongoing commitment to consumer education on the road to recovery, I recently had the pleasure of partnering with Akbar Gbajabiamila, host of American Ninja Warrior, former football pro and financial fitness expert, for an Instagram Live event. Akbar is passionate about helping people develop a financial game plan and he understands having a good credit history is a key component of good financial health. During the Instagram Live event, I answered questions from Akbar’s fans and shared ways to improve your credit score through tools like Experian Boost. In case you missed it, you can watch the video recap on Akbar’s Instagram account (@akbar_gbaja) or at the following link: https://www.instagram.com/tv/CLpbdDJlaQ6/ View this post on Instagram A post shared by 🇳🇬Akbar Gbajabiamila🇺🇸 (@akbar_gbaja) A positive credit history can be the gatekeeper to many of the things we all want in life, and we’re committed to helping facilitate fair and affordable access to credit for all consumers, including those in marginalized communities. This is one of the many reasons I’m passionate about my role at Experian. Educating consumers about credit is an important part of getting the economy as a whole humming again and helping those most in need. If you have additional questions about credit, feel free to check out the free resources below. Additional credit education resources and tools Join Experian’s weekly#CreditChat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern time. Visit the Ask Experian blog for answers to common questions, advice and education about credit. Add positive telecom, utility and streaming service payments to your Experian credit report for an opportunity to improve your credit scores by visiting experian.com/boost. You can request a free copy of your credit report from each of the three credit bureaus once a week through April 20, 2022 by visiting annualcreditreport.com For additional resources, visit https://www.experian.com/consumereducationor experian.com/coronavirus.