There is no doubt data breaches have become a part of the Corporate and consumer consciousness. As data breaches have become more prevalent and companies are in need of assistance to prepare for and respond to a breach, industry analysts have taken notice of the experts in the marketplace like Experian. In its first report on data breach services, we are proud to have been named as a leader in The Forrester Wave™: Customer Data Breach Notification And Response Services, Q3 2015.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars.

Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both.

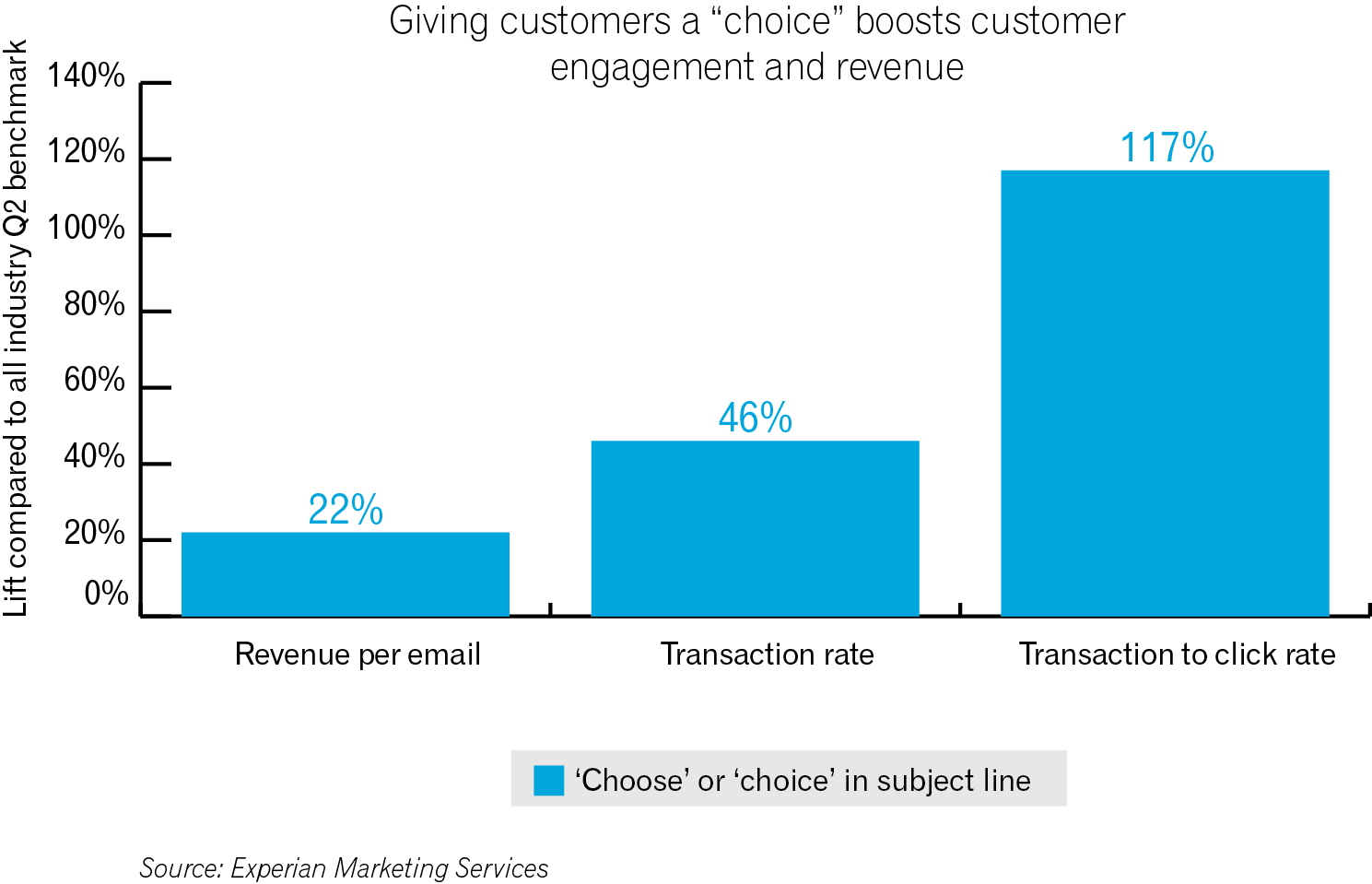

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

New research from Experian Marketing Services, a recognized leader in data-driven marketing and cloud-based marketing technology, shows that email campaigns using the words “choice” or “choose” in the subject line are driving substantially higher engagement and revenue rates than average.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.