It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”

![A Glimpse at the Largest Metropolitan Areas’ State of Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

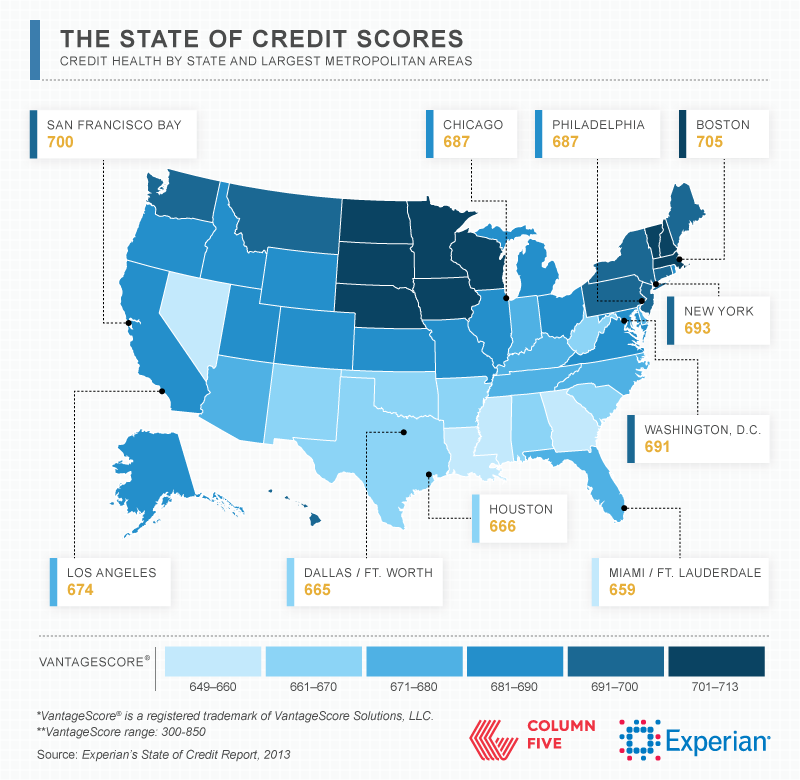

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

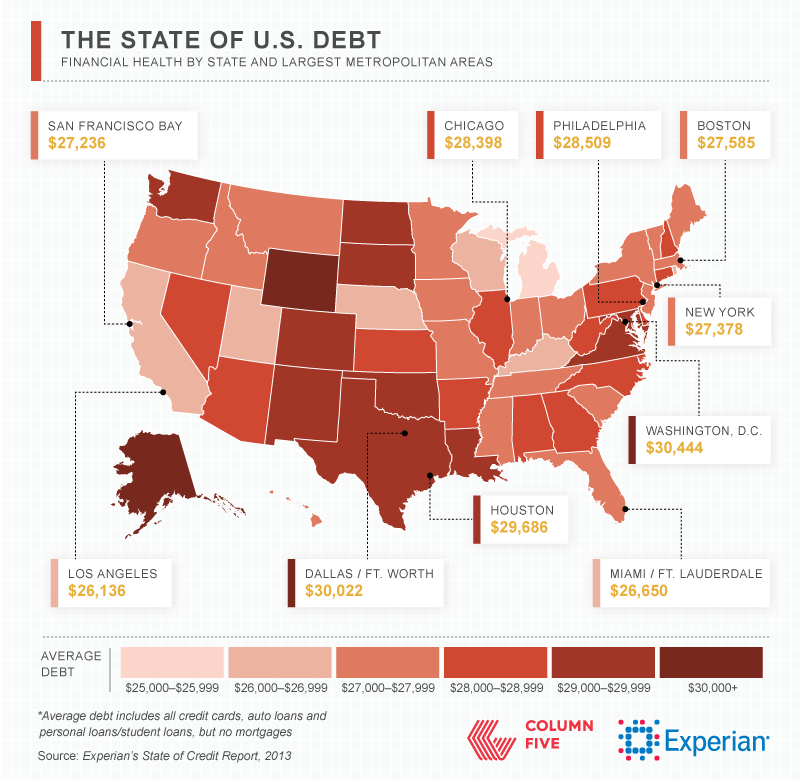

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

![Average Debt in Largest Metropolitan Areas [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian’s Fourth Annual State of Credit Report

View interactive map: Experian’s Fourth Annual State of Credit Report

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.