Most people will tell you that they’re extremely proud when their hometown or current city accomplishes something. Hometown pride is why people are diehard fans for the local professional or college sports teams. Knowing that their city shines bright in any light, gives people a good feeling inside. With that said, people in the New York Metro area should have a strong sense of pride in how their businesses are performing. According to Experian’s Q2 Metro Business Pulse analysis, which looks at the top metropolitan areas in four key business credit categories, businesses in the New York area had the lowest average bankruptcy rates in the quarter, at just 0.28 percent. Those in the Nassau, NY; Baton Rouge, La; Honolulu; and Miami areas also have reason to be excited, as their businesses rounded out the top five with the lowest rates in this category.

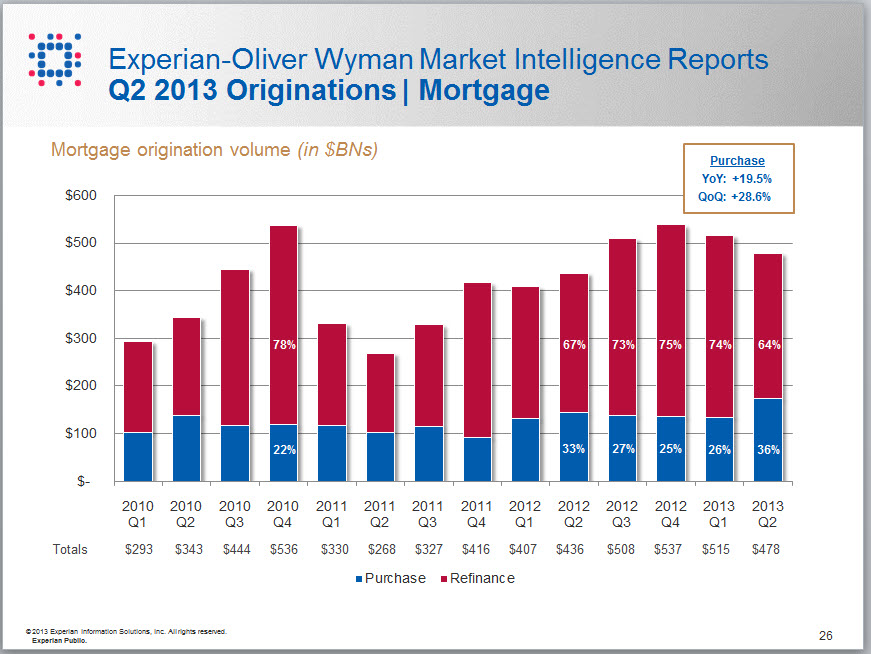

An analysis of trends shows that mortgage originations have increased by 10 percent from a year ago. More important, a look at the most recent completed quarter shows a 29 percent increase in home purchases from the prior quarter and a decrease in the number of refinances, suggesting a sustained recovery is beginning to come from purchases. These findings and others were part of the quarterly analysis from Experian that examines real-estate trends.

The key statistic in the real-estate market is the change in the ratios of refinances versus home purchases, with purchases making up a much greater proportion of the total origination volume. The data from Experian’s IntelliView product indicates that despite a 7 percent decrease from the previous quarter in refinancing activity, home purchases grew by 20 percent year over year and 29 percent quarter over quarter, and this is where we can begin to see some of the real-estate recovery taking place.”

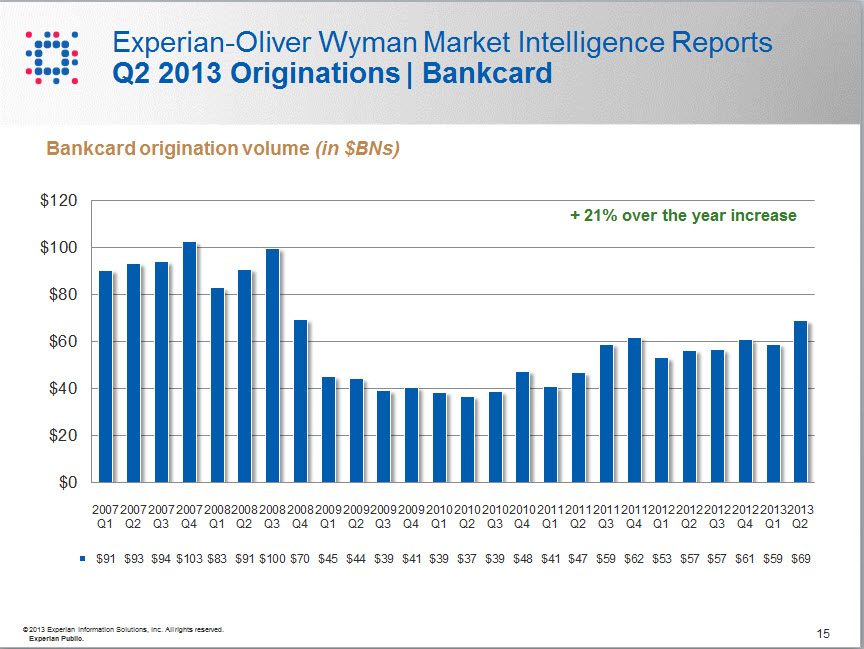

An Experian analysis of bankcard trends from Q2 2013 showed a 21 percent year-over-year increase in bankcard origination volumes, equating to $12 billion increase in new bankcard limits issued. Other insights offered by Experian, the leading global information services company, include record lows in early-stage bankcard delinquencies.

Bankcard originations continue to track with the recovery in terms of steady growth. While we may never hit the volumes we saw in 2007, the consistent growth rates that we are currently seeing in bankcard originations signal that the market is coming back online.