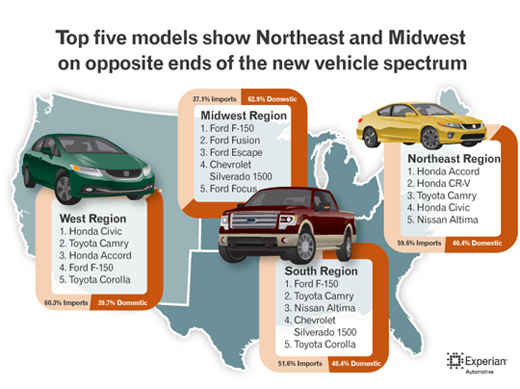

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

Grab a pen and paper. Jot down some differences between the Northeast and Midwest. What came to mind? Maybe it was the bright city lights of the Northeast versus the Midwest’s starlit farms? Or maybe it’s the city’s busy streets compared to quiet open fields? What you may or may not have written down is that Northeasterners prefer to drive more import vehicles than the folks in the Midwest.

According to Experian Automotive’s mid-year review of automotive market trends, in the first half of 2013, the top five new vehicle models in the Northeast region were all import brands. Conversely, as one might have guessed, American-made vehicles dominated the Midwestern roads. In the Northeast, the list was made up of the Honda Accord, Honda CR-V, Toyota Camry, Honda Civic and Nissan Altima. Out in the Midwest, Ford vehicles made up four of the top five and the Chevrolet Silverado 1500 filled out the list. The top five in order included the F-150, Fusion, Escape, Silverado 1500 and the Focus.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.

In the personal finance world, credit is one of the hottest topics to talk about and there are many resources available to consumers.

To further empower consumers to take a more active role in managing their credit, Experian provides a number of solid consumer education programs.

As a positive extension to those, in 2011 we developed Experian Credit Educator, a consumer-education service that offers personalized, live, one-on-one, telephone-based credit education sessions to consumers and customers of Experian’s clients.

Experian recently announced that we’ve added new features to this service in order to give consumers insights into specific actions which may produce an improvement to their credit score.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

Today I’ve been reading sensational and very misleading headlines saying things like “Experian Sold Consumer Data to ID Theft Service” and “Experian Duped into Selling Social Security Nos.”

Let me share with you the actual – and factual – events that led to the investigation and subsequent arrest of the suspect in the case surrounding Court Ventures and US Info Search.

The suspect in this case obtained access to US Info Search data through Court Ventures prior to the time Experian acquired the company.

To be clear, no Experian database was accessed.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.