When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

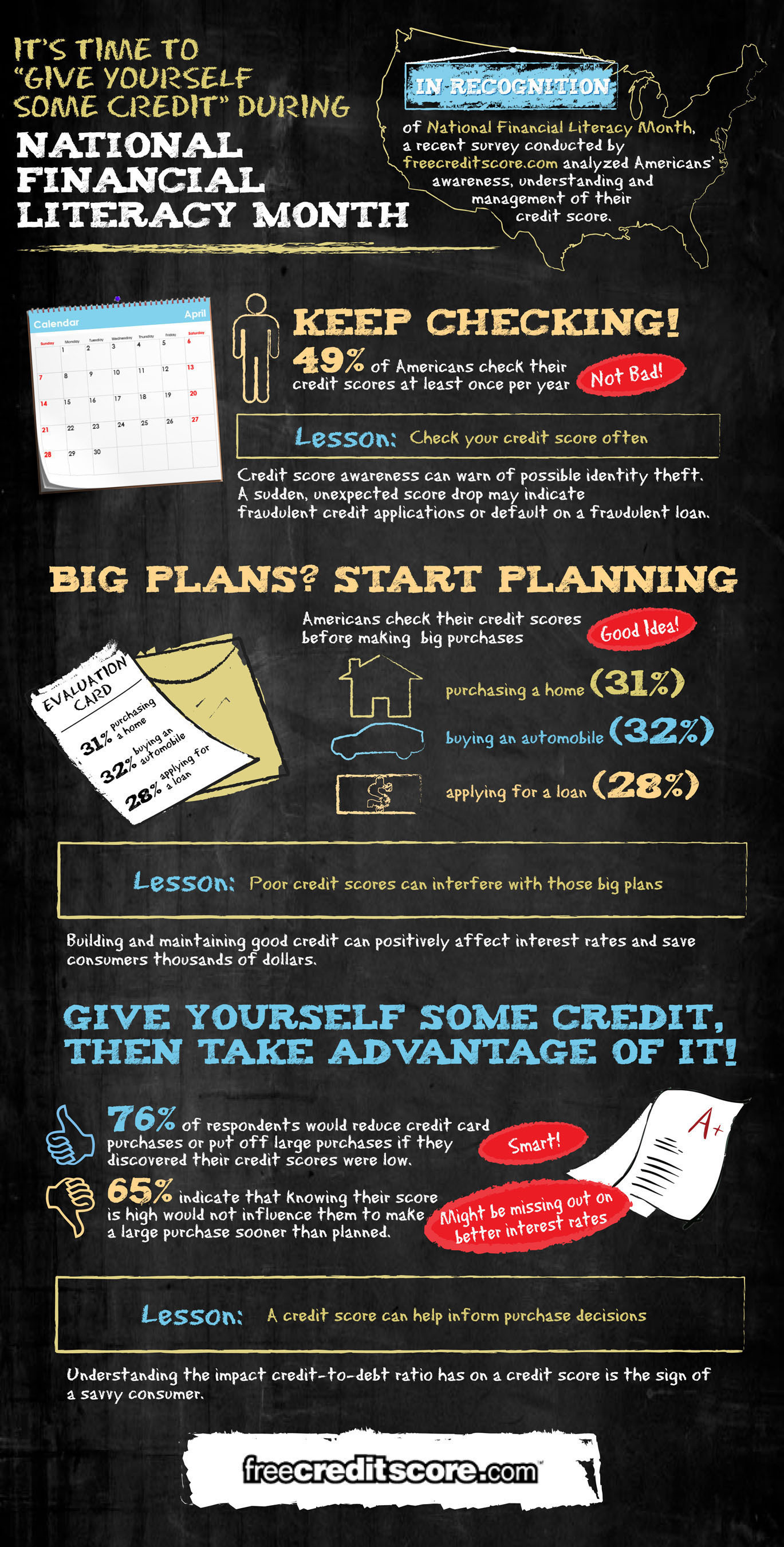

![Give Yourself Some Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.