A recent study conducted by the Governing Institute and commissioned by Experian confirms that government benefit agencies can greatly improve their eligibility verification processes through automated data analytics. Historically, assorted health and human service programs have been compartmentalized, with each benefit agency having its own data collection system, eligibility requirements and program rules. The technology to streamline processing by allowing one agency to match its data against other content repositories, though available, has not been in place. The result has been frequent re-entry of information causing processing delays, slowing response time and increasing manual labor costs. These shortcomings have limited agencies’ ability to detect and combat fraud.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

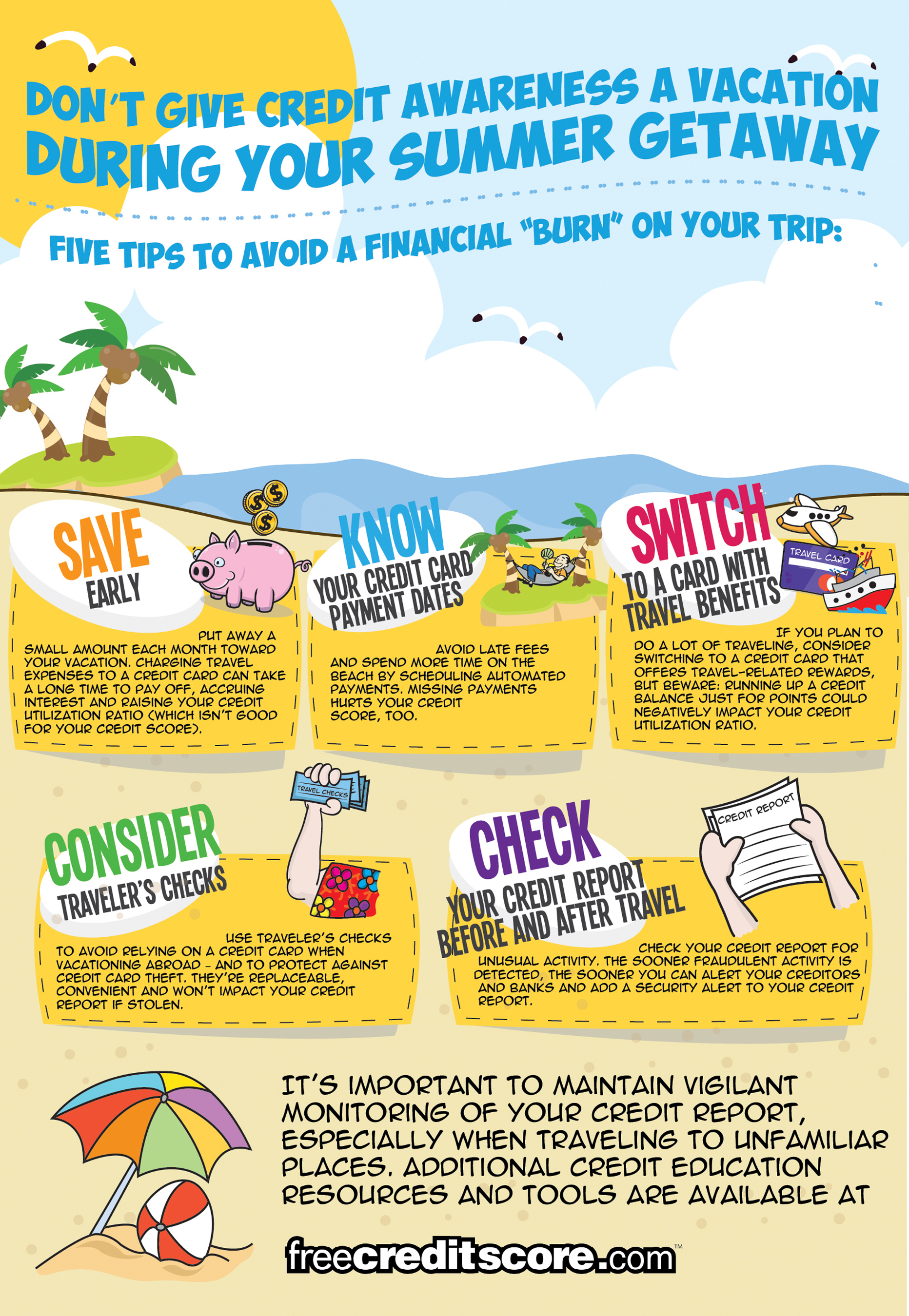

![5 Tips to Avoid a Financial “Burn” On Your Summer Getaway [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.