Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

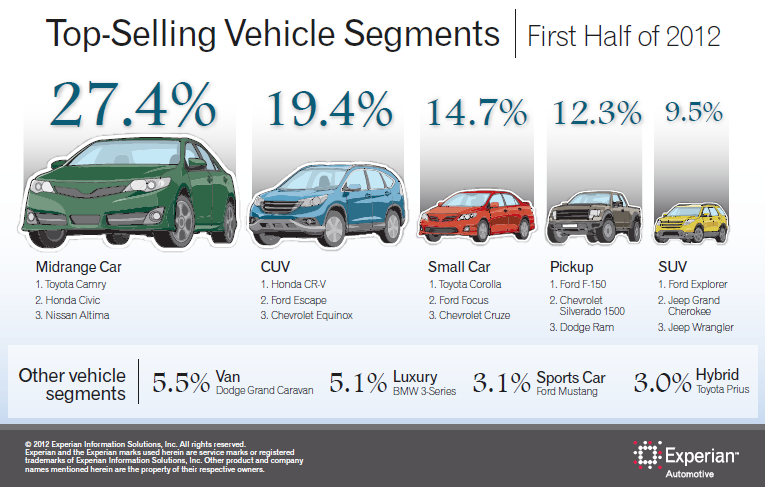

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.