For those of you who did not attend Experian’s Vision Conference this week, you may have missed an opportunity to learn how to drive profitable growth by leveraging the PowerCurve software to make accurate, analytics-based decisions quickly, efficiently and repeatedly to acquire, manage and grow your customer relationships. However, it’s not too late for you to catch up.

For those of you who did not attend Experian’s Vision Conference this week, you may have missed an opportunity to learn how to drive profitable growth by leveraging the PowerCurve software to make accurate, analytics-based decisions quickly, efficiently and repeatedly to acquire, manage and grow your customer relationships. However, it’s not too late for you to catch up.

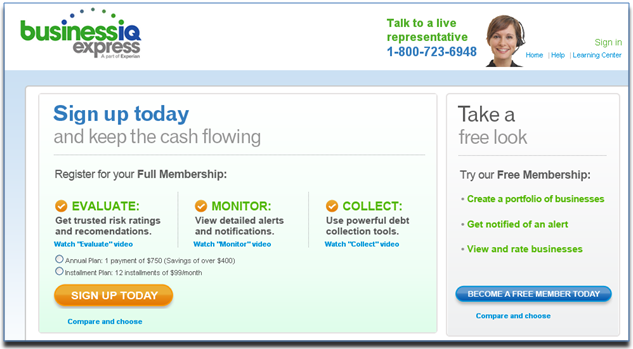

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change.”

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change.”

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.