Today, we stand at the forefront of a digital revolution that is reshaping the financial services industry. And, against this backdrop, financial institutions are at vastly different levels of maturity; the world’s biggest banks are managing large-scale infrastructure migrations and making significant investments in AI while regional banks and credit unions are putting plans in place for modernization strategies, and fintechs are purpose-built and cloud native.

To explore this more, I recently had the privilege of attending the annual Reuters NEXT live event in New York City. The event gathers globally recognized leaders across business, finance, technology, and government to tackle some of today’s most pressing issues.

On the World Stage, I joined Del Irani, a talented anchor and broadcast journalist, to discuss the future of lending and the pivotal role of data and AI in building a more inclusive financial system.

Improving financial access

Our discussion highlighted the lack of access to traditional financial systems, and the impact it has on nearly 100 million people in North America alone. Globally, the problem affects over one billion people. These people, who are credit invisible, unscoreable, or have subprime credit scores, are unable to secure everyday financial products that many of us take for granted.

What many don’t realize is, this is not a fringe subset of the population. Most of us, myself included, know someone who has faced the challenges of financial exclusion. Everyday Americans, including young people who are just starting out, new immigrants and people from diverse communities, often lack access to mainstream financial products.

We discussed how traditional lending has a limited view of a consumer. Like looking through a keyhole, the lender’s understanding of the person in view is often incomplete and obstructed. However, with expanded data, technology, and advanced analytics, there is an opportunity to better understand the whole person, and as a result have a more inclusive financial system.

At Experian, we have a unique ability to connect the power of traditional credit with alternative data, bringing a more holistic understanding of consumers and their behaviors. We are dedicated to leveraging our rich history in data and our expertise in technology to create the future of credit and ultimately bring financial power to everyone.

The future of lending

After spending two days with over 700 industry leaders from around the world, one thing is abundantly clear: much like the early days of the internet, today, we are at the cutting-edge of a technical revolution. Reflecting on my time at Reuters NEXT, I am particularly excited by the collective commitment to drive innovative, and smarter ways of working.

We are only beginning to scratch the surface of how data and technology can transform financial services, and Experian is positioned to play a significant role. As we look to the future, I am excited about the ways we will create new opportunities for businesses and consumers alike.

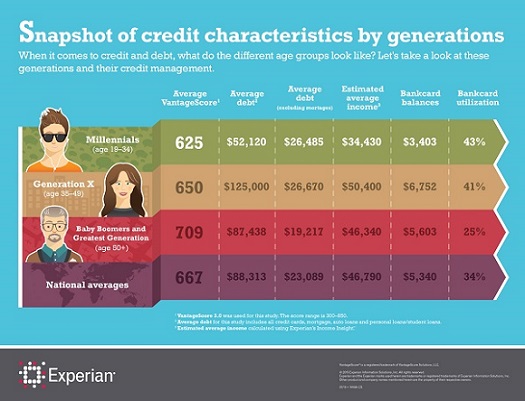

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.