Greater transparency in buy now, pay later activity is key to helping consumers build their credit histories and supporting responsible lending.

Experian North AmericaScott Brown, Group President, Financial Services

Affirm plans to report all pay-over-time loan products issued from April 1, 2025, and beyond, including Pay-in-4. The move will help drive greater transparency into the buy now, pay later market while helping consumers build their credit histories over time.

Experian Automotive today announced that there were 17.3 million more light-duty vehicles seven years and older on the road in the United States than there were three years ago.

According to its Q1 2012 Vehicles in Operation (VIO) market analysis, Experian Automotive also found that there were more than 245 million vehicles on U.S. roads, and that the age of vehicles increased when compared to Q1 2011, up 1.9 percent to an average age of 11 years.

Experian Automotive today announced that there were 17.3 million more light-duty vehicles seven years and older on the road in the United States than there were three years ago.

According to its Q1 2012 Vehicles in Operation (VIO) market analysis, Experian Automotive also found that there were more than 245 million vehicles on U.S. roads, and that the age of vehicles increased when compared to Q1 2011, up 1.9 percent to an average age of 11 years.

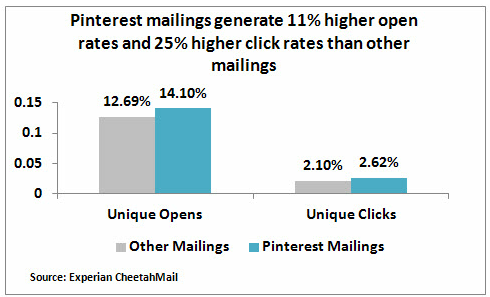

Experian Marketing Services’ CheetahMail® developed a new Pinterest email functionality late last year that has produced significantly higher both open and click rates for emails with the functionality, while also enabling retailers’ products to go viral. Several retailers, including Ballard Designs, have seen significant increases in click-to-open rates, Pinterest followers and pinboard activity by incorporating the capability into their email campaigns.

Theyyyy’re baaack! They once graced American televisions singing witty lyrics about their personal credit woes while waiting tables in pirate costumes, living out of the in-laws’ basement and getting snubbed by women because of their lackluster car. Now, after a two-year hiatus, The Original Band is back by popular demand.

Theyyyy’re baaack! They once graced American televisions singing witty lyrics about their personal credit woes while waiting tables in pirate costumes, living out of the in-laws’ basement and getting snubbed by women because of their lackluster car. Now, after a two-year hiatus, The Original Band is back by popular demand.