For more than 20 years, Experian has been an advocate for full-file reporting, which means that we support the widespread reporting of alternative data—rental payments, utility payments and cellular telephone payments to name a few. For a large segment of the population, the reporting of these types of payments could provide opportunities to establish and/or build a credit file.

In 2011, Experian recognized that positive rental payment data was missing from credit files and could be an opportunity for 100 million renters to finally be rewarded and not overlooked simply because they rent instead of own the place they call home. With this in mind, we led the industry to start incorporating on-time rental payments to credit files through our Experian RentBureau business and utilized new technology that could score consumers previously deemed unscoreable. This investment opened the doors to underserved populations and helped moved the needle to becoming more financially inclusive.

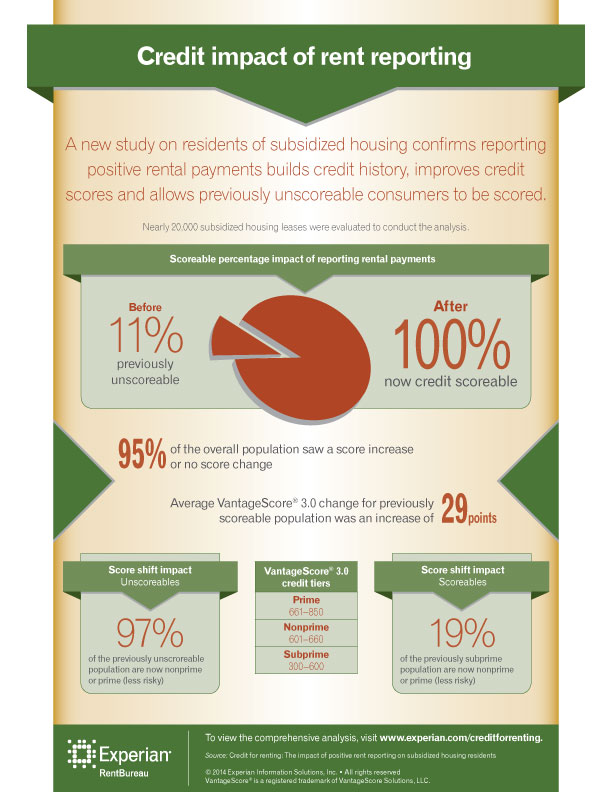

To show the value of this powerful data, Experian conducted an analysis in July 2014 on subsidized housing residents to examine how rental tradelines can impact credit file thickness, risk segment migration, credit scores and the ability to score previously unscoreable residents.

The study revealed that adding on-time rental payments to credit files may help those who operate primarily on a cash basis to integrate into the banking system and establish a credit history that they can leverage to receive more affordable credit and improve their economic well-being.

Here are some of the highlights of the study:

- 100 percent of the previously unscoreable study participants became credit scoreable

- The average VantageScore® 3.0 score change for previously scoreable participants in the study was an increase of 29 points

- 95 percent of study participants experienced a score increase or no score change with subprime and nonprime residents receiving the greatest positive score impact

- 19 percent of study participants previously considered subprime migrated to at least one higher (less risky) risk segment, typically yielding more affordable credit and additional credit opportunities

- 23 percent of thin-file residents migrated to the thick-file category, potentially signaling to a lender the ability to manage multiple credit obligations

- 97 percent of the previously no-hit (and credit unscoreable) residents fell in one of the two least risky risk segments with the addition of the paid-as-agreed rental tradelines

This report on the impact of positive rent reporting on subsidized housing residents further enforces the value of using big data for good to break down the barriers for an estimated 60 million Americans considered credit invisibles. At the core of Experian’s business are its data and analytic capabilities. We find innovative ways to help businesses turn our data insights into actions that provide responsible, affordable and accessible credit to more consumers. It is our commitment to continue to drive the industry toward more inclusion and opportunities for consumers to enhance their economic well-being.