All posts by Editor

More areas of the business are leveraging data and insight around customers than ever before. Today’s digital consumer puts more pressure on organizations to provide personal interactions across all industries, even when that individual is not interacting face-to-face. In order to accomplish that monumental feat, businesses are turning to their data assets to give them the insights they so desperately need. But that is no easy task. We find that most organizations lack trust in their data, typically due to outdated and ineffective data management practices. Businesses can no longer wait for others within the organization to improve the quality of their data. Many are looking to take more control themselves. In fact, according to a recent Experian study, 75 percent of respondents believe data quality responsibility should ultimately lie with the business with occasional help from IT. The rise of the business user is putting more pressure on the tools they leverage. While data quality is a continuous practice that requires constant care, it is certainly enabled by technology. That technology needs to be easy-to-use, intuitive, and provide value back to the business quickly. This week, the 2019 Gartner Magic Quadrant for Data Quality Tools was issued. The report provides an overview of the players in the space and the "key capabilities that organizations need in their tool portfolio, if they are to address the increasing importance and urgency of data quality." The business user is reshaping the data quality market. Now, rather than looking at just features and functions, new Experian research shows that the ease of use by business users and the ability to work with existing technology are more important. These tools need to be designed differently than they have in the past. 56% of businesses say their IT department doesn’t fully understand the data management needs of the business. That means that organizations need to put their data more in the hands of the people who leverage it every day. At Experian Data Quality, we believe in empowering business users to better understand their data assets in order to transform their businesses. We offer easy-to-implement, easy-to-use tools that are designed to help businesses maximize their data insight and build trust in their information. We want our clients to tackle their projects with speed and agility, giving them the confidence and clarity to put their data to good use. We are proud to be named a ‘Challenger’ once again in Gartner’s 2019 Magic Quadrant for Data Quality Tools. We believe in the changing nature of the business and are working to challenge the status-quo in our industry and for our clients. Access the Gartner 2019 Magic Quadrant for Data Quality Tools report.

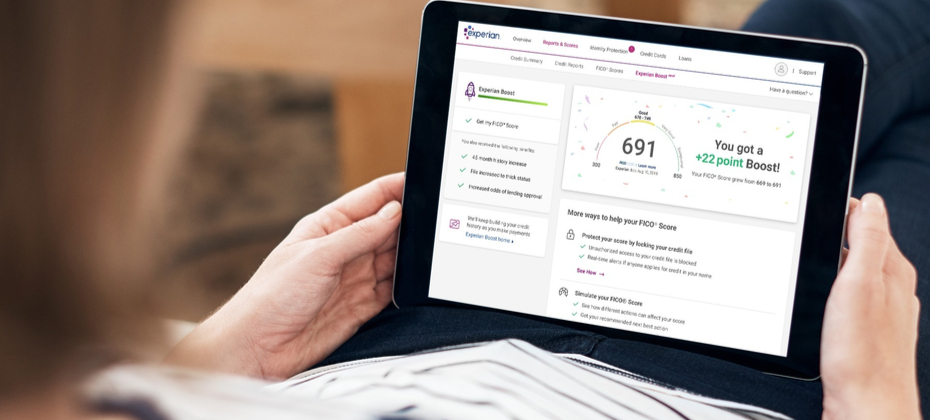

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don't have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we're bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

The Women in Experian Employee Resource Group recently celebrated International Women’s Week with a series of events, including executive panels, speakers and book club meetings. The theme of this year’s event is Better Balance = Better Experian, focusing not only on bringing awareness for gender balance, but also celebrating inclusion. The activities are part of Experian’s commitment to advancing a culture that not only respects differences, but actively celebrates them. We call this The Power of YOU. During the week, we announced that Merideth Wilson, Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, will be the lead ambassador for the Women in Experian (WiE) Employee Resource Group in North America. Throughout the year, Wilson and a global team of female leaders from across the business will plan initiatives designed to help women achieve their ambitions and build successful careers. In a Q and A this week, Wilson shared her thoughts and provided tips for women on how to be successful in the workplace. Q. Why is confidence so important for women to reach their career goals? A. Confidence is key for anyone wanting to reach their career goals, but I find it’s especially important for women to find their voice and be able to confidently express themselves. Women need to ask for what they want more often and be vocal about their career aspirations on a regular basis versus waiting for an annual review discussion, for example. Messages typically are delivered and received more successfully using a confident tone; authenticity in a person and one’s message is also very important. Q. What advice can you provide when it comes to accountability? A. Women have to hold ourselves accountable, both professionally and personally, and deliver/drive the results we say we will (or sign up for). Being accountable means taking personal responsibility for the outcome and removing the roadblocks in our way to achieving our goals. I often find that “credibility” is tied to “accountability,” and the importance of how we as women conduct ourselves in driving to the results cannot be overstated. Q. What are your thoughts on communication skills and being self-aware? A. Women need to know their audience. Effective communication often requires different styles and mediums depending on the situation and environment. One of the greatest communication skills a woman can have is the ability to confidently present in public. Public speaking is scary to many, but with practice it can be a woman’s best asset. Q. Explain how empathy and honesty can be key to career growth. A. Integrity, honesty and trustworthiness are three key traits to help propel a person’s career growth. It is nearly impossible to grow one’s career without the ability to truly relate to others with understanding, appreciation and respect for another person’s journey or perspective. Q. Why is it important to be inspirational and optimistic in the workplace? A. Good leaders inspire others to do more, be more and produce more. I find that people generally want to work with people they like, trust, admire and find upbeat. Bringing our full selves to work each day — in mind, body and spirit — helps contribute to a happy, productive and fun work environment for all, and it’s something we should aspire to each day. About Merideth Wilson Wilson is Senior Vice President and General Manager of Revenue Cycle Solutions for Experian Health, a position she assumed in September 2014. In this role, she serves as the executive responsible for the Claims, Contract Manager, Patient Estimates and Medical Necessity solution suites and operations. Wilson joined Experian in January 2004 through the Medical Present Value, Inc. (MPV) acquisition. She has held various leadership positions in operations, product management and development, outsourcing services, client delivery, and strategic marketing and planning. Wilson earned a Master of Business Administration from Mercer University and a Bachelor of Business Administration from Baylor University.

As digital transformation follows its course, ubiquitous data and new technologies are dramatically changing the way consumers interact with businesses. The Amazons and Googles of the world are redefining customer experience on a daily basis and setting the bar higher for the rest of industries to catch up. This ‘customer-first’ era calls for innovative ways to achieve sustainable growth and market leadership. Aimed at understanding this new reality, we commissioned Forrester Consulting to survey senior executives and decision makers about how they tackle the challenges and opportunities surrounding digital transformation. What we found is that the key to succeed in today’s highly competitive and fast paced environment is creating a comprehensive, unified view into their customers and their needs. And that although businesses are committed to keeping up with the pace of change to stay relevant, there are still trying to figure out how to execute their ‘customer-first’ vision. Businesses from all over the world wonder how they can attract and retain new customers, or what are the tools they need to quickly act on insights and make consistent, relevant decisions about what matters the most to their customers. Our research shows that the early beneficiaries of digitalisation such as fintech companies and e-commerce brands have been quick to understand younger, tech savvy and convenience-hungry consumers. Both industries have leveraged decades of technology developments to meet their customers’ expectations, setting the bar high. They have evolved from one-time transactions to building relationships, creating loyal followers and facilitating repeat purchases. Financial services and other sectors can find inspiration in how customer strategies focused on relevance and personalisation deliver the curated experiences consumers demand. When you put the customer first, the opportunities to create more value from your customer relationships are endless. We believe the future is bright for the business which remains nimble and willing to evolve their business models, using technology to meet the needs of tomorrow’s customer. Key findings 81% of executives believe traditional business models will disappear over the next five years due to digital transformation. 79% of key decision makers believe their customers can seamlessly interact with their organisations across mobile, web, and in-person channels – and are generally positive about the progress they are making. Two thirds of executives believe their profitability would improve if they were able to create that single, comprehensive view of the customer. Knowing and understanding customers better than anyone else is paramount to consistently assisting them how, when and where they need it. Businesses must ensure that they offer appropriate products that their customers can afford and benefit from now and in the future, regardless of market conditions or changing personal circumstances. Six out of ten executives believe sharing their data with third parties and tapping into additional data will help them create frictionless customer experiences. But there are some challenges they need to overcome before achieving that. For example, 40 percent of executives globally still feel they cannot easily share their data. They also need to make sense and find meaning from all the data they have. They are currently investing in new technologies to make sense of their data, but these efforts are not going far enough. 53% of businesses worldwide struggle to make consistent customer decisions. Part of it due to the gathering of inconsistent data from one channel to the next. The better businesses get at managing different points of interaction, the more insight they can obtain within a given customer’s experience. Using advanced analytics helps unlock the value latent in different points of interaction along the entire relationship with your customers. 77% of executives set aside budget for advanced analytics and decision-management systems. To turn strategic priorities into action, businesses have set aside budget to invest in analytics and digital decisioning. Thanks to innovative analytical tools, businesses can deliver improved, personalised experiences when they matter, better protecting consumers and complying with regulations. Download the full report.

Today I testified before the U.S. House Committee on Financial Services. Many important questions were asked: Are we doing enough to ensure the accuracy and security of consumer data? What are we doing to help promote financial inclusion so that millions of American consumers can finally gain access to the credit they deserve and need? On behalf of everyone at Experian, I was proud to share with the committee that financial inclusion is part of our sense of purpose. This sense of purpose is what drove us to create game-changing initiatives like Experian Boost, which will help millions of Americans instantly increase their credit scores and gain access to better financial opportunities. I also commented to the committee that nothing was more important to us than ensuring the security and accuracy of consumer data, and our mobile-optimized online dispute resolution service is evidence of that ongoing commitment. You can read the full text of my written testimony here. However, the issues discussed today need to be part of a larger and ongoing dialogue. Credit is vital to buying a place to live, a car to drive and paying for everyday expenses. We know we have a special responsibility to play in what is arguably one of the most effective credit ecosystems in the world. We take that responsibility very seriously. But we also know that winning the trust of consumers is something we need to consistently earn. We hold ourselves accountable for doing that every day and agree with committee members that everyone involved in consumer credit should do the same. We are proud of what we have accomplished so far, but we know we can and must go further. We need to constantly strive to reinvent what is possible by leveraging new technologies and innovative solutions. Today’s consumers and even our lending customers should expect nothing less from us. And Congress has an important role to play, too. We strongly support legislative initiatives like the Credit Access and Inclusion Act, which would amend the Fair Credit Reporting Act and allow positive consumer credit information, such as on-time payment histories, to be shared with consumer reporting agencies. This proposed legislation would also remove barriers to financial inclusion, such as state and local laws that prevent public utilities from sharing positive customer payment data. While many voices need to contribute to a robust dialogue on the future of the credit economy, it seems clear that the most effective solutions will stem from consumer demand and not legislation or regulation. There are over 100 million American consumers who don't have access to credit today, either because their credit scores are too low, or because they don't have enough credit history. Most of these individuals have never heard of Experian and have little if any idea of what we do. That’s ok. We know the struggles they face and we have some ideas on how we can help make a difference. In many ways we already are and we’re ready to roll up our sleeves to do even more in the future. Millions are counting on us.

The following is written by Mike Kilander, Global Managing Director, Data Quality, at Experian With companies facing increasingly complex data challenges that can determine the success or failure of their business, never has it been so important to have accurate and reliable data. Businesses encounter almost continuous disruption – frequently driven by accelerated data insights – and increasing regulatory pressure to improve transparency and ensure consumer privacy. Moreover, the modern consumer brings online expectations and digital demands, requiring companies to respond ever faster and more than before. One-to-one marketing has become the new digital experience. To handle these new digital demands and market pressure, organizations must improve their ability to leverage their data and gather key insights, especially on their ever-changing customers. But while there is more information available than ever before, data is a largely untapped resource. Why are we drowning in data, yet starved for insight? There are two key areas where organizations are struggling: developing trust in the accuracy of their data and gaining access to it. Organizations told us they suspect almost a third of their data is inaccurate, which limits their ability to leverage data to drive improved business outcomes. If you can’t trust your information, how are you supposed to make big strategic business decisions with it. Second, the average business user can’t get timely access to the data or insight they need. In fact, 70% say that not having direct control over data impacts their ability to meet strategic objectives. Too often, access to data only comes after the submission of an IT ticket and weeks of waiting. We see, year after year, many businesses fail to take full advantage of the opportunity their data. Current infrastructure and management practices are often not set up to handle today’s digital consumer, the volume of data generated, and the multitude of systems collecting the data, leaving users with inaccurate data and limited access. Consequently, they have been limited in their ability to leverage new data talent, technology, and best practices that can help them gain the necessary insight to innovate and stay competitive. In the past several years managing data became more complicated because of the increasingly diverse group of stakeholders who want to leverage and have access to data. It isn’t enough now just to make sure the data is right, which most companies still have not cracked. Now you also must make sure that insight is provided with the right context, to the right business user who can make the most effective decisions for the organization. These challenges will only become more acute as organizations not only continue to delay meaningful investment in data management, but also miss the emerging trend of democratization of data control in the organization. When investing in technology, few stop to think about the overarching operational data strategy and how decentralized data manipulation has become. Organizations need the right ownership or strong data leadership that allows them to access data and take advantage of insight, while considering consumer privacy, data security and data governance. Experian just released a new report looking at customer experience data trends, developing trust in information and changing data ownership. I encourage you to read this new report in the hopes that it will shed light into best practices around leveraging data. Download the new 2019 Global Data Management report here.

The following is written by Alison Sharp, HR Director, UK&I and EMEA, at Experian. We are thrilled to announce that Experian has been officially certified as a ‘Top Employer’ by the Top Employers Institute in the UK and Spain. The annual research programme recognises leading employers around the world. Awarding only those that provide the kind of conditions where their employees can develop, both professionally and personally, nurturing and developing talent throughout all levels of the organisation. This recognition is not only testament to the incredible work undertaken throughout the business, but also builds on ‘Top Employer’ status achieved in Experian South Africa and Bulgaria - awarded over the last couple of months. So, what makes Experian such a great place to work? An inspiring working environment, unlimited development opportunities and rewards that recognises your contribution and commitment are just a few. But above all else, it’s our people. And it’s our people who have made this recognition possible. By listening to them and encouraging new ideas, they have continued to help us develop our working culture and pushed the boundaries to create the best possible working environment. A key part of this is embracing diversity at all levels. Different approaches, different solutions and different views helps create an inclusive environment that people are proud to work in. We want everyone to bring their whole-self to work, creating a place where everyone has the freedom to explore and share interests, no matter what their individual story is, without fear of judgement. The more inclined we are to bring our rich outside world into our work, the more we will expose others to new perspectives and different thinking, which in turn makes Experian a great place to be. Today, we will celebrate our success, but the hard work doesn’t stop here. We have set ourselves the challenge to not only keep our Top Employer status next year, but also improve our overall performance against the institute’s tough certification criteria, continuing our development of Experian as an outstanding place to work. We asked our people what makes Experian a great place to work.

Digital commerce has changed the way consumers interact with businesses. More people are transacting online versus going into retail stores, and more than half of banking is done via mobile channels. Yet both businesses and consumers still want convenience and security, without increased fraud risk. And as interactions have become more anonymous in an online space, trust is based on businesses protecting consumers from fraud while still providing a great customer experience. So, what does it take to build trusted relationships online? New research from our 2019 Global Identity and Fraud Report shows that 74% of consumers see security as the most important element of their online experience, followed by convenience. In the past, businesses have often invested in one at the expense of the other, and our research suggests that consumers can expect both security and convenience without the trade-off. The availability of information consumers share with businesses make this possible, and consumers are willing to share more personal information if they believe it means greater online security and convenience. In fact, our research found that 70 percent of consumers are willing to share more personal data, particularly when they see a benefit. However, this value exchange of more personal information for a better online experience is the same information that puts consumers at a greater risk for fraud. Instead, businesses need to demand more from the information they already have access to and use more sophisticated authentication strategies and advanced technologies to better identify their customers and deliver tailored, streamlined experiences without increasing their risk exposure. Findings from the study reveal that consumers and business leaders agree that security methods enabled by new technologies and advanced authentication methods instill online trust. In fact, consumer confidence grew from 43 percent to 74 percent when physical biometrics was used to protect their accounts. The report also found that businesses are beginning to embrace the changing technology, while half of organizations globally reported an increase in their fraud management budget over the past twelve months. And lastly, the report looked at transparency and how that impacts consumer trust. In order to create even more trust online, many businesses are proactively sharing with customers how they use their personal information. The report found that nearly 80 percent of consumers say the more transparent a business is about the use of their information, the greater trust they have in that business. And the good news is that 56 percent of businesses plan to invest more in transparency-inspired programs such as – consumer education, communicating terms more concisely, and helping consumers feel in control of their personal data. Fraud remains a constant threat and it should come as no surprise that nearly 60 percent of consumers worldwide have experienced online fraud at some point. However, both business and consumers are getting smarter about how they manage fraud and it comes down to the important theme of trust. In order for consumers to trust businesses, they need to feel secure. And by adopting better security measures, businesses can embrace the important role of protecting customers and giving them the experience they want and deserve. Download the new Experian 2019 Fraud & Identity report here.

Experian Health has announced a partnership with Change Healthcare, a leading revenue cycle management provider, to jointly provide an identity management solution to solve patient identification and duplication challenges most often occurring during the patient registration process. Accurate identification of patients across care settings is one of the most common challenges in healthcare today. Improper identity management plagues multiple aspects of the healthcare system and all stakeholders, including providers, payers, pharmacies, employers, and consumers. Without accurate record matching, patients can be put at risk. According to statistics cited by Pew Research Center up to 20 percent of patient records are not accurately matched within the same healthcare system—driving up costs, creating inefficiency, and risking patient safety. The solution delivered to the market will leverage Experian Health’s robust identity management capabilities, along with Change Healthcare’s Intelligent Healthcare NetworkTM connecting providers and payers, to accurately identify patients and match records within and across disparate healthcare organizations. With the companies’ extensive footprint across healthcare providers, and Change Healthcare’s ecosystem of over 700 channel partners, the partnership will aim to deliver trusted identity management capabilities that are integrated with healthcare workflow applications across the continuum. “It’s imperative the healthcare industry focus on accurate patient identification and data management to improve overall patient safety,” said Jennifer Schulz, group president, Experian Health. “This new partnership aligns with our commitment to connect and simplify healthcare in a data-driven world, and ultimately deliver an optimal consumer experience.” At launch, the solution is expected to be available to all providers and payers in the United States. Currently, Experian’s Universal Identity Management solution, in particular, now includes 136.3 million people, representing 42.6% coverage of the U.S. population, and that number continues to grow every month. This partnership will expand the company’s reach even more with partners such as payers and smaller clinics to scale its identity solutions at a quicker pace and benefit the entire industry. “We are pleased to be able to move our business forward with key collaborations that will help us deliver a seamless and scalable identity management solution to more organizations,” added Schulz. “We look forward to working with Change Healthcare and exploring more partnership opportunities with them that can continue to address the healthcare industry’s most pressing operational issues through the power of data and analytics.”