All posts by Editor

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.

Recently there has been one area of Consumer Financial Protection Bureau (CFPB) reform that has gained support from Republicans and Democrats in Congress, as well as the CFPB Director himself: ensuring the confidentiality of privileged information that financial institutions provide to the bureau.

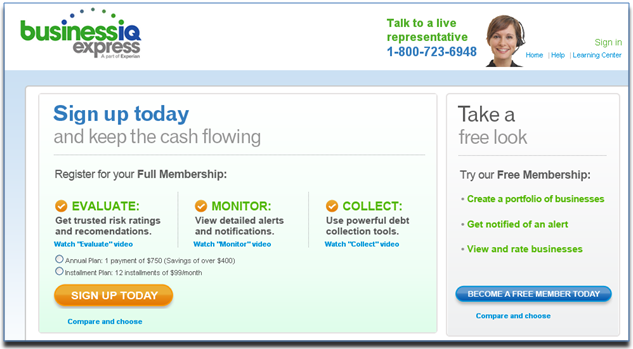

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

Earlier this week, Experian launched BusinessIQ Express, a new online tool designed to help small businesses improve cash flow by helping them make more informed decisions about their business relationships. Learn how this new tool can help small businesses.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change."

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.

On March 26th, the Federal Trade Commission (FTC) released its highly anticipated final reports on consumer privacy, entitled “Protecting Consumer Privacy in an Era of Rapid Change."

In their final report, the Commission applauded industry’s efforts towards strengthening industry self-regulations—including the Digital Advertising Alliance’s Self Regulatory Program for Online Behavioral Advertising—but called on industry to do more to protect consumer privacy.

Last month, the Network Advertising Initiative (NAI)—a coalition of more than 80 leading online marketing companies—released its 2011 annual report reviewing efforts in online advertising self-regulation. In the annual report, which is required by the NAI’s self-regulatory Code of Conduct for Online Behavioral Advertising (OBA), the NAI reviewed the practices of member companies with regards to the collection, use and disclosure of data for OBA purposes.

Last month, the Network Advertising Initiative (NAI)—a coalition of more than 80 leading online marketing companies—released its 2011 annual report reviewing efforts in online advertising self-regulation. In the annual report, which is required by the NAI’s self-regulatory Code of Conduct for Online Behavioral Advertising (OBA), the NAI reviewed the practices of member companies with regards to the collection, use and disclosure of data for OBA purposes.

The Death Master File (DMF) is a database operated by the Social Security Administration (SSA) that contains over 87 million records with information on persons who had Social Security numbers and whose deaths were reported to the SSA from 1962 to the present. The DMF is considered a public document under the Freedom of Information Act, and monthly and weekly updates of the file are made available through the Department of Commerce.

The Death Master File (DMF) is a database operated by the Social Security Administration (SSA) that contains over 87 million records with information on persons who had Social Security numbers and whose deaths were reported to the SSA from 1962 to the present. The DMF is considered a public document under the Freedom of Information Act, and monthly and weekly updates of the file are made available through the Department of Commerce.

A recent Experian Automotive credit trends study revealed that vehicle history can have a major impact on loan performance. The study found that more than 2 percent of the late-model used vehicles (model year 2005 and newer) had a negative vehicle history event (frame damage, salvage, odometer rollback, etc.), which can significantly impact the vehicle's value.

A recent Experian Automotive credit trends study revealed that vehicle history can have a major impact on loan performance. The study found that more than 2 percent of the late-model used vehicles (model year 2005 and newer) had a negative vehicle history event (frame damage, salvage, odometer rollback, etc.), which can significantly impact the vehicle's value.