All posts by Rod Griffin

“What does a credit bureau do?” is one of the most common questions I’ve answered throughout the years – both at conferences and cookouts. Admittedly, it can be difficult understanding the different roles of credit bureaus, credit score companies, and lenders. Amid COVID-19, it’s important for us to define our purpose and help guide you toward the right resources for financial help. As the consumers’ bureau, Experian is committed to examining financial questions and helping consumers, businesses, and lenders navigate this transitional fiscal landscape. It’s important for you to know your financial options and how to separate fact from fiction, especially during times of crisis. Here are answers to some of the most common questions about credit. Do credit bureaus make lending decisions? This is one of the rare instances in credit reporting for which there is a simple answer. No, credit bureaus do not make lending decisions. Lenders – such as banks, mortgage companies, credit unions, and credit card issuers – help consumers borrow money and they make the lending decisions. The credit bureaus are responsible for working closely with lenders to provide information that helps them make informed and responsible lending decisions. At Experian, we equip lenders with accurate and complete data about consumers’ and small businesses’ credit activity and payment history, which enables lenders to develop a full picture of a borrower’s financial health. During COVID-19, it is important for there to be open lines of communication between consumers and lenders about upcoming payments and payment plans. Some lenders are offering deferments and other workable accommodations to ensure consumers do not fall behind on their payments. It is important for consumers to contact their lenders to understand what options are available to them. Do credit bureaus control my credit score (and whether it goes up or down)? Credit bureaus, like Experian, do not determine your credit score. Credit scores are calculated based on third-party credit-scoring models, like those developed by FICO or VantageScore Solutions. These models use information from your credit reports, including credit activity sourced from credit bureaus, to calculate a credit score. The scoring models are proprietary to the companies that develop them. In the most fundamental terms, the credit bureaus are responsible for compiling the credit reports. The scoring companies create algorithms that calculate the score. Credit scores reflect the information in your credit report at the moment the credit score is calculated. The scores will change to reflect changes in your credit report. You control how you use credit, so you play an important role in determining whether your scores trend upward or slip downward. If you consistently make good credit decisions, your scores will trend upward over time. Reviewing your credit report helps you manage your credit and gives you a full picture of what lenders see. Monitoring your credit report is as important as reviewing bills and bank statements, as your credit is an integral part of your overall financial health. Additionally, with an increase in phishing and cyberscams as a result of COVID-19, it’s especially important to stay informed about your credit report, so that you can dispute anything you believe may be inaccurate and ensure that there is no evidence of fraud that could impact your score. Are lending decisions based solely on my credit score? No, credit scores are just one factor in lenders’ decision-making process. Lenders consider additional information when making a decision, such as employment status, income and information about a consumer’s assets and liabilities. In the wake of COVID-19, lenders may start to tighten their credit standards – meaning consumers may need a higher score to receive a loan. Because of this, it is important to be proactive and take action to mitigate any potential negative impact on your credit score. If you’re worried you may miss a payment, contact your lender to discuss your options. Through April 2021, Experian has partnered with our peer credit bureaus to offer a weekly free credit score at https://www.annualcreditreport.com/. This additional measure will allow consumers to access their credit reports frequently and talk to their lenders with the most updated information possible. How are credit bureaus working with the government during COVID-19? At Experian, we fully supported the signing of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which provides relief to Americans through expanded unemployment coverage and by providing grants and loans to small businesses. The CARES Act also provided important guidance to lenders about how to work with consumers affected by COVID-19. Experian is working with lenders to ensure appropriate accommodations are made to protect consumers. Additionally, the credit reporting industry has developed reporting standards for lenders to use during emergency periods, such as COVID-19. These reporting standards allow lenders flexibility when reporting accommodations made to consumers who are experiencing hardships due to the pandemic. For additional questions regarding COVID-19 debt and credit relief options, view Experian’s full list of financial and non-financial institutions’ websites where you can find information on relief measures: COVID-19 (Coronavirus) Credit Card and Debt Relief.

If you asked me how I’d feel about taking a personal finance class in school when I was growing up in a small town near St. Louis, Missouri, I probably would’ve told you it sounds better than trigonometry and chemistry on the list of classes I had to take. They weren’t my best subjects. Now that I’m a few years older, and I hope a bit wiser, I can promise you I would answer that question a lot differently if asked today. I now know there are some instances in life where it makes sense to learn by making mistakes, but money is not one of them. Like many people, I had my first experience with credit and money management when I took out a student loan. I was the first person in my family to go to college, so we didn't know what we were getting ourselves into. Unfortunately, I learned the impact of poor borrowing habits and high interest rates the hard way – for many, many years. Learning about money, and especially credit, by making mistakes can lead to long term damage to your financial health, which is one of the many reasons I’m passionate about financial education in schools today. Effective financial education programs will help young adults be more successful older adults. We know that if a young person has a basic understanding of how credit works, they tend to be less likely to overextend their credit card use. It’s one of the reasons Experian was the first in its industry to invest in youth financial education, as a founding partner of the Jump$tart Coalition for Personal Financial Literacy two decades ago. Over that time, we’ve continued to support the organization. Eleven years ago, we launched the Jump$tart National Educator Conference that offers teachers around the country tools and information about personal finance to take back to their classrooms. Last year, more than 350 teachers attended the conference. This year alone they will teach more than 48,000 students across the country about personal finance. It's been a very powerful partnership. While we’ve made a lot of progress in educating our youth about personal finance, there is still a lot of work to do. As of this year, 21 states across the U.S. require high school students to take a personal finance course, an increase of 4 states since 2018, according to a recently released report from the Council for Economic Education. This report also reinforced the idea that students who receive financial education borrow more sensibly. They tend to look at low-cost over high-cost financing options and they are more likely to apply for aid, receive grants and accept federal loans, which all tend to be lower interest forms of borrowing. Applying for grants or low-cost financing options could have made a serious impact on my financial health as a young adult. Considering student loan debt has now reached $1.56 trillion, it’s time we all start paying more attention to the positive impact financial education can have on our young people as well as our economy. Not only is financial education in schools the right thing to do, we know it’s something students want. We recently surveyed a group of more than 500 high school graduates to learn what they want when it comes to finance and credit education. Some key findings include: 49% of Gen Z consumers surveyed said they found financial topics to be somewhat interesting or very interesting—and 11% of them even said they loved learning about them. Only about one-third—36%—of Gen Z consumers said they had taken a class on a financial topic, and among that group, many of them still had looming financial questions. Of the 64% that had never taken a financial education class, 43% reported wanting to learn to save money, 38% wanted to learn how to manage their expenses, and another 36% said they wanted to take a class that taught them how to file their taxes. A large majority—76%—of Gen Z consumers said that they thought their high school should have offered a class on managing finances. So, what can we do to help ensure our young people grow up to be financially healthy adults? If you’re a parent and want to find out if your children’s school offers financial education, head to https://checkyourschool.org/. If your school is not on the list, learn how you can become engaged in this initiative by working with JumpStart. In the meantime, you can also find free, educational resources on our website to help teach your children about personal finance and credit. We have prepared a simple lesson plan, presentations and online brochures that are free to download, and you can find answers to commonly asked questions about personal finance, credit, fraud, identity theft and more on our Ask Experian blog and our weekly Twitter Credit Chats.

As 2019 comes to a close, many people are outlining their goals for the new year. For some people, this means making plans to get healthier, reconnect with old friends or find a new job. For many, improving financial health comes in at the top of the list. In fact, we know saving more is a top resolution for 50% of people and one in three want to improve their credit scores in 2020. Saint Exupery once said, “a goal without a plan is just a wish” and he was right. When setting any goal, it’s important to put a plan in place. An essential first step toward creating an effective plan of action is getting a grasp of your current situation. The same is true for creating and achieving goals related to improving your financial health. Each year, we take a look at how Americans across the country are managing their credit to help people understand the purpose and impact of their credit scores. Our annual State of Credit report highlights average credit scores, debt levels and delinquency rates of people across America. In releasing this report, we hope to give people insight to help them make more informed decisions about credit use as we prepare to head into a new decade. Our latest report showed the average credit score hit an eight-year-high at 682. While people are taking on slightly more credit card, mortgage and nonmortgage debt year-over-year, delinquency rates are decreasing on average and utilization remains consistent at 30%, which means people are responsibly managing the debt they’re carrying. If your credit score is lower than you’d like, or if you’re looking for ways to maintain a positive credit history and improve your financial health, here are five ways you can better your financial standing in 2020: Check your credit report and credit score. Your credit report serves as your financial references. Take care of your credit report and you will take a big step toward better financial health. Credit scores play an important role in your financial journey. They translate the information in your credit report into a number reflecting the risk of doing business with you. Check your credit score at the same time you check your credit report. When you get credit score you should receive an explanation of what the score means and what from your credit report is most affecting it. This is an important step to gauge your current standing and to develop a plan to improve your credit report and scores. You can get a free credit report once every 12 months from Experian by visiting www.annualcreditreport.com or through the Experian app. Keep your utilization rate low. Your utilization rate, or balance-to-limit ratio, should never exceed 30 percent of your credit limit. At a maximum, your total credit card balances should not be more than 30 percent of your total credit card limits, and you don’t want any one card to have a balance of more than 30 percent of the limit of that one card. Both can hurt you. This doesn’t mean that you want to get your balances up to 30 percent and keep them there. The lower your utilization rate, the better. People with the best credit scores have utilization rates of less than 10 percent. As you head into 2020, focus on reducing your credit card balances and keeping your balances low. Use the tools available to you like Experian Boost. If you’re paying your cell phone, cable, satellite and utility payments on time, you can use our free tool, Experian Boost, to potentially increase your credit scores in the new year. We see scores improve for two out of three people who use Experian Boost with an average increase of more than 10 points. Plan ahead for major credit purchases. For many, the start of a new year can mean a new car, a new home and more. When preparing to make a major purchase, it is critical to demonstrate financial stability in the three to six months leading up to it. While it is important to optimize your scores before purchasing a house or a car, be careful not to make too many big moves right before your purchase. Closing accounts or applying for new credit could temporarily reduce your scores, so don’t open any new accounts during the months leading up to your purchase. Wait to close accounts or apply for new ones until after you have the keys to that car or house in hand. Pay on time, every time. Nothing will hurt your credit score more than missed or late payments. To maintain a positive credit history, make a plan to catch up on any missed payments. Enrolling in autopay can be a helpful way to stay on a payment schedule that works for you. Remember, credit can be a financial tool, but debt is a financial problem. Create your financial game plan for 2020 and use these tips to prepare for a financially healthy new year. If you need help along the way, visit the Ask Experian blog or tune into our weekly Credit Chat.

For many of us, the holidays are an exciting time filled with family, friends and a flurry of gift giving and receiving. Unfortunately, this time of year can also put a strain on finances and your financial health. In fact, we see many people start a new holiday season while they’re still working to pay off debt from the year before. Each year, our holiday spending survey takes a look at how people are feeling about holiday spending, how much they plan to spend and their financial goals for the new year. We found shoppers plan to spend 75% more this year on holiday spending than in 2018 with an average of $1,649, and 63% agree holiday expenses affect their finances negatively. We also found 38% of the people we spoke to are feeling stressed as the holiday season approaches. Getting a spending game plan in order now can help protect your financial health and keep your holidays merry and bright. Here are three ways to stay financially fit this holiday season and beyond: Create your holiday spending plan. Setting a budget is an important first step to ensure you’re not spending more than you can afford, but your holiday spending plan should include more than that. Think about who you need to shop for, where you’re going to shop and when you’re going to shop. Our survey showed the lure of a good deal can be hard for some to resist. In fact, one in five Americans said they would risk becoming a victim of identity theft for a good deal. Having a plan in place can help you avoid risky spending behavior while scrambling for last minute gifts. So, make that list and check it twice. Use credit as a financial tool. All year and especially around the holidays, I like to remind people that credit can be a financial tool, while debt is a financial problem. We know that about 44% of people plan to use credit to pay for gifts, and it’s important to do so responsibly. After all, the bills always arrive in January. If you’re going to use credit to pay for gifts, make sure you have a plan for paying your balances off to avoid missing payments and increasing your utilization rate – two critical factors that can have a negative impact on credit scores. Additionally, we found one in four shoppers plan to open a new credit card this season. Opening one or two cards to take advantage of in-store discounts or cash back offers can be a useful way to save money during the holidays, but don’t overdo it. If you take advantage of too many rewards offers, you may find you’ve saved yourself right into debt. Prepare your credit for holiday shopping and the new year. Getting your credit ready for the holiday season and the new year should be part of your holiday spending plan. That way, if you do plan to apply for new credit this shopping season or in 2020, your credit is ready to work for you. Get a copy of your credit report to ensure there are no surprises and catch up an any missed or late payments. This is also the first holiday season you can use free tools like Experian Boost to improve your credit scores if you’re paying your telecom and utility payments on time. We see scores improve for two out of three users with an average boost of more than 10 points. If you have a limited credit history or a thin credit file, you may see an even bigger boost to your credit score. We know almost have of those we spoke to for our survey will try to improve their credit score before the start of the new decade and Experian Boost is proving to be a valuable tool for consumers looking to do just that. There's often the temptation to overspend, but the best gift you can give yourself is being financially smart. My hope is these tips can help boost your holiday cheer while preparing you for a financially healthy new year. Happy holidays.

Building a credit history takes time. Establishing a credit history early in life can help ensure you have access to affordable credit when you need it. The problem is that people tend to learn about credit and finances through trial and error. This is unfortunate because recovering from financial mistakes takes time, too. In fact, it could take years to rebound from one financial misstep. This trend is especially common for young adults who are just beginning to get their financial feet wet, and it’s one of the many reasons credit education and improving the financial health of consumers of all ages is core to our mission at Experian. As Director of Consumer Education and Advocacy, I get the opportunity to talk to a variety of students and young adults across the country on a regular basis. Millennials and Gen Z are often labeled slackers, but I don’t believe that for an instant. They experienced the financial crisis firsthand in their early years, and they really don’t want to repeat what their parents went through. Can you blame them, really? One thing we know for certain about young adults is they are very interested in learning as much as they can about money, finance and credit, and it’s our goal to be an educational resource to them. As the saying goes, you don’t know what you don’t know. We have a chance to give younger generations the information and tools to know more than previous generations did at their ages. Here are some of my favorite tried and true tips to help set young adults up for credit success: Start small and grow slowly. A secured account with a small credit limit can establish your credit history and help you start saving at the same time. Good credit and strong savings habits go hand-in-hand. You don't need a credit card with a high limit to have good credit. Use the credit you have wisely. Good credit scores are not about having a lot of credit, but rather about how you use the credit you have available. Make a small purchase each month and pay it in full. That will show you can use credit well without taking on debt. Use your cell phone to improve your credit. With Experian Boost, you can add positive telecom and utility payments to your credit history and possibly boost your credit score. In the past, failing to pay your utility or cell phone bills could hurt your credit, but paying on time didn't help. With Experian Boost, that's changed. Use technology to make managing your credit automatic. Millennials and Gen Zers are the most technologically savvy generations in our history. Use technology, such as online banking apps and credit management tools like the Experian app, to automate savings and payments, to alert you to potential fraud and to track your progress as you build your credit history. We know helping people better understand and access credit is a team effort, and we work closely with our advocacy networks to increase our impact. We recently joined the American Bankers Association to provide young adults with financial education. Leading up to Get Smart About Credit Day, we hosted a Facebook Live with Jeni Pastier, Director of Financial Education Programs for the American Bankers Association to address credit topics young adults typically don’t understand or know about at all. You can watch the full video here and find additional articles to get smarter about credit on the Ask Experian blog.

Financial health matters. That’s why we’re joining the Center for Financial Services Innovation and the nation’s leading banks, financial services providers and nonprofits in supporting #FinHealthMatters Day on June 27, 2017.

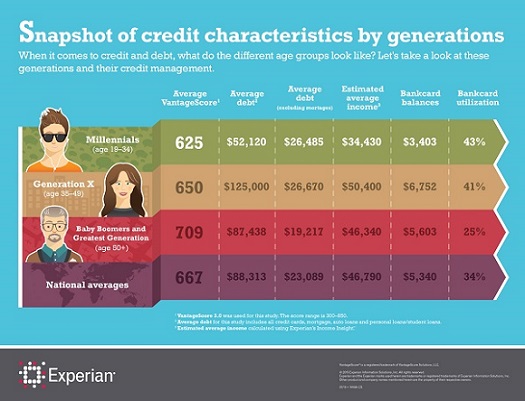

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

A recent report by the Consumer Financial Protection Bureau (CFPB) found that many people are confused and frustrated about how to check credit reports and scores and they feel they lack information to take action to improve their credit histories. I have to admit that I was not surprised by some of the survey’s results, and I suspect my colleagues in financial literacy weren't either. We devote our careers to educating consumers, financial educators and businesses about how to empower people to understand credit and the role it plays in their everyday lives. But it's a steep uphill climb. As a new federal agency, the Consumer Financial Protection Bureau is a relative newcomer to the financial literacy arena, but many of the people working in its education division have years of knowledge and experience in the field. I've met and worked with a number of them, and I have great respect for the focus they are bringing to such an important issue. Many others -- in the public sector like the Federal Trade Commission, and non-profits like the Mission Asset Fund and the Consumer Federation of America's America Saves, and companies like Experian -- invest in, conduct and work together on programs with the sole focus of helping people become more financially capable.

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

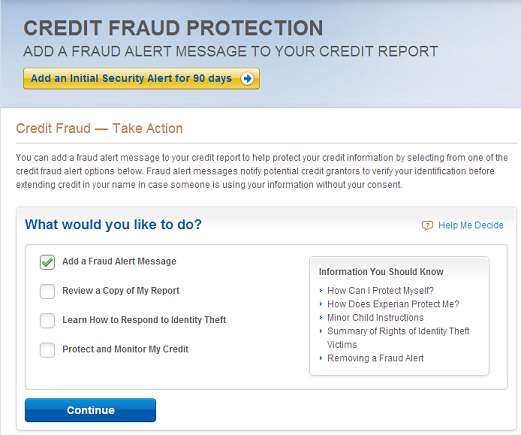

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim: