Trends

Global trends

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

New findings from Experian show that Cyber Monday retained its rank as the top email volume and transaction day.

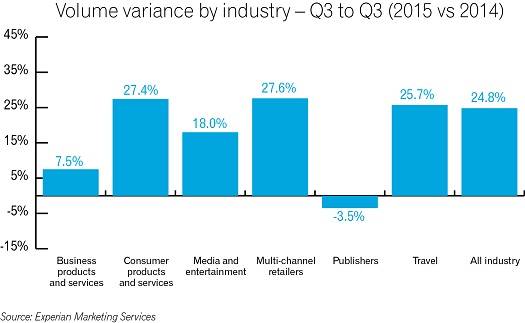

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Consumers are more confident managing their credit since recession.

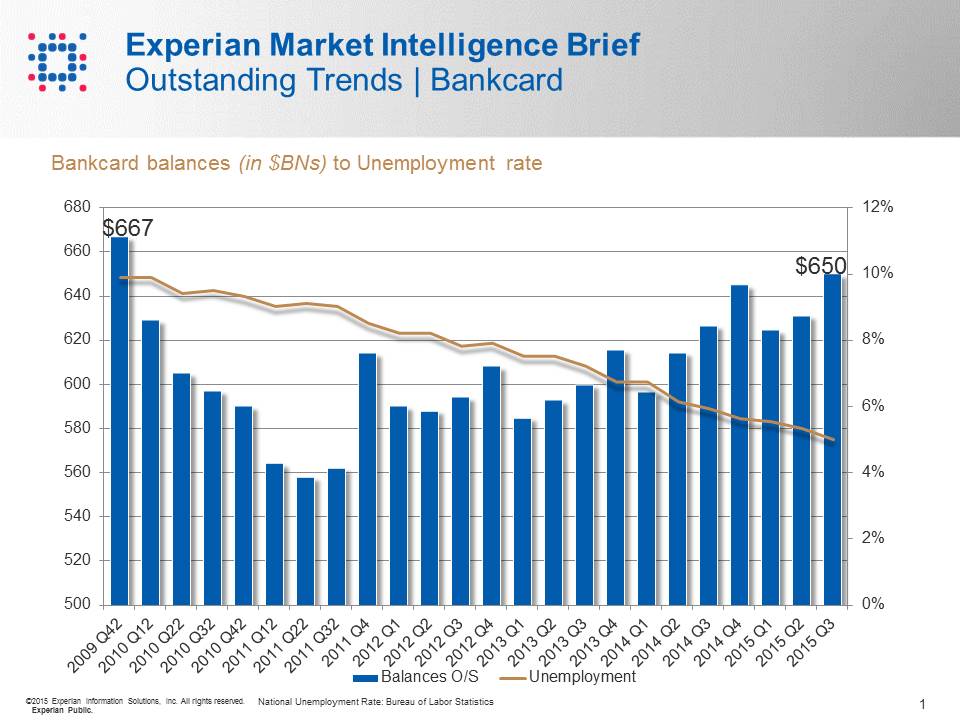

Experian released the Q3 today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion.

Consumers are more confident managing their credit since recession.

Experian released the Q3 today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

As data breaches become more prevalent, companies must try to stay ahead of the curve and be prepared to respond to any kind of security incident. In an effort to provide a glimpse into what 2016 could bring, Experian Data Breach Resolution released its third annual Data Breach Industry Forecast white paper.

The following article was written by Kassandra Kurth, Director of Strategic Initiatives for Experian Health, and featured in Executive Insight: Telemedicine has transformed the healthcare industry. From rural America, where in-person doctor visits are difficult, to the farthest reaches of the globe, internet technology allows doctors to visit the sick, diagnose illness, prescribe medicine and even perform surgery without ever actually touching a patient. The recent focus of healthcare automation for providers has been on electronic clinical documentation, but providers also have opportunities to automate revenue cycle functions.