Social Responsibility

Experian is deeply committed to making an important difference in each of the communities we operate and live all over the world. Through our relationships with nonprofit organizations, our dedication to consumer education and our encouragement of employee volunteerism, we are able to champion a number of important causes. Read about our latest corporate social responsibility news below:

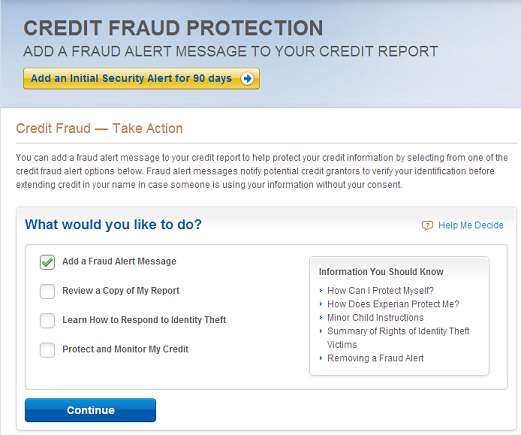

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register's top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian's success.”

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register's top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian's success.”

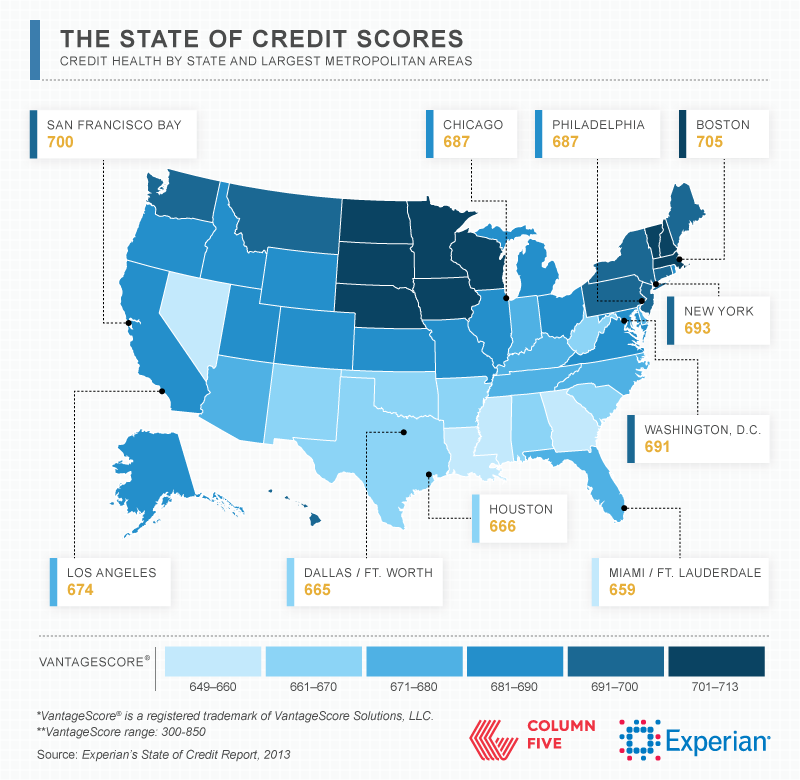

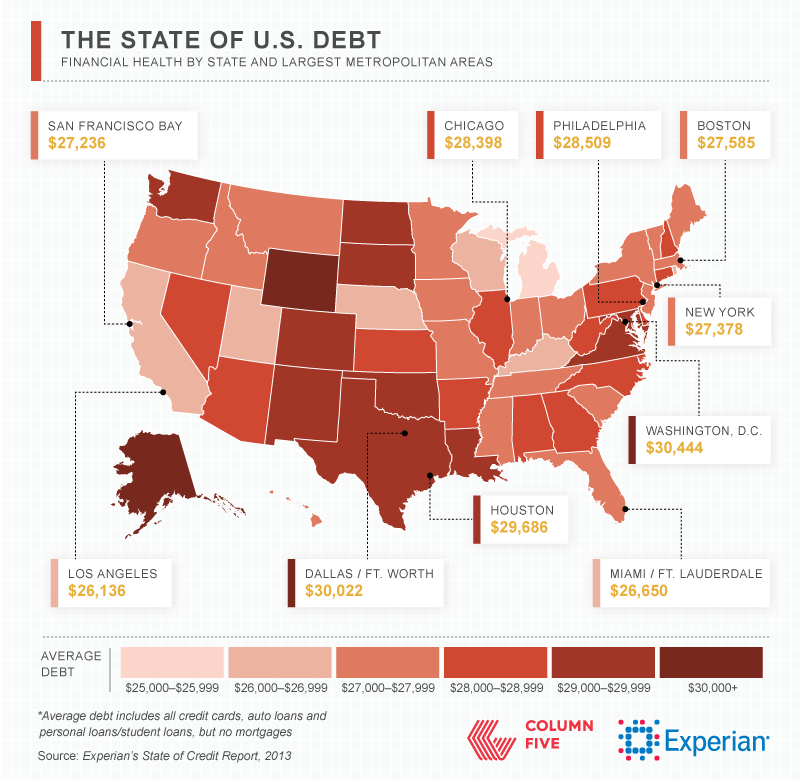

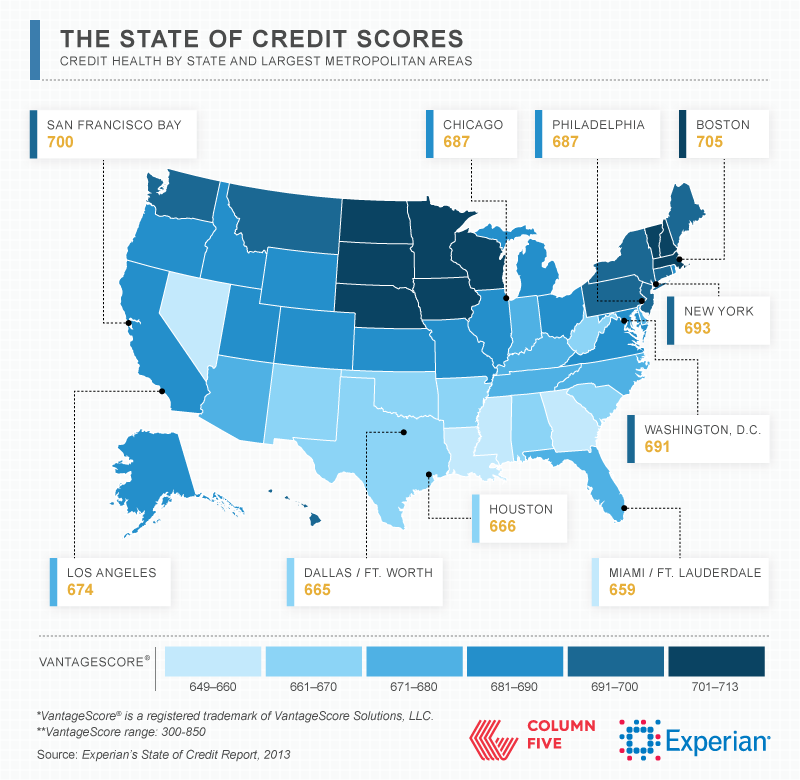

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian's Fourth Annual State of Credit Report

View interactive map: Experian's Fourth Annual State of Credit Report

A glimpse at credit scores in the largest metropolitan areas ...

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

1. Think experience over tangible items

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December - so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

This guest post is by Gail Cunningham, Vice President of Membership and Public Relations.

Experian’s recent State of Credit Study revealed that The Greatest Generation has something else to brag about: responsibly managing credit. And that’s no small achievement considering that some of these folks have 50 or more years of credit history under their belt. That’s a lot of on-time payments. If you fall into the 65+ age bracket, congratulations! You’ve done a lot right. Now let’s keep a good thing going. Here are some tips to help you stay financially healthy moving forward:

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) awarded Victor Nichols, CEO of Experian North America, its “Making the Difference” award from their Annual Leaders Conference in Denver. This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.