News

What’s happening in our industry and what we’re doing

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

This Q&A interview that appeared on Monster.com with Dr. Shanji Xiong, Experian DataLab’s global chief scientist, discusses his career and provides advice for data scientist hopefuls.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

The Relevancy Group’s The Marketer Quarterly recognized Experian’s contributions to outstanding email marketing campaigns

This article published in CIO Review magazine by Eric Haller, executive vice-president of Experian’s global DataLabs, discusses the science behind Big Data and how it can be used as a force for good.

This article published in CIO Review magazine by Eric Haller, executive vice-president of Experian’s global DataLabs, discusses the science behind Big Data and how it can be used as a force for good.

Consumers are more confident managing their credit since recession.

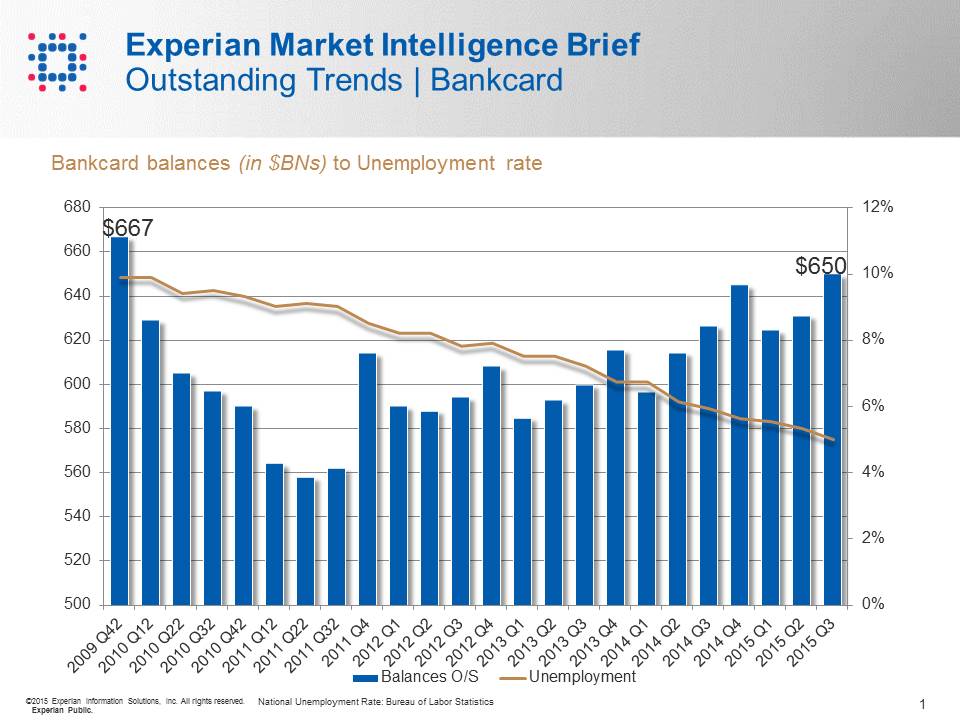

Experian released the Q3 today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion.

Consumers are more confident managing their credit since recession.

Experian released the Q3 today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

By all accounts, the national housing market in the US stabilized with a recent report showing year-over-year growth at 6.8 percent for October 2015. However, while interest rates remain near all-time lows, it’s estimated that millions of Americans are unable to take advantage of this opportunity because they are unscoreable using the current credit score model mandated by Fannie Mae and Freddie Mac (“the GSEs”).

Under their current guidelines, the GSEs require mortgage lenders to use an older version of a consumer’s FICO credit score when assessing their credit risk. This model is based on data from 1995 to 2000 and unnecessarily excludes millions of qualified borrowers. For instance, VantageScore 3.0 allows for the scoring of 30–35 million more people that are currently un-scoreable under the legacy credit score model.

By all accounts, the national housing market in the US stabilized with a recent report showing year-over-year growth at 6.8 percent for October 2015. However, while interest rates remain near all-time lows, it’s estimated that millions of Americans are unable to take advantage of this opportunity because they are unscoreable using the current credit score model mandated by Fannie Mae and Freddie Mac (“the GSEs”).

Under their current guidelines, the GSEs require mortgage lenders to use an older version of a consumer’s FICO credit score when assessing their credit risk. This model is based on data from 1995 to 2000 and unnecessarily excludes millions of qualified borrowers. For instance, VantageScore 3.0 allows for the scoring of 30–35 million more people that are currently un-scoreable under the legacy credit score model.