News

What’s happening in our industry and what we’re doing

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

Experian Consumer Services (ECS) was recognized as the winner of the "Best in Class Call Center" category at the industry-leading Call Center Excellence Awards at the recent Call Center Week's Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian Consumer Services (ECS) was recognized as the winner of the "Best in Class Call Center" category at the industry-leading Call Center Excellence Awards at the recent Call Center Week's Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car - huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Consumers are can now be notified when their personal information is being used in an authentication transaction, allowing them to assess whether or not they recognize and expect their identity to be in review by a business. The service enables consumers to respond to the notification, and in cases of potential fraud, to be directed to seamless and effective resolution assistance.

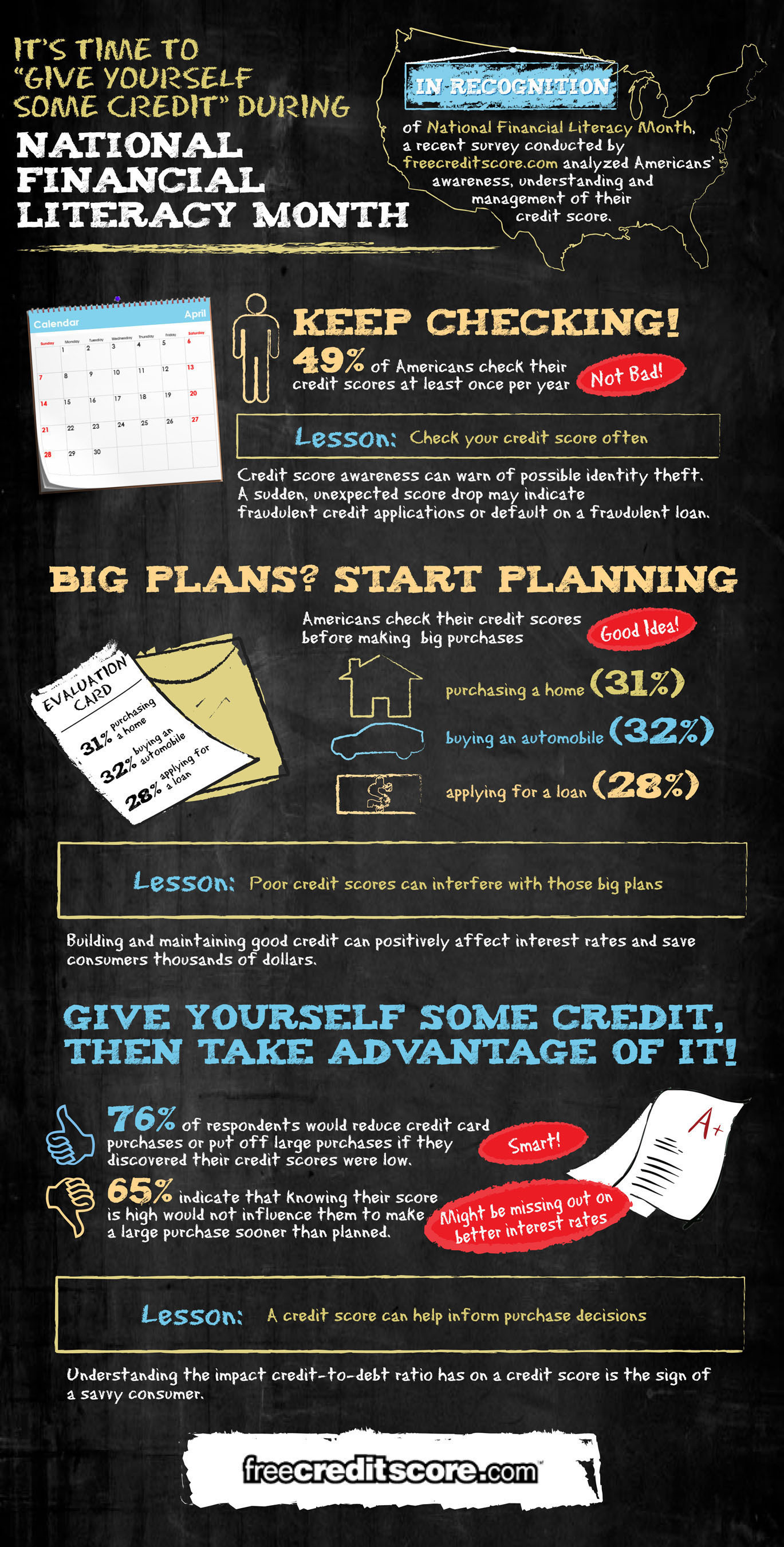

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

Linda Haran has been selected for her leadership and contributions to the field of mortgage technology by Mortgage Banking Magazine for the development and introduction of Experian’s IntelliViewSM product.

The company’s new interactive, Web-based query, analysis and reporting tool enables financial professionals to optimize strategic planning, uncover new opportunities and improve decision making by having 24-7 online access to Experian’s aggregated quarterly consumer credit data. Data is available for seven lending categories, including bankcard, retail card, automotive, first mortgage, second mortgage, home-equity lines of credit and personal loans.

IntelliView data is sourced from the information that supports the Experian–Oliver Wyman Market Intelligence Reports and is easily accessed through an intuitive, online graphical user interface, which enables financial professionals to extract key findings from the data and integrate them into their business strategies. This unique data asset does this by delivering market intelligence on consumer credit behavior within specific lending categories and geographic regions.

Linda Haran has been selected for her leadership and contributions to the field of mortgage technology by Mortgage Banking Magazine for the development and introduction of Experian’s IntelliViewSM product.

The company’s new interactive, Web-based query, analysis and reporting tool enables financial professionals to optimize strategic planning, uncover new opportunities and improve decision making by having 24-7 online access to Experian’s aggregated quarterly consumer credit data. Data is available for seven lending categories, including bankcard, retail card, automotive, first mortgage, second mortgage, home-equity lines of credit and personal loans.

IntelliView data is sourced from the information that supports the Experian–Oliver Wyman Market Intelligence Reports and is easily accessed through an intuitive, online graphical user interface, which enables financial professionals to extract key findings from the data and integrate them into their business strategies. This unique data asset does this by delivering market intelligence on consumer credit behavior within specific lending categories and geographic regions.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.