Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all. Read about our latest innovation news below:

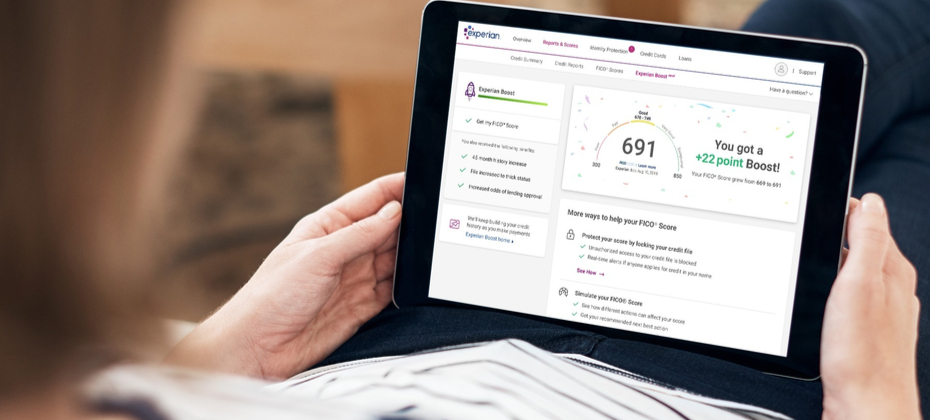

Today marks a notable milestone in our company’s history and for consumers. Today we officially launched Experian Boost, a free tool that, for the first time, will allow millions of consumers to add positive payment history directly into their credit file for an opportunity to instantly increase their credit score. For the past several years, we have been working to develop new products and innovations that will disrupt the credit industry and help improve the financial lives of consumers. This commitment to financial inclusion has defined us and created a real sense of purpose for everyone who works here – and that purpose is realized with the launch of Experian Boost today. There are more than 100 million Americans who don't have access to credit today. A low credit score, due to a thin file or incomplete information, may force these consumers to rely on high interest credit cards and loans. The fact that many of these consumers consistently and responsibly pay cell phone and utility bills on time every month hasn’t seemed to matter. At Experian, we know that’s not right. A good credit score is a gatekeeper to better financial opportunities. We need to develop products and services that make achieving and maintaining a good score easier, not harder. As the consumer’s bureau, we want to ensure that as many people as possible can access and participate in the financial system, and we believe everyone deserves a fair shot at achieving their financial dreams. We have a fundamental mission that is shared by our colleagues around the world: to strive to be a champion for the consumer. With Experian Boost, we're bringing that mission to life and I couldn’t be prouder. Many of our colleagues at Experian worked tirelessly over the last few years to make this day a reality. To everyone who’s played a part, I offer my very heartfelt thanks. It’s truly a great day to be a part of Experian, and we know there will be a lot of great days ahead for all the consumers who will benefit from having their credit score truly reflect who they are. To find out more about the Experian Boost, please visit experian.com/boost.

As digital transformation follows its course, ubiquitous data and new technologies are dramatically changing the way consumers interact with businesses. The Amazons and Googles of the world are redefining customer experience on a daily basis and setting the bar higher for the rest of industries to catch up. This ‘customer-first’ era calls for innovative ways to achieve sustainable growth and market leadership. Aimed at understanding this new reality, we commissioned Forrester Consulting to survey senior executives and decision makers about how they tackle the challenges and opportunities surrounding digital transformation. What we found is that the key to succeed in today’s highly competitive and fast paced environment is creating a comprehensive, unified view into their customers and their needs. And that although businesses are committed to keeping up with the pace of change to stay relevant, there are still trying to figure out how to execute their ‘customer-first’ vision. Businesses from all over the world wonder how they can attract and retain new customers, or what are the tools they need to quickly act on insights and make consistent, relevant decisions about what matters the most to their customers. Our research shows that the early beneficiaries of digitalisation such as fintech companies and e-commerce brands have been quick to understand younger, tech savvy and convenience-hungry consumers. Both industries have leveraged decades of technology developments to meet their customers’ expectations, setting the bar high. They have evolved from one-time transactions to building relationships, creating loyal followers and facilitating repeat purchases. Financial services and other sectors can find inspiration in how customer strategies focused on relevance and personalisation deliver the curated experiences consumers demand. When you put the customer first, the opportunities to create more value from your customer relationships are endless. We believe the future is bright for the business which remains nimble and willing to evolve their business models, using technology to meet the needs of tomorrow’s customer. Key findings 81% of executives believe traditional business models will disappear over the next five years due to digital transformation. 79% of key decision makers believe their customers can seamlessly interact with their organisations across mobile, web, and in-person channels – and are generally positive about the progress they are making. Two thirds of executives believe their profitability would improve if they were able to create that single, comprehensive view of the customer. Knowing and understanding customers better than anyone else is paramount to consistently assisting them how, when and where they need it. Businesses must ensure that they offer appropriate products that their customers can afford and benefit from now and in the future, regardless of market conditions or changing personal circumstances. Six out of ten executives believe sharing their data with third parties and tapping into additional data will help them create frictionless customer experiences. But there are some challenges they need to overcome before achieving that. For example, 40 percent of executives globally still feel they cannot easily share their data. They also need to make sense and find meaning from all the data they have. They are currently investing in new technologies to make sense of their data, but these efforts are not going far enough. 53% of businesses worldwide struggle to make consistent customer decisions. Part of it due to the gathering of inconsistent data from one channel to the next. The better businesses get at managing different points of interaction, the more insight they can obtain within a given customer’s experience. Using advanced analytics helps unlock the value latent in different points of interaction along the entire relationship with your customers. 77% of executives set aside budget for advanced analytics and decision-management systems. To turn strategic priorities into action, businesses have set aside budget to invest in analytics and digital decisioning. Thanks to innovative analytical tools, businesses can deliver improved, personalised experiences when they matter, better protecting consumers and complying with regulations. Download the full report.

Financial exclusion is a global issue with an estimated 1.7 billion adults currently ‘unbanked’ . Experian’s core mission is to help bring financial inclusion to every adult in the world. There are currently millions of ‘thin file’ consumers and SMEs in sub-Saharan Africa. These are consumers with limited information on a traditional credit bureau or have no information at all, so-called ‘invisibles’, who find themselves excluded from mainstream finance. They often face more difficulty – or higher costs - when applying for financial products or services. That’s why we are proud to announce today the launch of a ground-breaking new smartphone app, GeleZAR, in South Africa, which aims to bring more micro-entrepreneurs into the mainstream economy and ensure they get the credit score they deserve.. Using the expertise of our global innovation hubs, we have developed a unique financial education and credit scoring mobile app. GeleZAR is designed to educate entrepreneurs and individuals on how to manage their finances, budget and credit score in a fun, entertaining and digestible way. It can also advise individuals on how to maintain a good credit health and recommends remedial actions where needed. In partnership with a local South African consumer and fintech developer, Experian designed the app specifically for entry-level smartphones. We are also working with one of the largest low-cost mobile phone retailers in Africa to trial the app which has been pre-installed on a range of its entry-level smartphones.. The intention is to extend the rollout and make the app accessible for free on more than six million devices annually. Working with alternative data that an individual user consents to share on the app, GeleZAR will be able to assess an individual’s stability, build a credit profile and potentially improve their credit score. This in turn could enable them to access a broader range of financial products at more affordable interest rates. This is a great example of how Experian is innovating to find new ways to empower our customers while uplifting societies. It also fulfils our passion for financial inclusion and the accurate assessment of affordability. Experian’s cutting edge technological capabilities enable us to use the power of data to transform lives, businesses and economies for the better. Through our pioneering work in this space we hope to help consumers around the world on their credit journey. GeleZAR is just one of the ways we are delivering on our mission to build and improve the credit files of millions of people in South Africa and beyond.

Digital commerce has changed the way consumers interact with businesses. More people are transacting online versus going into retail stores, and more than half of banking is done via mobile channels. Yet both businesses and consumers still want convenience and security, without increased fraud risk. And as interactions have become more anonymous in an online space, trust is based on businesses protecting consumers from fraud while still providing a great customer experience. So, what does it take to build trusted relationships online? New research from our 2019 Global Identity and Fraud Report shows that 74% of consumers see security as the most important element of their online experience, followed by convenience. In the past, businesses have often invested in one at the expense of the other, and our research suggests that consumers can expect both security and convenience without the trade-off. The availability of information consumers share with businesses make this possible, and consumers are willing to share more personal information if they believe it means greater online security and convenience. In fact, our research found that 70 percent of consumers are willing to share more personal data, particularly when they see a benefit. However, this value exchange of more personal information for a better online experience is the same information that puts consumers at a greater risk for fraud. Instead, businesses need to demand more from the information they already have access to and use more sophisticated authentication strategies and advanced technologies to better identify their customers and deliver tailored, streamlined experiences without increasing their risk exposure. Findings from the study reveal that consumers and business leaders agree that security methods enabled by new technologies and advanced authentication methods instill online trust. In fact, consumer confidence grew from 43 percent to 74 percent when physical biometrics was used to protect their accounts. The report also found that businesses are beginning to embrace the changing technology, while half of organizations globally reported an increase in their fraud management budget over the past twelve months. And lastly, the report looked at transparency and how that impacts consumer trust. In order to create even more trust online, many businesses are proactively sharing with customers how they use their personal information. The report found that nearly 80 percent of consumers say the more transparent a business is about the use of their information, the greater trust they have in that business. And the good news is that 56 percent of businesses plan to invest more in transparency-inspired programs such as – consumer education, communicating terms more concisely, and helping consumers feel in control of their personal data. Fraud remains a constant threat and it should come as no surprise that nearly 60 percent of consumers worldwide have experienced online fraud at some point. However, both business and consumers are getting smarter about how they manage fraud and it comes down to the important theme of trust. In order for consumers to trust businesses, they need to feel secure. And by adopting better security measures, businesses can embrace the important role of protecting customers and giving them the experience they want and deserve. Download the new Experian 2019 Fraud & Identity report here.

Experian Health has announced a partnership with Change Healthcare, a leading revenue cycle management provider, to jointly provide an identity management solution to solve patient identification and duplication challenges most often occurring during the patient registration process. Accurate identification of patients across care settings is one of the most common challenges in healthcare today. Improper identity management plagues multiple aspects of the healthcare system and all stakeholders, including providers, payers, pharmacies, employers, and consumers. Without accurate record matching, patients can be put at risk. According to statistics cited by Pew Research Center up to 20 percent of patient records are not accurately matched within the same healthcare system—driving up costs, creating inefficiency, and risking patient safety. The solution delivered to the market will leverage Experian Health’s robust identity management capabilities, along with Change Healthcare’s Intelligent Healthcare NetworkTM connecting providers and payers, to accurately identify patients and match records within and across disparate healthcare organizations. With the companies’ extensive footprint across healthcare providers, and Change Healthcare’s ecosystem of over 700 channel partners, the partnership will aim to deliver trusted identity management capabilities that are integrated with healthcare workflow applications across the continuum. “It’s imperative the healthcare industry focus on accurate patient identification and data management to improve overall patient safety,” said Jennifer Schulz, group president, Experian Health. “This new partnership aligns with our commitment to connect and simplify healthcare in a data-driven world, and ultimately deliver an optimal consumer experience.” At launch, the solution is expected to be available to all providers and payers in the United States. Currently, Experian’s Universal Identity Management solution, in particular, now includes 136.3 million people, representing 42.6% coverage of the U.S. population, and that number continues to grow every month. This partnership will expand the company’s reach even more with partners such as payers and smaller clinics to scale its identity solutions at a quicker pace and benefit the entire industry. “We are pleased to be able to move our business forward with key collaborations that will help us deliver a seamless and scalable identity management solution to more organizations,” added Schulz. “We look forward to working with Change Healthcare and exploring more partnership opportunities with them that can continue to address the healthcare industry’s most pressing operational issues through the power of data and analytics.”

I nearly made a bad mistake a couple of weeks ago after I received an email from a top online retailer stating there was a “problem with my recent order.” I had recently purchased several items and knew that any delay would jeopardize my holiday gift delivery. I was just about to click the “Login” button and then stopped. Thankfully, I had the presence of mind to double-check the sender, and, it wasn’t my favorite shopping site after all – just a really good fake email from a phishy sender. I had almost fallen victim to one of the oldest and most common fraud scams in the books — a phishing email. Phishing is the fraudulent practice of sending emails claiming to be from reputable companies. Fraudsters do this to get recipients to click a link and reveal personal information, like passwords and credit card numbers. Sometimes, they will even install malware on your mobile device or computer, directing you to a fake storefront to pilfer information like bank accounts or create new fraudulent accounts using your identity information. First, I thought, “Wow, what a dumb mistake, especially given our focus at work.” But phishing scams today have become more sophisticated and personal. We are all busy with life – our work, family, commute, and dinner plans, along with keeping up on the latest news cycle. Virtually anyone could be inclined to quickly click on a link stating there is an issue with their recent order. The best phishing scams are those that appear to come from a trusted source and reference real information about you, one of your recent shopping orders, or your personal preferences. Sometimes, a scam can even take the form of an “update” on the delivery of your recent orders, and you might rush into clicking links to resolve the problem. Know then trust What is it about phishing scams that make them so effective? It is the personal nature of the attack. The best ones are those that appear to come from a trusted source and discuss information about you, a recent order, your personal preferences, or even just to provide an “update” on delivery to rush you into clicking based on an issue or delay. One extremely lucrative attack that comes to mind is a recent UK bank attack where fraudsters obtained banking login credentials and accessed accounts in an attempt to submit fraudulent wire transfers. Posing as bank employees, the fraudsters contacted the accountholders to let them know that a fraudulent wire transfer attempt had been made on their account. And in order for the bank to cancel the wire, they needed the accountholders to provide a confirmation code that they would receive instantaneously through their mobile device to confirm their identity. What the accountholders didn’t realize is that the bank’s standard process for any wire transfer was to send a one-time password to the mobile phone number on file to confirm an abnormal transfer’s authenticity – not to stop fraudulent attempts. So, when the accountholders received the passcode, they unknowingly provided them to the fraudsters over the phone, effectively authenticating the transfers with the bank. Oh phishing fraud… Oh phishing fraud… But what about the holidays, you ask? Given our chaotic lives, fraudsters love to use phishing during the holidays. Attackers generally focus on major online retailers to enable the largest possible attack. Many consumers have established two-factor verification for accounts with top online retailers, but fraudsters can use this to their advantage if you’re not vigilant. For example, a scammer might send an email to suggest there is a problem with your recent order, then when you click on a link in the email to check on the issue, you might see a pop-up indicating that you’re using a different device than previously seen in the account. Without thinking too far into it, you’re given a one-time passcode that you enter to confirm your identity. The attacker can use your credentials and passcode to successfully log in as you, purchase goods using on-file payment information, and have the goods shipped to an alternate address. Another effective method for fraudsters is to leverage mediums that billions of consumers around the world use daily, like social media. This is the time of year where everyone is sharing photos and links with their friends and family – which is a prime opportunity for fraudsters to use malware or keyloggers to access social media accounts, masquerade as you, and amplify attacks by reaching out to all of your connections. And since fraudsters can just as easily take advantage of the latest AI and machine learning advances, scams are more sophisticated than ever before. Today’s attacks often use millions of servers worldwide to make attacks appear personal – to look like messages from a friend, family member, or other connection. They know your name, mention something personal that they found on one of your social media posts and ask you to do something – like click on the latest viral video or picture. This can all be done automatically and be sent to millions of people at the touch of a button. Send phishing scams on their way I know this all seems unsurmountable, but there are things that businesses and consumers can do to identify if they’ve been a victim and to avoid becoming a victim in these types of schemes. From a business perspective, the most effective approach is to assess users’ historical behavior. Are you seeing a large number of customers trying to move similar amounts to recently linked accounts or purchasing huge volumes of in-demand items? Perhaps the contact center is getting a lot of calls claiming fraud, which can be a sign of recent fraud attacks. Businesses can closely monitor transactions, educate their employees and customers to not click on untrusted links, and make sure there is more than one person to sign off on any account changes or large money transfers. For consumers, the number one thing you can do is to immediately contact the organization or financial institution where you were victimized. I know this takes time out of an already busy day, but it provides the best chance of recouping any lost funds. The other thing you can do is to immediately notify your social contacts about the scam if you’ve fallen victim. That way, others can protect themselves and help limit the damage and spread of any phishing incident. My experience with an “almost” phishing scam is that no one is immune. But the more everyone is aware of the potential consequences and how they can protect themselves, the less likely phishing attempts will be successful. Check out the Experian Insights blog to learn more about how Experian helps businesses and consumers during the holidays and throughout the year.

Most of us have experienced the feeling of frustration when it comes to online security protocols. You need to log-in to an account, but you’ve forgotten your password. When you choose an option to reset your password, you are asked to answer one of your security questions. But you forget which movie you said was your favorite while you were growing up. You take a guess, but unfortunately it’s the wrong one and you find yourself locked out of your account. At this point, you’re annoyed and wonder why accessing your account is so difficult in the first place. Historically, the attempt to balance customer security and convenience has been one of the biggest challenges online businesses have faced. As consumer expectations for smooth online experiences increase, businesses aim to deliver security protocols that make customers feel safe and protected, while allowing for easy and convenient access. According to our recent Global Fraud and Identity Report, 66 percent of consumers like security protocols when they transact online because it makes them feel protected. In fact, the lack of visible security was the number one reason customers abandoned a transaction. However, while consumers may tolerate the nuisance of common barriers to accessing their accounts, including forgetting their password or having to re-renter other security controls like CAPTCHA or two-factor authentication, higher friction doesn’t necessarily mean better security or a better overall experience. If businesses were able to offer a frictionless customer experience that was as secure, if not more secure, than the experience today, they could potentially increase overall revenue and growth. One-third of the consumers we surveyed said they would do more transactions online if there weren't so many security hurdles to overcome. And the number rose even higher in different age groups. For instance, the percentage rose to 42 percent when it came to millennials. We believe that a fundamental shift in the thinking is required. No longer, should businesses attempt to balance security against consumer convenience, but rather, we believe that with the right use of technology, analytics and data, both goals can be simultaneously achieved. In the name of both security and convenience independently, we are already seeing data-driven, artificial-intelligence powered systems operating behind the scenes. We believe that a merging of these two functions will yield significant benefits for the business as a whole. For this to work, businesses will need to gain and maintain the customer's trust without the familiar perception of security. Customers want to be recognized and businesses want to address the growing fraud they are experiencing. Solutions that combine device and behavioral intelligence with other data points such as biometrics, processed via advanced machine-learning, could help businesses in the future, simultaneously recognize their customers more accurately, and do so without challenging them. Winning companies will move from balancing security against convenience, to achieving both goals via a synergistic approach, and ultimately will evolve trust through technology, data and analytics.

In an article published by Bloomberg this week, Brian Cassin, Experian CEO, discusses the transformation of the business from a credit bureau to an innovative, global information services firm. The story highlights some of the remarkable work Experian does with high-profile clients including Coca-Cola and Fannie Mae, using data to inform marketing and strategy decisions. The article also references recent product innovations including Ascend, which offers analytics on demand, and PowerCurve, our market-leading decision analytics platform. Worth mentioning is that Experian’s strong financial performance also comes through in the article, which notes that the company’s stock price has doubled since 2015 while the FTSE 100 index has stagnated. Check out the full article.

We recently participated in Finovate Fall, where we joined top fintechs and financial institutions from around the world to debate about the current state of the financial services industry and more importantly, its future. A future where the so-called ‘experience economy’ will unfold and those putting the customer at the center of their innovation will thrive. But, how to get there and remain relevant in an ever-challenging environment? Committing to a culture of technology and innovation that transforms interactions between businesses and consumers is the first step. Take financial institutions and fintechs, for example. Despite their different approaches to what it takes to serve their customers better, both traditional and non-traditional industry players agree that technologies such as artificial intelligence (AI) and machine learning play a pivotal role in their respective digital transformation strategies. But with the change comes the challenge: most of organizations recognize they still struggle to fully operationalize the output of their advanced predictive analytics. To be true to our own commitment to technology and innovation and help businesses execute machine learning models within their decision processes, we have launched a new release of our flagship decisioning platform. The latest PowerCurve release integrates machine learning to deliver a faster and better analysis of data. These actionable insights will help our clients identify the opportunities presented by each of their customers quicker and more easily. Leveraging today’s technology to sustain tomorrow’s growth We believe that enabling businesses to leverage their current technology investments to support future growth is key to ensure they get the full benefit of their commitment to innovation. The latest PowerCurve capabilities allow custom plug-ins to be added at any time to support the next generation of technology and decision-making strategies while ensuring consistent, precise and personalized experiences that satisfy consumers’ demands over time. This enhanced flexibility means that businesses can get value of their current data and technology investments today and keep at pace with the latest and most effective decision management strategies across the entire customer life cycle. In addition, PowerCurve will continue to satisfy compliance requirements and provide the necessary governance and explainability that is essential in today’s market. With the updates to our decisioning platform and incorporation of machine learning capabilities, businesses will be able to make the right decisions today, resting reassured that those decisions will remain precise and relevant in the future.