Financial Education

One of the largest barriers to financial inclusion is a lack of financial education. Experian is changing that. Our partnerships and initiatives are dedicated to getting the proper tools, resources and information to underserved communities so that consumers can best understand and improve their financial health. Read about our financial education news below:

The Information Age transformed our way of life. It gives us new ways to communicate, have instant access to resources and the power to share information freely. Unfortunately the luxuries of this new age pose unique threats to consumers that were unconceivable in years past. It opens doors for thieves to capitalize on unsuspecting and innocent consumers. Fraud and identity theft is a booming business. Fraud and identity theft are important concerns for people today. Understanding the tools available to help you prevent fraud and recover from it can help you reduce concerns about your personal information being compromised.

More than 20 years ago, Experian became the first credit bureau to create a consumer education program. We started the program because we wanted to arm consumers with the right information and resources to help them understand the fundamentals of credit management and the benefits of having good credit.

Getting a copy of your credit report is the easiest first step to take control of your finances. A personal credit report contains details about your financial behavior and identification information. It is an easy-to-read summary of your credit accounts and total debt—both existing balances and available limits. Under federal law you are entitled to a copy of your credit report every twelve months. To obtain your credit report go to www.annualcreditreport.com.

Did you know that April is the official month for promoting financial literacy? Being aware of your credit and where you stand is important all year long, but the next 30 days will be dedicated specifically to educating consumers on all aspects of personal finance from managing your credit, paying off debt and saving for your first home or child’s secondary education to how to invest and plan well for retirement. We know how these topics can be overwhelming and intimidating. It’s one of the reasons that our weekly #CreditChat on twitter and Ask Experian column focuses on these subjects all year round. We want to give consumers the right resources and access to experts in an effort to help consumers change their financial behavior – that is part of our commitment. Join us all month long in our special Google+ hangouts, tweet chats (#CreditChat), and visit our blog for some exciting new resources created just for you!

Agreement extends Experian data and consulting services to ProAct clients Experian®, the leading global information services company, today announced an agreement with Ser Technology, developer of ProAct, a Web-based business intelligence consumer lending analysis and data warehousing solution. The agreement integrates Experian’s Global Consulting Practice expertise with ProAct providing SerTechnology’s credit union clients a 360 degree portfolio view, improving efficiency in the delivery of portfolio risk management decisioning. “We’re excited to collaborate and work more closely with Experian,” said Douglas White, executive vice president of business development at Ser Technology. “Credit unions are overwhelmed with increased risk management compliance burdens as well as executing strategic portfolio risk management strategies. With Experian, credit unions can now leverage ProAct and Experian data and business consulting for strategic portfolio risk management solutions.”

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

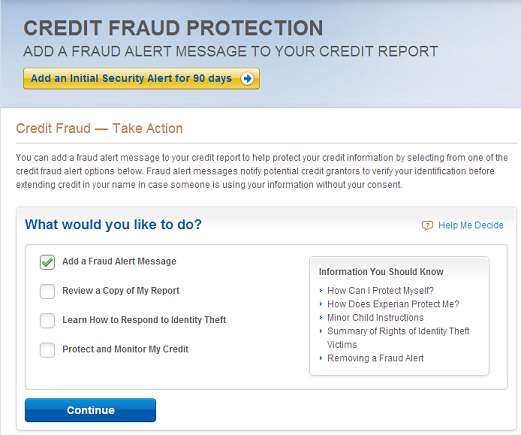

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

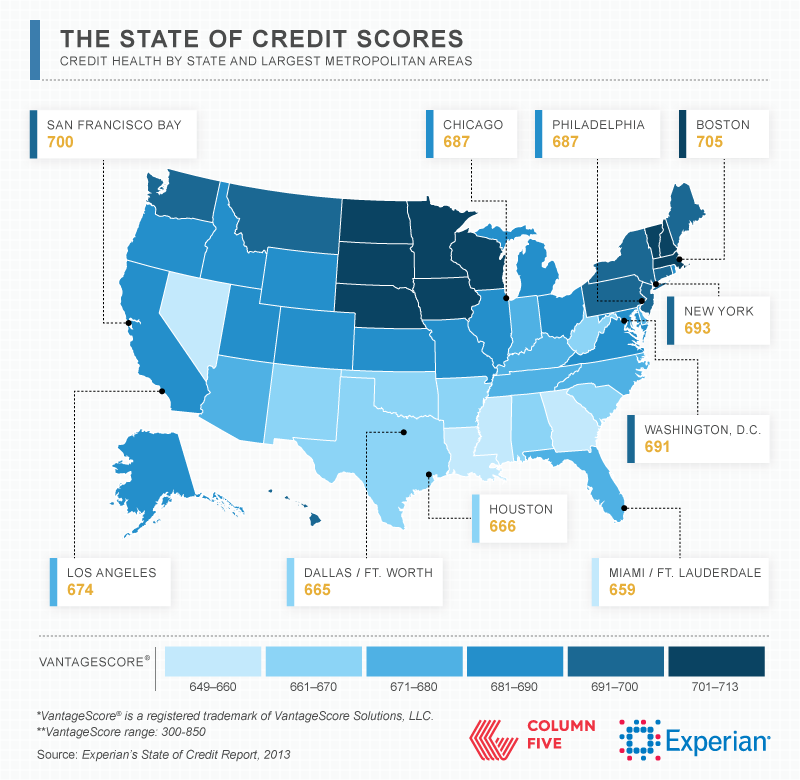

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.