Corporate Responsibility

I am a Senior Business Analyst in Experian’s office in Bulgaria. When refugee camps in my country first began filling up with Syrian refugees, I went to help as a volunteer. Since Experian had helped with similar initiatives for those in poverty in Bulgaria, I thought it would be a good idea to volunteer so I could inform other Experian employees of ways they could volunteer in the future. And now I can see that happening, as Experian is about to embark on a new volunteer project as a result. When I first stepped into the refugee camp as part of my own volunteer efforts, it was evening and nearly winter. I came with two volunteers, each carrying bags of clothes and food. No one can really prepare you for the conditions you witness in the camp, and they’re difficult to describe, too. Families had staked claims in small spaces by hanging up curtains, and while some families had the luxury of a bed made from a basic mattress, most people slept on the ground. As I made my way through the camp, I met a family of 12, including a small baby. I was overwhelmed by the welcome they gave me as they invited me to stay and talk with them. A few of them spoke some English, but the rest just wanted to communicate to me in whatever way they could. They graciously prepared me a dinner in traditional Syrian style — couscous, with vegetables and sauces. The meal was like a small celebration for them. They were delighted to even have my attention. Before I left, they sang me a traditional Syrian song that brought tears to my eyes. These people were a normal family — just like mine. They may be from a different country, speak a different language and have different cultural traditions, but I felt a strong sense of kinship to them. My experience grew in me a desire to do more for refugees coming to our country and bring more people along to help. I decided to apply for funding for Experian to work alongside the Refugee Project in a joint initiative to make a bigger, long-term impact on these people. This funding would give other Experian employees a chance to volunteer and provide refugees with the supplies they need. Additionally, Experian is in the process of organizing workshops for families who wish to stay in Bulgaria. These workshops will provide financial education to help them open a bank account, learn how our financial system works and give them the financial information they need to rebuild their lives. It means a lot to me to see what a difference we’re making and how we’re changing lives. I love knowing our work is helping people find a place to live, get a job and start their own business, as well as introducing Syrians to our local culture and customs. Read more #ExperianStories from our colleagues around the world. Photo: Tram in Sofia, Bulgaria

Serasa today launches a new service that allows Brazilian consumers to check their credit reports online for free. By visiting serasaconsumidor.com.br or by downloading the SerasaConsumidor App on Google Play or iTunes, consumers can check if they are delinquent, what led them to this status and whether it relates to bank, credit card, financial, retail, utilities, protested securities, checks without funds or lawsuits checks. Consumers will also have information about lenders, such as telephones, address, email and website as well as the value of the debt and repayment date for the delayed debt. Additionally, the consumer can renegotiate the debt directly, without intermediaries, if the company is a partner of Serasa’s free service Limpa Nome Online. People can make a free online inquiry as often as they would like. To participate in the free online program, consumers must access serasaconsumidor.com.br and fill out a registration or enter an email address and password if already registered. The service is also available on mobile Apps Android and iOS. To properly verify the user accessing the information in Serasa, after the registration, the consumer must go through an authentication process. One of the steps is to enter the mobile number and confirm the validation code received via SMS. This validation is required only on the first access. For the director of SerasaConsumidor, Fernanda Monnerat, this new service presents the opportunity for consumers to easily and safely check the existence debts in a single digital environment. \"It\'s another tool that we provide to Brazilians so they can have access to services that make possible, above all, their financial citizenship and ability to build a more sustainable relationship with the credit. Therefore, we reaffirm once again the commitment of Serasa with the consumer,” said Monnerat. Among other free services available on the SerasaConsumidor website, consumers can opt-in to the positive data initiative, which gathers information on the consumer’s payment history, measures their payment timeliness of debts and evaluates the risk of debt distress. Through the program, it is also possible to make a document alert and stolen checks alert. Free registration in Serasa helps to reduce risk of fraud and to avoid the challenges of having personal information used by scammers. Also on the website, users will find guidelines and tests on financial education on the newly launched page www.serasaconsumidor.com.br/organizar-financas.

Headlines bemoan the lack of personal finance being taught in our schools. Most students will graduate with little to no education on personal finance basics. But, with Experian’s help, LifeSmarts is making a difference for students across the country. Together, we are helping students get on the right path to a lifetime of success by equipping them with the financial knowledge and consumer skills they need to make informed, responsible choices.

2,500 university students across 16 cities have been trained by Experian\'s experts and young volunteers of the social responsibility project ‘Manage Your Future Now’ project. The project, which was launched by Experian to promote self-improvement among university students, female entrepreneurs, and SMEs, reached the milestone in December and the achievement was celebrated at a recent event at the Experian office in Turkey. Coming from 10 cities across the country, 42 participants gathered to share their experiences. Feedback was positive with everyone agreeing that the project has been beneficial in increasing awareness of social responsibility. The participants were presented with a certificate for their commitment and contribution to the project. ‘Manage Your Future Now’ is a partnership between Experian, the United Nations Development Program and the Habitat Association/Center and Credit Bureau. The initiative includes providing training on financial risks, responsible borrowing, financial management and the efficient management of relationships with banks and the financial sector. Didem Köprücü, Human Resources Manager for Turkey and the Middle East at Experian, said: “We are proud that more people are benefiting under the ‘Manage Your Future Now’ project. Our training is improving every year and I would like to thank all the volunteers and young trainers for their valuable contribution. “The third stage of our project in 2016 will cover financial risk management, as well as financial opportunities for entrepreneur candidates. For this stage of the project we plan to reach 3,000 students and entrepreneur candidates across 26 cities. “However, we intend to continue our project, reaching more people every year.” The project aims to reach 3,000 students by the end of March 2016.

Small Business Saturday is just around the corner, and as it approaches there are a growing number of advertising campaigns encouraging consumers to forego the big box retailers in favor of shopping local.

As a supporter of my own neighborhood small businesses, I can appreciate the effort. After all, the success of small businesses is what really drives our economy forward. Not only do they provide employment opportunities for those in the community, but small businesses often bring a level of innovation and can stimulate growth.

Small Business Saturday is just around the corner, and as it approaches there are a growing number of advertising campaigns encouraging consumers to forego the big box retailers in favor of shopping local.

As a supporter of my own neighborhood small businesses, I can appreciate the effort. After all, the success of small businesses is what really drives our economy forward. Not only do they provide employment opportunities for those in the community, but small businesses often bring a level of innovation and can stimulate growth.

I am part of a community that completely energizes me, makes me believe that there are good people in the world and that makes me want to be better. Over the course of four days in September, my co-workers and I were transported into the world of self-proclaimed “money media nerds” at FinCon, the Financial Influencers conference, where people share thoughts, best practices and update one another on the latest trends. FinCon is THE annual event for the financial media community.

I am part of a community that completely energizes me, makes me believe that there are good people in the world and that makes me want to be better. Over the course of four days in September, my co-workers and I were transported into the world of self-proclaimed “money media nerds” at FinCon, the Financial Influencers conference, where people share thoughts, best practices and update one another on the latest trends. FinCon is THE annual event for the financial media community.

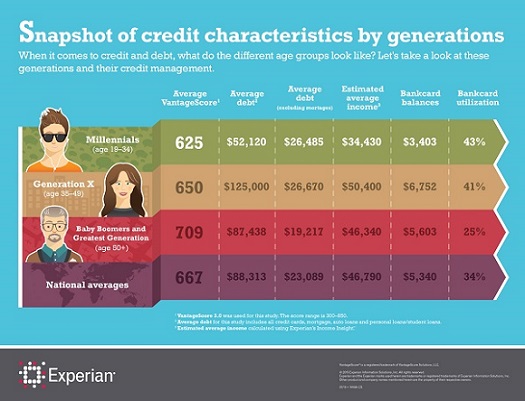

If we looked at current generations in a family structure, Baby Boomers are mom and dad, the Greatest Generation are grandma and grandpa, Generation X are the older siblings and Millennials are those overindulged younger siblings that always got later curfews and more relaxed rules. For that reason, there is a natural, friendly, sibling-type rivalry between Generation X and Millennials. And this week, millennials came out the victors because Generation X failed to school its younger sibling when it came to average debt load.

If we looked at current generations in a family structure, Baby Boomers are mom and dad, the Greatest Generation are grandma and grandpa, Generation X are the older siblings and Millennials are those overindulged younger siblings that always got later curfews and more relaxed rules. For that reason, there is a natural, friendly, sibling-type rivalry between Generation X and Millennials. And this week, millennials came out the victors because Generation X failed to school its younger sibling when it came to average debt load.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

A recent study conducted by Experian showed that a majority of vacationers overspend their budgets and rely on credit cards to provide extra funds. At the extreme end, more than half of millennial vacationers (52 percent) lean heavily on their credit cards, racking up vacation debt they’ll be repaying long after their trip comes to an end.