At A Glance

At a Glance When an unknown printer took a galley of type and scrambled it to make a type 2ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release

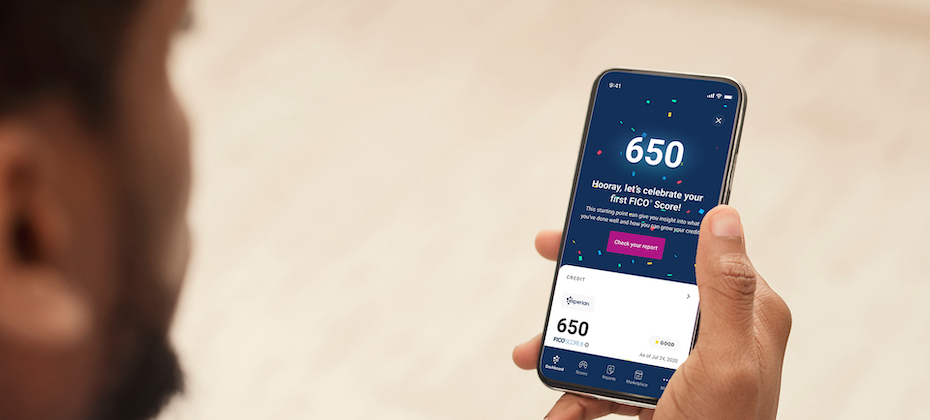

For the past several years, we’ve been on a journey to improve financial access for millions of people around the world. We’ve made it our job to help consumers get the best financial outcomes. This focus on consumers defines us and informs everything we do. In 2019, we reshaped how consumers access credit with Experian Boost™. Since then, nearly 9 million consumers have connected to the product. While we are proud of what we have and continue to accomplish with Experian Boost, we know there is more to be done to ensure more consumers can access fair and affordable credit. Improving outcomes for underserved consumers When credit is used responsibly, it can create new opportunities from getting a college degree, buying a car or home and starting or expanding a business. These are milestones that help people establish careers, build wealth and ultimately achieve greater financial freedom. Yet, there are millions of consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. In fact, our recent research shows there are at least 28 million credit invisibles in the U.S. with an additional 21 million consumers who are unscoreable by the credit score models most used by lenders today. Without an established credit history, these consumers struggle to qualify for everything from an auto loan to a mortgage and even an apartment or employment. This problem more frequently impacts communities of color with 28 percent of all Black and 26 percent of all Hispanic consumers currently unscoreable or credit invisible. Increasing financial inclusion depends on creating opportunities for underrepresented consumers to succeed. And this starts with ensuring all consumers have a financial identity. Bringing financial power to all with Experian Go The challenge is many consumers who are not in the credit ecosystem today are unsure where to start. Today, we reached a pivotal and exciting milestone in our commitment to consumers with the launch of Experian Go™. This new program opens the front door to the financial ecosystem for millions of consumers by helping them establish their financial identity and move from credit invisible to scoreable. Within minutes, credit invisibles can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost™[1], and instant access to financial offers through Experian Go. In fact, early analysis shows 91 percent of consumers with no credit history who connect to Experian Boost, a free feature that allows users to contribute their on-time cell phone, video streaming service, internet, and utility payments directly to their Experian credit report, can become scoreable in minutes with an average starting near-prime FICO® Score of 665[2]. Throughout the experience, we’ll provide ongoing credit education and access to tools like Experian Boost™ to make it easy for consumers to learn how to use and responsibly grow their credit histories. Until now, our industry has struggled to verify the identity of credit invisibles. Over the last several years, we’ve introduced new identity verification technologies to our toolbox. With Experian Go, we’re leveraging these technologies to verify a credit invisible’s identity and get them in the front door to start building credit. No other credit bureau or organization is doing this today. During our pilot, we helped more than 15,000 consumers establish their credit history. This is a great start. Now that Experian Go has launched, I look forward to helping millions more consumers get the credit they deserve. To learn more about Experian Go, visit www.experian.com/go. [1] Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. [2] Experian analysis based on an anonymized and statistically relevant sample of consumer credit reports with only Experian Boost tradelines included and FICO® Scores. December 2021.

I’m delighted to announce that Experian has been named as a Top Employer across five countries. Our teams in the UK, Germany, Brazil, Singapore and Australia were all recognised in the 2022 awards which is a fantastic achievement. At Experian we pride ourselves on having a great People First culture, it’s something we are all proud of and want to protect. We do this by supporting a dynamic, positive and inclusive working environment for our employees wherever they are in the world. Our people are passionate about the work that we do, using data, analytics and technology to help transform lives and create a better tomorrow for people and organisations. We see our people live that purpose everyday in their work and it is wonderful to see that pride, about the role we play – supporting clients, consumers economies and society – getting recognised once again.

The past few years have sparked a swift digital transformation that subsequently drove a rapid increase in fraud. In fact, fraudsters have gotten more creative, putting businesses and consumers at risk now more than ever. At Experian, we predict that more intricate challenges lie ahead and are dedicated to helping businesses combat fraud threats. Here’s what we expect in 2022: 1. Buy Now, Pay Never – The Buy Now, Pay Later (BNPL) space has grown massively recently. In fact, the number of BNPL users in the US has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 who are spending more than $20.8 billion . Without the right identity verification and fraud mitigation tools in place, fraudsters will take advantage of some BNPL companies and consumers in 2022. Experian predicts BNPL lenders will see an uptick in two types of fraud: identity theft and synthetic identity fraud, when a fraudster uses a combination of real and fake information to create an entirely new identity. This could result in significant losses for BNPL lenders. 2. Beware of Cryptocurrency Scams – Digital currencies, such as cryptocurrency, have become more conventional and scammers have caught on quickly. According to the FTC, investment cryptocurrency scam reports have skyrocketed, with nearly 7,000 people reporting losses totaling more than $80 million from October 2020 to March 2021 . In 2022, Experian predicts that fraudsters will set up cryptocurrency accounts to extract, store and funnel stolen funds, such as the billions of stimulus dollars that were swindled by fraudsters. 3. Double the Trouble for Ransomware Attacks – In the first six months of 2021, there was $590 million in ransomware-related activity, which exceeds the value of $416 million reported for the entirety of 2020 according to the U.S. Treasury's Financial Crimes Enforcement Network . Experian predicts that ransomware will be a significant fraud threat for companies in 2022 as fraudsters will look to not only ask for a hefty ransom to gain back control, but criminals will also steal data from the hacked company. This will not only result in companies losing sales because of the halt caused by the ransom attack, but it will also enable fraudsters to gain access and monetize stolen data such as employees’ personal information, HR records and more – leaving the company’s employees vulnerable to personal fraudulent attacks. 4. Love, Actually? – Because more consumers went on dating apps and social media to look for love during the pandemic, fraudsters saw an opportunity to create intimate, trusted relationships without the immediate need to meet in-person. The FBI found that from January 1, 2021 — July 31, 2021, the FBI Internet Crime Complaint Center received over 1,800 complaints, related to online romance scams, resulting in losses of approximately $133 million. Experian predicts that romance scams will continue to see an uptick as fraudsters take advantage of these relationships to ask for money or a “loan” to cover anything from travel costs to medical expenses. 5. Digital Elder Abuse Will Rise – According to Experian’s latest Global Insights Report, there has been a 25 percent increase in online activity since the start of Covid-19 as many, including the elderly, went online for everything from groceries to scheduling health care visits. This onslaught of digital newbies presents a new audience for fraudsters to attack. Experian predicts that consumers will get hit hard by fraudsters through social engineering (when a fraudster manipulates a person to divulge confidential or private information) and account takeover fraud (when a fraudster steals a username and password from one site to takeover other accounts). This could result in billions of dollars of losses in 2022. As a leader in fraud prevention and identity verification, Experian offers a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian's fraud management tools.

In the early 1960s, Simon Ramo had a vision of a cashless society made possible by information and technology. This vision led to the creation of our business in North America. Ramo believed information could change the way people lived. Today, we know this to be true and continually see the ways data and technology can create enormous good in the lives of millions of consumers. While much has changed since the 1960s, Ramo’s vision holds true and continues to fuel the way we work at Experian. These principles have put consumers at the center of our business, which has forced us to think outside the box and do things differently. Let me give you an example. Until 2019, consumers had never been able to contribute information directly to their credit report. When we launched Experian Boost, we fundamentally changed the game. We put consumers in the driver’s seat and empowered them to contribute their on-time bill payments directly to their Experian credit report. By doing so, we’ve helped millions of consumers instantly improve their FICO® Score. This was a game changing move that is making a tangible difference for consumers. In fact, Experian Boost users have accessed more than $1.7 billion in credit due to improved credit scores. While we are proud of what we continue to accomplish with Experian Boost, we know financial inclusion depends on all of us doing more. On all of us doing things differently. We recently released new research in partnership with Oliver Wyman which shows 106 million Americans, or 42% of the adult population, lack access to mainstream credit because they are credit invisible, unscoreable or have a subprime credit score. Communities of color are more likely to lack access to mainstream credit, with 28% of Black and 26% of Hispanic consumers unscoreable or invisible, which is perpetuating historic disadvantage. While we have made a lot of progress in recent years by incorporating new data in decisions, as an industry, we can and must do better to ensure all consumers have access to fair and affordable credit. The old way of doing things, the old tools, will not work to ensure more consumers can access the financial services they need when they need them. The score models historically used by lenders are leaving nearly 50 million Americans behind. We need better data and better technology to help more consumers. When advanced analytics and machine learning are combined with expanded data sets as they are with Experian’s Lift Premium™ score, 96% of the population can be scored, including an estimated 65% credit invisibles and the entire conventionally unscoreable population. This is significantly greater than the 81% of consumers that can be scored by conventional scores today. Scoring 100% of Americans and expanding fair access to credit to creditworthy consumers is our goal. This is an exciting time as we are nearing a point where we can say, no matter who you are, where you live or what part of your financial journey you’re on, we can score you and help you access the financial services you need. We can’t do it on our own. Financial inclusion depends on industry adoption of these new tools and insights. As we begin a new year, I believe the financial services industry is at an inflection point. And I am hopeful. I think we can all agree it’s time for a new way of doing things and today we have the tools available to make it happen.

It’s a privilege to be recognized for a cause that’s important to so many of us at Experian. I am honored to be awarded a bronze Stevie® Award in the “Women Helping Women – Business” category for supporting women in Decision Analytics (DA) and overseeing our employee resource groups across DA. The award specifically calls out our long-standing Accelerated Development Program (ADP), which identifies and mentors women business leaders within our organization The Stevie Award trophy is one of the world's most coveted business prizes, representing more than 60 countries. The awards have been given to small, medium and large businesses for an array of categories since 2002. In 2018, HR Director Richard Teague and I helped launch ADP, which has identified 44 mid-career, high-potential women on the Global Decision Analytics team in a leadership training program. Around half of the women who participate have been promoted within two years. The ADP program also complements our DEI initiatives, which includes our five employee resource groups that have played a valuable connecting and our engagement our team members during both the pandemic and personal challenges. If you would like to find out more about any of the GDA DEI networks, including how you can get involved, please contact the relevant network lead: Mental Health – Chris Fletcher Disability and Neurodiversity – David Bernard LGBTQ+ – David Gallihawk Gender Network – Marika Vilen or Jen Cosgrove Race and Ethnicity – Shri Santhanam

An industry’s greatest innovators are successful not only because they deliver superior products in the present, but also – and perhaps more importantly – because they continuously solidify their place in the future through a drive to create a better tomorrow that encourages modernization and disruption. With this approach, Experian has been named Most Innovative Company of the Year in the 2021 11th Annual Best in Biz Awards. Over 700 companies entered, and winners of this prestigious honor were chosen by a small group of prominent editors and reporters from top-tier publications like Associated Press, Forbes, CNET, and Wall Street Journal. In their day-to-day reporting, these judges hear about and cover companies which are on the forefront of innovation. Over the last year, Experian has focused on helping consumers and financial institutions with a wide range of challenges. This includes opening up credit to underserved communities, adapting to changing consumer expectations, addressing the growing threat from fraud, and becoming a more agile technology provider in an ever-changing market. We are truly honored to be recognized as Most Innovative Company of the Year by the Best in Biz Awards. Experian embraces a culture of discovery that enables us to grow and evolve while remaining at the forefront of innovation. Of course, the key is to never stop questioning, evolving, and innovating. And we won’t.

For the ninth year, the Orange County Register has named Experian North America as a Top Workplace, securing the #1 ranking for the second consecutive year. The award, which is based on employee feedback in a survey of hundreds of leading companies in Orange County, recognizes our company’s culture of inclusion, and our commitment to employees and communities. Orange County is the home of our North America operations, and we are especially honored to be recognized again for our inclusive work environment and achieving higher performance while giving back. This honor demonstrates the talent and compassion of all the people who work at Experian. Thank You All our decisions are driven by our desire to ensure our employees feel valued and protected. As part of this, we issued a ‘Thank You’ Share Award to all employees at the beginning of this year to recognize perseverance through the pandemic, giving thousands of employees an equity stake in the company. Coming Together Our Employee Resource Groups (ERGs) continue to grow and support employees in different ways, which include activities that bring employees together internally to serve their communities externally. For example, our Asian American ERG worked closely with Pan-Asian leadership organization Ascend to support the Asian American community and employees, considering increasing discrimination and xenophobia during the pandemic. Together they kicked off Feed Your Hospital, which facilitated the delivery of meals to frontline COVID-19 healthcare workers by supporting local Asian restaurants. Meals were purchased at the restaurants and delivered to participating hospitals. The campaign raised funds for hospitals in Orange County. Social Good This year, we also awarded two OC-based organizations with major grants – the OC Hispanic Chamber of Commerce and TGR Foundation (a Tiger Woods Charity). For the OC Hispanic Chamber of Commerce, we funded and facilitated credit education initiatives for the Youth Chamber Program – funds went towards scholarship awards and event costs. We also added credit education to the ‘Pre-Venture Business Program’ curriculum – with funds going into marketing, training, one-on-one consulting, and event costs offered in both Spanish and English. For the TGR Foundation grant, we are working on ongoing projects with the foundation to support credit education, small business entrepreneurship, homeownership, and financial inclusion efforts. In total, employees volunteered more than 900 hours to Orange County-based nonprofits and Experian matched funds to those organizations that employees volunteered with and donated to. Our employees continue to help people who are facing unprecedented and unforeseen challenges. Different groups and employees of all levels are working together to help our clients, customers and communities persevere. We are honored that the Orange County Register continues to recognize our tireless efforts to make a difference in the communities in which we live and work.

Over the past year at Experian, we’ve continued to facilitate innovation in the fintech space – leveraging our expertise and history of helping financial institutions and individuals address a wide range of challenges. We’re thrilled to be recognized for the impact of this important work, being named a global fintech leader in the Center for Financial Professionals (CeFPro) Fintech Leaders 2022 report. One of the most comprehensive international research and ranking programs on the status of fintech in financial services, CeFPro ranks Experian among the report’s top companies within the Fraud Prevention and Credit Risk categories, and in the top 15 Overall Ecosystem Rankings. This recognition showcases the value of fraud and identity management services amid the rise of digital channels, and critical importance of continuing to develop strategies to mitigate risk. At Experian we have a deep history in pioneering tools and services that prioritize improving financial health for all. Through the ongoing development of our core products and continued innovations, we believe improving financial health is how we can make a difference for institutions and individuals alike. Our core products harness the expertise of our people and are examples to others in the industry who look to advance innovation in the fintech space and beyond. We continue to invest in new technology and infrastructure to deliver fresh insights and transform the way businesses and consumers operate. For more than 125 years, we’ve helped consumers and clients prosper. Recognition by the CeFPro report is particularly meaningful to us. The study garners their rankings from the very individuals and institutions that engage with Experian – drawing on market analysis and original research that is also backed by an advisory board composed of 60 international industry professionals. We’re honored and inspired – and look forward to continuing to push the envelope in the fintech space and beyond.

The United Nations identifies removing poverty as one of its 17 Sustainable Development Goals. There’s a reason it’s number one on their list: Access to affordable financial services opens the door to opportunities for people to transform their lives – from homes and healthcare to education and entrepreneurship.. At Experian, our focus is on increasing access to financial services, improving financial literacy and building consumer confidence; we help people take control of their financial health. We are using the power of data innovation to transform lives and help businesses grow, improving financial health for people around the world. We created a dedicated Social Innovation Programme to fund, build and recognize products that will have a positive impact on the financial health of consumers. Between 2013 and April 2021 we have invested over US$8m across 29 product ideas. Eighteen of those products have launched, reaching 61 million people, many of whom are from financially vulnerable backgrounds. In June, we opened applications for our latest round of annual Social Innovation funding and asked teams to come up with new innovative products that positively impact the financial health of our consumers and use data for good. Of these, seven projects were shortlisted and presented to our Social Innovation Committee, which I am privileged enough to chair. It was a tough decision, but we chose three truly diverse projects to receive this year’s Social Innovation funding and we are really excited about what they could achieve. These projects will give millions of people in India access to a more positive loan decision, allow citizens in the UK to manage their vulnerability data across multiple organisations, and help farmers in Brazil to access the credit they need to keep their businesses going. Between them, these three projects alone have the potential to reach over 85 million people in the next five years, which is a truly exciting prospect. We are proud to celebrate our culture of purpose-led innovation. Our social innovation products have reached 61 million people since 2013 and we aim to reach 100 million by 2025. Read more about how we are helping to create a better tomorrow.

This year is the first time we are observing International Day of Persons with Disabilities (IDPD), but Experian has been working to support those who identify as part of this community long before now. I share the story of my colleague, software engineer Andy Willard. While Andy has been with Experian for 25 years, he didn’t share his deteriorating eyesight condition with managers at first. “Truthfully, I didn’t ask for a lot. I had the position and I don’t want to rock the boat or put a spotlight on myself. But in 2000, I stopped driving and rode the bus to work a lot. That would take an hour and a half each way. I finally went to my manger and requested telecommuting days, and at the time no one was getting those,” Andy said. His managers immediately agreed and he works 100 percent remotely, long before the pandemic. Experian provided tools like larger monitors and accessibility software to assist with on-screen reading. He appreciates the technology and the time the company allows him for classes to learn about new ways to adjust to working with his visual impairment. But, there can still be some challenges, like when a company-wide software update doesn’t automatically reconnect his system with the screen reader or screen magnifying tools. We know we still have work to do. Being named a Best Place to Work for Disability Inclusion earlier this year let us know we’re on the right track; and we’re excited to continue developing our partnerships with Disability:IN and the National Disability Institute, for which our Chief Diversity, Equity and Inclusion Officer Wil Lewis is a board member of both. As the co-executive sponsor of the ASPIRE employee resource group, which focuses on mental health, caregiving and disabilities, we want our coworkers to know they are supported and we will do all we can to ensure they continue to grow and develop their careers, as Andy did. His first job at Experian was as an analyst, then moved on to software development and then into a software engineering role. I’m proud of the work we are doing at Experian. We’ve made great strides forward to support an inclusive work environment for everyone, and there’s more to be done. I encourage my coworkers to share their stories as Andy did so we know where we should focus our efforts and support our colleagues in making Experian an employer of choice for people who live with disabilities.

Last week, Experian’s Nottingham office hosted the National Data Strategy Forum as it kicked off its series of regional events showcasing the power of data. The day brought together a wide range of stakeholders, including National Numeracy, the National Literacy Trust and the University of Nottingham, alongside representatives from the Department of Culture, Media & Sport, to talk about the ways data can benefit Midlands business, societies and communities. From financial inclusion, digital literacy, and the role of data in protecting the most vulnerable in our society, to the ways data can create business opportunities for the future, and how we can work together to support grassroots innovation across the region, the discussion focused on how Government and industry can work together to accelerate regional success. This is an early and important step in helping realise the potential of data to create a better tomorrow for people in the Midlands and across the UK. We look forward to continuing to engage with the NDS Forum to bring that potential to life.

It’s hard to believe that Christmas is just around the corner. Many of us will be starting to think about (or if you’re very organised, have already finished) their Christmas shopping. Black Friday sales will kick-off this week’s online bonanza, as bargain hunters pursue the best deals online. However, while we are all busy getting into the spirit of things, it has never been more vital that we do what we can to protect ourselves from identity fraud. As the popularity of the Black Friday sales season has grown, we’ve also seen a marked increase in the volume of fraudulent activity, as criminals use stolen or illegally obtained personal details to apply for credit in someone else’s name. According to our latest analysis of National Hunter Fraud Prevention Service data, the fraud rate for credit card applications has increased by 43% in the last three months to 69 confirmed fraudulent applications per 10,000 applications. It’s expected the rate will rise even more in December, as criminals look to take advantage. It’s naturally worrying if you are a victim of ID fraud. The fraudster will likely have tried to obtain credit in your name – perhaps on multiple occasions – and you’ll be concerned about how and from where they got hold of your information in the first place. Fortunately, there’s a host of things you can do to protect yourself. Checking your credit report on a regular basis is one of the best ways to spot if fraudsters have used your personal information to attempt to access credit, and our dedicated teams can help guide you through the steps if the worst happens and your identity has been stolen. New services and solutions are also helping companies identify and prevent more fraud. In part, the rise in rates can be attributed to better detection, helping fraud teams focus their energy on fraudulent applications, rather than genuine ones. So, while you’re browsing for gifts this festive season, make sure you are mindful of those looking to spoil your Christmas spirit. Help is available and you can read more on how to guard yourself against identity fraud on our website.