sdfsad sddfs sdfsdf sdsf sd sfsdfsdf s

asdf sa dsdfdsf ds dsf sdfsdf sdfsd sdf

In this article…

For all of the ways money – and access to it – affects our lives, it’s unfortunate that it is not discussed regularly with young people. Sadly, when it is discussed, it’s often in response to highly emotional financial stress or difficulty rather than as a positive learning opportunity. Establishing a positive, fact-driven relationship with money early in life can be a critical factor in future success. Equitable access to financial tools and resources to create a better tomorrow can help everyone achieve their life’s goals. That’s why we’re proud to announce the launch of the Center for Financial Advancement® (CFA) Credit Academy. CFA is a key initiative of HomeFree-USA, and we’ve been partnering with the organization to provide complementary training to their housing counselors on financial and credit education information and resources. This new six-month program is for 250 scholars from 14 Historically Black Colleges and Universities (HBCUs). My colleagues on Experian’s Credit Education team are leading the program to help scholars gain an understanding of credit and its importance. The hope is they’ll become knowledge ambassadors for their peers, family and their communities. Experian research shows there are 28 million US consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. Credit invisibility more frequently impacts underserved communities with 26% of Hispanic consumers and 28% of Black consumers unscoreable or invisible compared to 16% of White and Asian consumers. That can make homeownership, the greatest driver of generational wealth, an even bigger challenge for underserved communities. Ensuring these students are aware, informed and visible within the credit ecosystem will help them access more equitable lending when they’re ready to take steps to buy a car, own a home, and build generational wealth. In addition to live sessions and self-paced content, the CFA Credit Academy culminates with a hackathon competition in April, challenging all students to form teams of four at participating HBCUs to build the next best credit education program for their peers. The winning team will earn a $40,000 scholarship, sponsored by Experian. We can’t wait to see what the scholars come up with, and we look forward to sharing their ideas. To learn more about Experian’s work in diverse communities: visit www.experian.com/diversity.

We welcome today’s recommendations, which will help deliver a better and more equitable credit market for everyone. Comprehensive, accurate data delivers better outcomes for consumers, and bringing more data into the CRA ecosystem will further improve those outcomes. We are pleased to see the regulator taking action to ensure the UK financial system remains one of the most effective, innovative and competitive in the world. Experian shares the FCA’s view that there are opportunities to improve the operation of the credit information market in the UK, and was happy to co-operate fully with the FCA’s team during the multi-year Market Study process. A number of the remedies outlined in the FCA report were supported by Experian in a 2018 white paper, The Future of Credit Information. Amongst other things, this included establishing a base level of credit data for regulated CRAs to give consumers and lenders a clear, consistent baseline for credit reporting, while encouraging a competitive and innovative environment for non-regulated credit data and accurate insight. Experian aims for consistently excellent data across its enterprise. It invests continuously to improve data coverage, accuracy, timeliness, richness and increase credit visibility of consumers to the financial system, and it continues to innovate to improve credit outcomes for consumers.

It continues to astonish and amaze us that the majority of the men and women who enlist in our nation’s military bring immense commitment but very little money. When you’re an E5 or lower military rank with a family living in Southern California, the cost of living in this region can be financially challenging. Delilah Moreno Denny remembers earning $13,000 a year during his first year in the Army and the “pass the hat” exercise during morning formation when someone in the unit had a new baby. Delilah served in the Army reserve while pregnant, and her unit gifted her a basket full of diapers. As co-executive sponsors of the Military, Veterans, and Patriots (MVP) Employee Resource Group at Experian, we sought to continue that kindness and found Support The Enlisted Project (STEP). Our members have organized virtual baby supply drives and helped at the warehouse. Denny Galiano STEP fills the gap for enlisted members in many ways. We’re proud that Experian is expanding our partnership by bolstering its Emergency Financial Assistance (EFA) program through our United for Financial Health initiative. EFA helps soldiers, sailors, airmen and marines learn about financial literacy and credit. Many of our enlisted members join the military just out of high school without basic financial education about credit, balancing a checkbook, saving for the future, or managing debt. EFA helps military members move from financial crisis to financial self-sufficiency so that they can have a more stable future during their service and when they become veterans. As supporters of STEP and its mission, and as veterans, we’re excited that our relationship is evolving from providing basic needs to helping create a better tomorrow for our nation’s military service members. It is our honor to continue serving our U.S. Armed Forces community by providing resources that will lead to financial empowerment.

Bloor Research recently named Experian a Champion in the latest Data Quality Market Update 2022. Bloor’s Market Update specifically provides individuals with a technology update and ranking of vendors based on their products and progress in the market. Experian was the only vendor placed in the Champion category. Data quality is the foundation for any data-driven organization. However, many organizations still struggle to achieve the needed quality data necessary to feed critical initiatives. In our most recent research report, we discovered that 85% of businesses believe poor quality contact data for customers negatively impacts their operational processes and efficiency. To solve these challenges, data quality solutions continue to evolve. Leveraging trustworthy data equips organizations with the power to make their data actionable and fit for a purpose. Our research also showed: 89% say that implementing data quality best practices has improved their business agility 87% believe that data quality is fundamental to the core of business operations 91% say investing in data quality has positively impacted business growth In effect, this empowers business leaders to make better and faster decisions when outlining key operational strategies and initiatives. Since three quarters of businesses who have improved their data quality in the last year say they have exceeded their goals in some manner, we find that organizations that emphasize data maturity are more likely to experience success. Experian has a long history in the data quality space, starting with our address validation solutions. However, as data usage has evolved, so have our solutions. We incorporate cutting edge technology paired with an easy-to-use interface that allows individuals at all levels of the business to better understand the quality of their data and improve this important asset. A high degree of automation and precision will be required as businesses tackle today’s challenges related to data quality. At Experian, the overarching goal is to help clients maximize their potential with the power and confidence supplied by superior quality data—the cornerstone of success in today’s digital-forward realm of business operations. Explore our data quality solutions today to find out for yourself what makes us data quality experts. Click here to start your free trial.

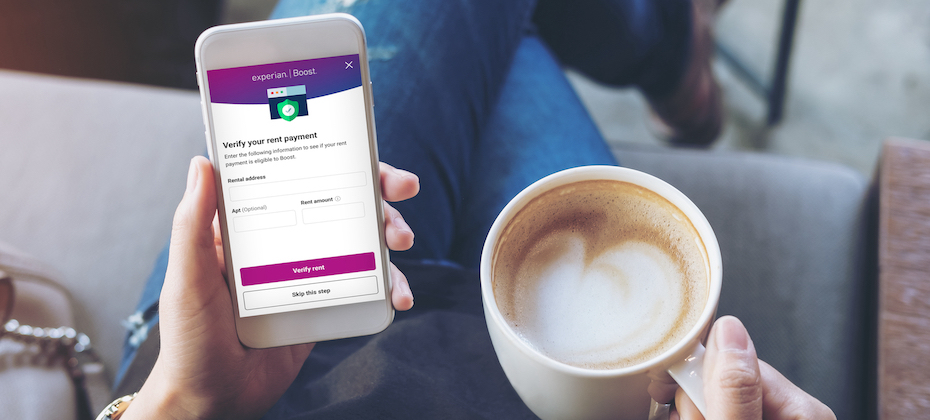

I recently came across a quote that said, “The world you see is created by what you focus on.” As I look back on my last 16 years with Experian, I see a lot of truth in this. While Experian has historically been recognized as a business-to-business organization, over the last several years, we’ve had a transformational shift in focus that’s fundamentally changed our business. This shift has made our world look a lot different than it used to. Today, consumers are at the center of everything we do. They’re the driving force behind our innovation and growth. Every day, millions of consumers come to Experian looking for ways to improve their financial health and we’ve been building one of the largest global member bases. These direct relationships put us in a unique position. We can listen to consumers to hone our focus – and we do. Just like in everyday relationships, listening builds trust and respect. It helps us understand what consumers want and allows us to innovate to meet them where they are on their financial journey. In 2019, we heard consumers’ call for more control of their data and responded with Experian Boost®[1]– a first-of-its-kind feature that allows consumers to contribute information directly to their Experian credit file. To date, we’ve helped 8.6 million consumers instantly improve their FICO® Scores[2] with an average increase of 13 points. Since launch, we’ve continued to listen and enhance the feature to maximize the number of consumers who can benefit. Shortly after we brought Experian Boost to market, we wanted to ensure consumers who paid their monthly telecom and utility bills from their savings or credit cards could benefit alongside those who paid these reoccurring bills through their checking account, and we did. Against the backdrop of the COVID-19 pandemic, at a time when television streaming had skyrocketed, we wanted to ensure consumers who subscribed to video streaming services, including Netflix®, Hulu™, HBO Max™, Disney+™ and others, could use these monthly payments to build their credit histories, and we did. We regularly connect new streaming service partners to Experian Boost. Most recently, consumers who subscribe to Paramount+, Peacock, Showtime® and ESPN+ can also contribute their on-time bill payments directly to their Experian credit file through Experian Boost. Earlier this year we introduced Experian Go™ – a free, first-of-its-kind program to help “credit invisibles,” or people with no credit history, begin building credit. Within minutes, credit invisibles who enroll in the program can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost and instant access to financial offers through Experian Go. Since launch, more than 84,000 consumers have established an Experian credit report through Experian Go and become visible to potential lenders. As a next step, today we’ve announced a new beta release of Experian Boost that allows consumers to contribute qualifying, “positive” residential rent payments directly to their Experian credit file. This capability makes Experian Boost the only feature that can instantly improve a consumer’s FICO® Score 8through positive rent payments at no cost. This is the next step in our commitment to helping consumers get the credit they deserve. With the beta release, consumers who rent from over 1,500 of some of the largest U.S.-based property management companies, and who pay their rent directly to their property management company or through platforms like AppFolio Property Management, Buildium®, Yardi® Breeze and Zillow® Rental Manager, can add qualifying positive rent payments to their Experian credit file through Experian Boost. Based on preliminary analysis[3] highlighting the potential impact of positive residential rent payment reporting through Experian Boost, we estimate 66% of consumers will see an instant increase to their FICO® Score 8, a FICO® Score 8 improvement of nearly 10 points on average for those who receive a boost and are new to using Experian Boost. And we’re not done yet. To ensure more renters can benefit, we’ll continue to add new property management companies over time. In later phases, we’ll update the feature further to add individual landlords and smaller property management companies over time. I’m proud of what we’ve accomplished so far and, as we look ahead, I’m excited for the ways we can help consumers that are yet to come. With our focus on consumers and our ability to listen and innovate, I believe we’ve just scratched the surface in terms of our capacity to help bring financial power to all. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Analysis completed using FICO® Score 8 with Experian data. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

At Experian, we are proud to have a culture where our teammates can bring their whole selves to work. Perhaps no one exemplifies that spirit as much as our newest United for Financial Health partner, pop artist Jake Wesley Rogers. Jake is debuting a two-part Financial Glow Up video series across his social media channels to raise financial health awareness. Known for his bold style in music, fashion and expression, Jake is lauded as a queer storyteller through a universal lens and will soon take his talents on the road, as the opening act for Panic! At The Disco’s tour this fall. His new videos are a creative and intimate look inside the financial aspects of his career. He takes us along as he prepares for his upcoming tour, highlighting how managing everyday financial decisions, like using Experian Go, can empower consumers. Our partnership with Jake is the latest in a trio of new United for Financial Health partnerships focused on the LGBTQ+ community. Last month, we announced our support for Born This Way Foundation and its Channel Kindness, and we’re excited Jake is joining our efforts with another new Experian partner, True Colors United which aims to end homelessness among LGBTQ+ youth. Earlier this year, we announced a process to help transgender and non-binary consumers change their name on their Experian credit report without losing their credit and financial history. During Pride Month, our weekly Twitter #CreditChat addresses important financial topics such as Financial Tips for Same Sex Couples and the LGBTQ+ Community. To learn more about Experian’s commitment to financial empowerment for all, check out The Power of You: 2022 Diversity, Equity and Inclusion Report. You can catch the first of Jake’s new Financial Glow Up videos on his Instagram and TikTok, and by searching #JWRExperian on those channels.

test