At A Glance

At a Glance When an unknown printer took a galley of type and scrambled it to make a type 2ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release

On July 16, the CFPB published its “first ever” monthly report providing a snapshot of complaints filed by consumers through the agency’s complaint portal. For full disclosure, Experian is one of the top three companies that received the most complaints from February through April 2015. But that is absolutely deceiving.

Financier Worldwide moderates a discussion on improving decision-making and increasing value using Big Data analytics between Shanji Xiong at Experian DataLabs, Ken Elliott at HP and Shaheen Dil at Protiviti. FW: To what extent are you seeing an increased demand for Big Data analytics in today’s business environment? What overarching advantages does it offer to companies? Dil: Many organisations have made fundamental investments in Big Data infrastructures and capabilities and are now actively exploring the best ways to achieve return on these investments.

Federal and local governments around the world are expected to spend $475.5 billion on technology products and services by 2019. From New York to Chicago to Rio de Janeiro, metropolitan centers around the world are looking for new ways to be “smart” – to become more sustainable, improve the efficiency of public services and citizens’ quality of life. Forward-thinking civic and business leaders are experimenting with massive amounts of data – and the tools and technologies to compile and examine it – in order to improve how efficiently and effectively cities are managed.

In 2014, sports analytics was a $125 million market. By 2021, its value is expected to balloon to $4.7 billion. But this market wasn’t always so lucrative or widely accepted.

Back in 2002, the Oakland Athletics General Manager Billy Beane earned a trip to the Major League Baseball playoffs despite having a payroll of just over $40 million — $80 million less than major market teams like the New York Yankees. The key to the A’s success? Not just their scouts’ intuition, but sabermetric principles and rigorous – though at the time, overlooked – statistical analysis.

In 2014, sports analytics was a $125 million market. By 2021, its value is expected to balloon to $4.7 billion. But this market wasn’t always so lucrative or widely accepted.

Back in 2002, the Oakland Athletics General Manager Billy Beane earned a trip to the Major League Baseball playoffs despite having a payroll of just over $40 million — $80 million less than major market teams like the New York Yankees. The key to the A’s success? Not just their scouts’ intuition, but sabermetric principles and rigorous – though at the time, overlooked – statistical analysis.

Our world today runs on data. It’s changing the way we browse the Internet, run our businesses, treat medical patients and invest in technology. It’s the key to solving society’s biggest problems: famine, disease, poverty and ineffective education. And it is powering the global economy.

But the data-driven economy is at a crossroads. With the eruption of information, we also open ourselves up to new risks and privacy concerns. As companies adopt more interconnected products and systems, the “Internet of Things” could usher in the next wave of challenges that range from data breaches to other potential privacy concerns if information is used improperly. As a society, we must decide whether to champion the explosion of connected information or allow its detractors to significantly constrain the innovation and growth ahead.

Our world today runs on data. It’s changing the way we browse the Internet, run our businesses, treat medical patients and invest in technology. It’s the key to solving society’s biggest problems: famine, disease, poverty and ineffective education. And it is powering the global economy.

But the data-driven economy is at a crossroads. With the eruption of information, we also open ourselves up to new risks and privacy concerns. As companies adopt more interconnected products and systems, the “Internet of Things” could usher in the next wave of challenges that range from data breaches to other potential privacy concerns if information is used improperly. As a society, we must decide whether to champion the explosion of connected information or allow its detractors to significantly constrain the innovation and growth ahead.

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Erin Lowry, the founder of Broke Millennial, gives her perspective on millennials and credit using Experian data.

Experian Marketing Services unveiled a new, more predictive and addressable Experian Marketing Suite at its 2015 Client Summit in Las Vegas, Nev.

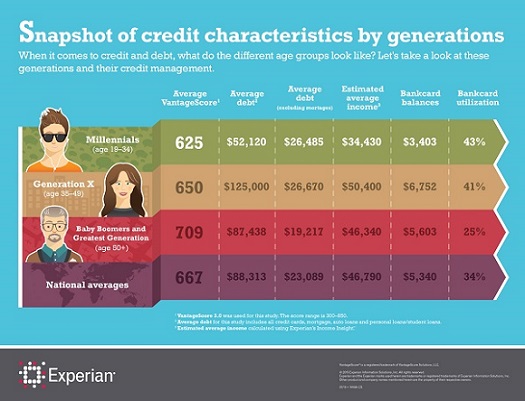

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

In the video and presentation, Craig Boundy, CEO of Experian North America, discusses how big data is being used as a force for good. Good for consumers, good for business and good for society.He shares his perspective how Experian’s work in data and analytics has real-life applications.

Addressing the issue of identity management has become a top priority for marketers. The fact is that their customers are represented by dozens of identities – both known and unknown – in today’s digital world. According to new research published in our recently published 2015 Digital Marketer Report, linking identity data is now the #1 challenge for marketers around the world, up from fourth place just a year ago. Further, 89% of marketers report having challenges creating a single customer view.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.