Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Experian had the honor of celebrating innovative achievements in marketing with a few of our superstar clients at the 2016 Marketing&Tech Innovation Awards presented by Direct Marketing News and The Hub. The second annual awards program honors achievements in marketing leveraging data and technology. Three Experian Marketing Services’ client programs were recognized for their innovation in analytics, email marketing and omnichannel marketing.

Experian identified e-commerce fraud attacks across the United States for both shipping and billing locations among all states and ZIP Codes.

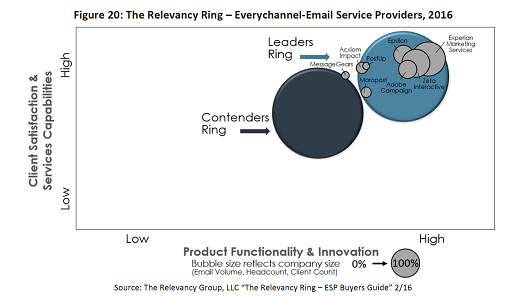

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

The Experian Marketing Suite is recognized by The Relevancy Group for its innovative technology and functionality, offline and addressable TV solutions for marketers.

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

This Forbes business story about how the Experian DataLabs was established illustrates the innovation and entrepreneurial spirit that is alive and well at Experian today.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

TMCnet’s premium technology blog, TechZone360 featured a byline article by Eric Haller, Executive Vice President of Experian DataLabs about the growing demand for data scientists. According to Haller, because data science is in its infancy, there’s tremendous room for innovation.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

The American economy rises and falls on the successes of the small business community. As a major contributor to job growth, as well as innovation, small businesses have laid the foundation toward our country’s economic success. But as important as small businesses are to financial progress of our economy, some business owners have experienced their own growth challenges along the way.

Click here to listen to the interview in SoundCloud. This Bloomberg Business Radio interview with Eric Haller, executive vice president of Experian DataLabs, covers Experian’s innovative approach to using big data and social media to help small businesses with credit verification.