Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

This Q&A interview that appeared on Monster.com with Dr. Shanji Xiong, Experian DataLab’s global chief scientist, discusses his career and provides advice for data scientist hopefuls.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

Good data is a critical part of building a robust business strategy. Organizations use actionable data insight to improve the customer experience, drive operational efficiencies, leverage cost savings, and enhance the bottom line. In fact, the majority of sales decisions are expected to be driven by customer data by 2020.

New findings from Experian show that Cyber Monday retained its rank as the top email volume and transaction day.

2,500 university students across 16 cities have been trained by Experian's experts and young volunteers of the social responsibility project ‘Manage Your Future Now’ project. The project, which was launched by Experian to promote self-improvement among university students, female entrepreneurs, and SMEs, reached the milestone in December and the achievement was celebrated at a recent event at the Experian office in Turkey. Coming from 10 cities across the country, 42 participants gathered to share their experiences. Feedback was positive with everyone agreeing that the project has been beneficial in increasing awareness of social responsibility. The participants were presented with a certificate for their commitment and contribution to the project. ‘Manage Your Future Now’ is a partnership between Experian, the United Nations Development Program and the Habitat Association/Center and Credit Bureau. The initiative includes providing training on financial risks, responsible borrowing, financial management and the efficient management of relationships with banks and the financial sector. Didem Köprücü, Human Resources Manager for Turkey and the Middle East at Experian, said: “We are proud that more people are benefiting under the ‘Manage Your Future Now’ project. Our training is improving every year and I would like to thank all the volunteers and young trainers for their valuable contribution. “The third stage of our project in 2016 will cover financial risk management, as well as financial opportunities for entrepreneur candidates. For this stage of the project we plan to reach 3,000 students and entrepreneur candidates across 26 cities. “However, we intend to continue our project, reaching more people every year.” The project aims to reach 3,000 students by the end of March 2016.

The Relevancy Group’s The Marketer Quarterly recognized Experian’s contributions to outstanding email marketing campaigns

This article published in CIO Review magazine by Eric Haller, executive vice-president of Experian’s global DataLabs, discusses the science behind Big Data and how it can be used as a force for good.

This article published in CIO Review magazine by Eric Haller, executive vice-president of Experian’s global DataLabs, discusses the science behind Big Data and how it can be used as a force for good.

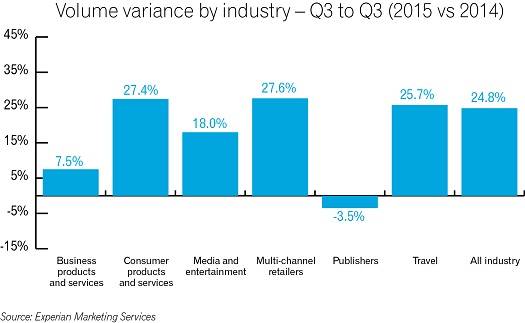

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Experian data shows U.S. consumers are more confident managing their credit card debt since recession as Q3 2015 reaches highest level since 2009

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.