Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

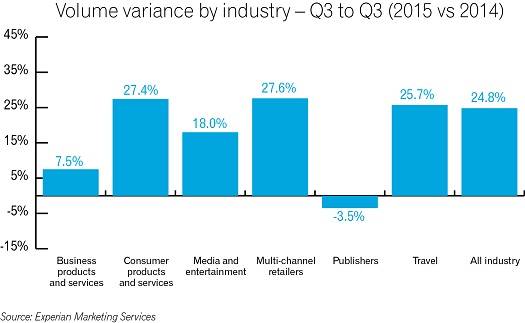

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Email volume during Q3 2015 and the 2015 holiday season is up 25 percent over 2014

Experian data shows U.S. consumers are more confident managing their credit card debt since recession as Q3 2015 reaches highest level since 2009

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

Environmentally friendly, lower fuel costs and tax incentives. These are all words that describe alternative-powered vehicles, and serve as reasons why many car shoppers flocked to their local dealerships over the past several years with the intent of “going green” with their next vehicle. However, that trend seems to be fading into the past.

By all accounts, the national housing market in the US stabilized with a recent report showing year-over-year growth at 6.8 percent for October 2015. However, while interest rates remain near all-time lows, it’s estimated that millions of Americans are unable to take advantage of this opportunity because they are unscoreable using the current credit score model mandated by Fannie Mae and Freddie Mac (“the GSEs”).

Under their current guidelines, the GSEs require mortgage lenders to use an older version of a consumer’s FICO credit score when assessing their credit risk. This model is based on data from 1995 to 2000 and unnecessarily excludes millions of qualified borrowers. For instance, VantageScore 3.0 allows for the scoring of 30–35 million more people that are currently un-scoreable under the legacy credit score model.

By all accounts, the national housing market in the US stabilized with a recent report showing year-over-year growth at 6.8 percent for October 2015. However, while interest rates remain near all-time lows, it’s estimated that millions of Americans are unable to take advantage of this opportunity because they are unscoreable using the current credit score model mandated by Fannie Mae and Freddie Mac (“the GSEs”).

Under their current guidelines, the GSEs require mortgage lenders to use an older version of a consumer’s FICO credit score when assessing their credit risk. This model is based on data from 1995 to 2000 and unnecessarily excludes millions of qualified borrowers. For instance, VantageScore 3.0 allows for the scoring of 30–35 million more people that are currently un-scoreable under the legacy credit score model.

As data breaches become more prevalent, companies must try to stay ahead of the curve and be prepared to respond to any kind of security incident. In an effort to provide a glimpse into what 2016 could bring, Experian Data Breach Resolution released its third annual Data Breach Industry Forecast white paper.

The following interview was conducted by William Vorhies and featured on Data Science Central. Q: What work does a data scientist do and what knowledge do they need? A: 90% of the data in the world has been created in the last two years. Data Scientists retrieve, sift, analyze, process, and store all the data according to business or consumer needs. Simply put, Data Scientists convert the collected and analyzed data into business intelligence. Thus, there are multiple attributes a Data Scientist should have. Not only should they have technical expertise and coding capabilities, but they should also have good intuition and communication skills.

The following article was written by Kassandra Kurth, Director of Strategic Initiatives for Experian Health, and featured in Executive Insight: Telemedicine has transformed the healthcare industry. From rural America, where in-person doctor visits are difficult, to the farthest reaches of the globe, internet technology allows doctors to visit the sick, diagnose illness, prescribe medicine and even perform surgery without ever actually touching a patient. The recent focus of healthcare automation for providers has been on electronic clinical documentation, but providers also have opportunities to automate revenue cycle functions.

Through Experian’s long-standing partnership with the UCI Paul Merage School of Business, I had the pleasure of participating recently in UCI’s Distinguished Speaker Series. I spoke about the role big data plays in today’s economy, and how data is being used as a force for good. My message to the 300+ attendees was clear – big data is everyone’s business. And it’s only going to get bigger. We have 90% more data today than we had just 2 years ago. What will happen in the next 2 years, much less the next 10? As big data gets bigger, how can we use it in even better ways, as a much greater force for good in society? Where we’re headed In the next decade, I predict that: Every single industry – from food service to entertainment to technology to retail – will be using big data in some way. We’re moving quickly in that direction already. A recent Gartner survey found that three-quarters of companies plan to invest in big data over the next 2 years. We’ll be using big data to cure big diseases. I believe we can fully cure cancer and HIV, among others, if we can tap into new insights from wearable technologies and genetic mapping, and put all that data to good use. Big data will help our economy improve. The presidential candidates may argue about the best way to create jobs and increase wealth, but any way you look at it, big data has to be a part of it. The more we can capture trend data on spending patterns and investment returns, the more we can be smart about where we spend our tax dollars, and even how we manage our personal finances. In other words, big data is going to become the backbone of society in ways we least expect today. Sometime in the future, when you go to a museum or an art gallery, big data will make your experience more personal, more customized, and more relevant to your interests. We’re starting to see hints of this now. Think of how you might receive coupons on your phone for cheaper drinks at the ballpark food counter, because your phone realized you were at the game. “But I think we’re going to take this to an even higher level.” Imagine if we could add virtual reality to your experience – so that, when you walk into an art museum, your phone generates a hologram of your favorite artist. Overall, you’ll be getting a lot more value out of your everyday experiences. Some of the best uses of big data will be in the public sector, an area we’re already achieving significant benefits. Right now, big data is helping to improve public services, transportation and land use. Of particular interest these days, big data is helping to protect public safety in large crowds. And it’s helping people at hospitals figure out how to pay for their care, and pinpointing the most cost-effective payment plans. I think opportunities for big data will continue to expand within the public sector. How we get there But this will only happen if we take the right steps now: We all need to keep learning. This is the message I emphasized with the audience at UCI. No matter where you are in your career, it can only help to sharpen your skills in data and insights analysis. There’s more to discover, every day. Develop policies that encourage data-sharing. We can only benefit from big data if we make it easy for companies and governments to exchange the type of information that will ultimately make our world better. We have a tremendous responsibility to help implement policies that support that goal. Look beyond the obvious. Keep thinking of new sources of data and new applications for it. We’ll all benefit from thinking creatively. That’s the focus we’ve been taking at Experian. One example is our DataLabs, where we are using breakthrough experiments to take risks, so we can do good things with data on behalf of our clients. And we think the world will be better in the long run because of it. Watch these video excerpts from this event: Using Big Data For So Much More How is Big Data Helping Entrepreneurs Big Data Hurdles ### Craig Boundy is the CEO of Experian North America

In a recent report, the Consumer Financial Protection Bureau (CFPB) estimated that there are more than 45 million American consumers that are “credit invisible,” meaning that they either have no credit history or a credit file too thin to receive access to mainstream credit products.

This limits their ability to get an affordable loan for a car, realize the dream of homeownership or even restricts access to capital to start a small business. More frequently, a lack of credit history forces consumers to turn to more expensive, short term lending options.

While credit invisibles may not have a traditional credit history, many make their cable, utility and mobile phone payments on time. However, this on-time payment data is not being included in their credit file.

In a recent report, the Consumer Financial Protection Bureau (CFPB) estimated that there are more than 45 million American consumers that are “credit invisible,” meaning that they either have no credit history or a credit file too thin to receive access to mainstream credit products.

This limits their ability to get an affordable loan for a car, realize the dream of homeownership or even restricts access to capital to start a small business. More frequently, a lack of credit history forces consumers to turn to more expensive, short term lending options.

While credit invisibles may not have a traditional credit history, many make their cable, utility and mobile phone payments on time. However, this on-time payment data is not being included in their credit file.