Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Federal and local governments around the world are expected to spend $475.5 billion on technology products and services by 2019. From New York to Chicago to Rio de Janeiro, metropolitan centers around the world are looking for new ways to be “smart” – to become more sustainable, improve the efficiency of public services and citizens’ quality of life. Forward-thinking civic and business leaders are experimenting with massive amounts of data – and the tools and technologies to compile and examine it – in order to improve how efficiently and effectively cities are managed.

In 2014, sports analytics was a $125 million market. By 2021, its value is expected to balloon to $4.7 billion. But this market wasn’t always so lucrative or widely accepted.

Back in 2002, the Oakland Athletics General Manager Billy Beane earned a trip to the Major League Baseball playoffs despite having a payroll of just over $40 million — $80 million less than major market teams like the New York Yankees. The key to the A’s success? Not just their scouts’ intuition, but sabermetric principles and rigorous – though at the time, overlooked – statistical analysis.

In 2014, sports analytics was a $125 million market. By 2021, its value is expected to balloon to $4.7 billion. But this market wasn’t always so lucrative or widely accepted.

Back in 2002, the Oakland Athletics General Manager Billy Beane earned a trip to the Major League Baseball playoffs despite having a payroll of just over $40 million — $80 million less than major market teams like the New York Yankees. The key to the A’s success? Not just their scouts’ intuition, but sabermetric principles and rigorous – though at the time, overlooked – statistical analysis.

Our world today runs on data. It’s changing the way we browse the Internet, run our businesses, treat medical patients and invest in technology. It’s the key to solving society’s biggest problems: famine, disease, poverty and ineffective education. And it is powering the global economy.

But the data-driven economy is at a crossroads. With the eruption of information, we also open ourselves up to new risks and privacy concerns. As companies adopt more interconnected products and systems, the “Internet of Things” could usher in the next wave of challenges that range from data breaches to other potential privacy concerns if information is used improperly. As a society, we must decide whether to champion the explosion of connected information or allow its detractors to significantly constrain the innovation and growth ahead.

Our world today runs on data. It’s changing the way we browse the Internet, run our businesses, treat medical patients and invest in technology. It’s the key to solving society’s biggest problems: famine, disease, poverty and ineffective education. And it is powering the global economy.

But the data-driven economy is at a crossroads. With the eruption of information, we also open ourselves up to new risks and privacy concerns. As companies adopt more interconnected products and systems, the “Internet of Things” could usher in the next wave of challenges that range from data breaches to other potential privacy concerns if information is used improperly. As a society, we must decide whether to champion the explosion of connected information or allow its detractors to significantly constrain the innovation and growth ahead.

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Erin Lowry, the founder of Broke Millennial, gives her perspective on millennials and credit using Experian data.

Experian Marketing Services unveiled a new, more predictive and addressable Experian Marketing Suite at its 2015 Client Summit in Las Vegas, Nev.

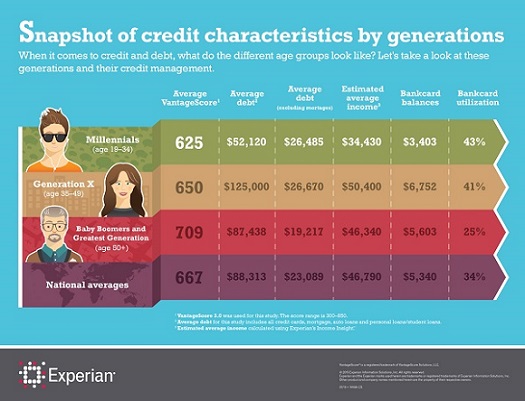

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

In the video and presentation, Craig Boundy, CEO of Experian North America, discusses how big data is being used as a force for good. Good for consumers, good for business and good for society.He shares his perspective how Experian’s work in data and analytics has real-life applications.

Addressing the issue of identity management has become a top priority for marketers. The fact is that their customers are represented by dozens of identities – both known and unknown – in today’s digital world. According to new research published in our recently published 2015 Digital Marketer Report, linking identity data is now the #1 challenge for marketers around the world, up from fourth place just a year ago. Further, 89% of marketers report having challenges creating a single customer view.