Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

![A Glimpse at the Largest Metropolitan Areas’ State of Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

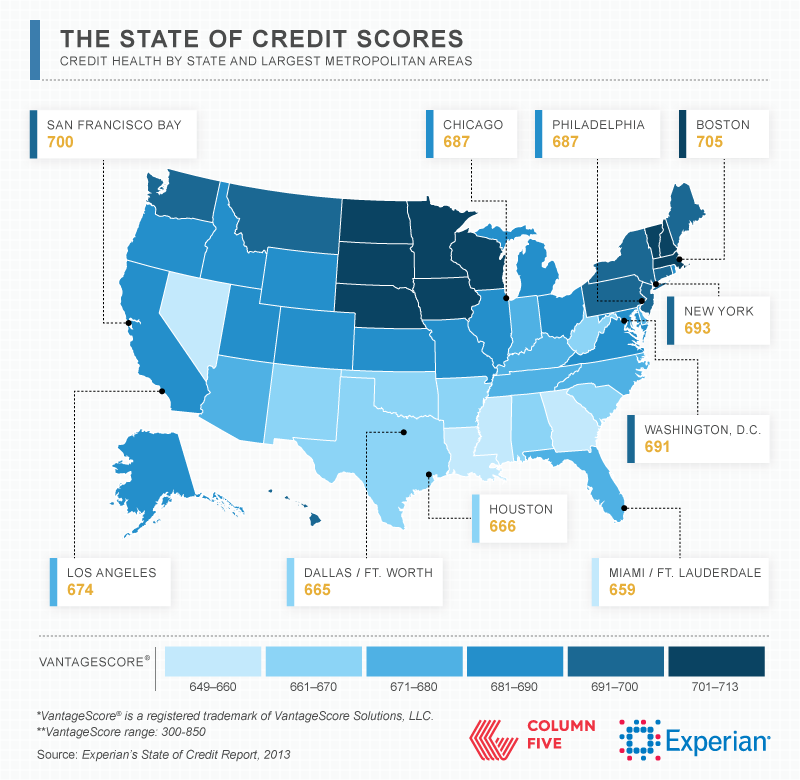

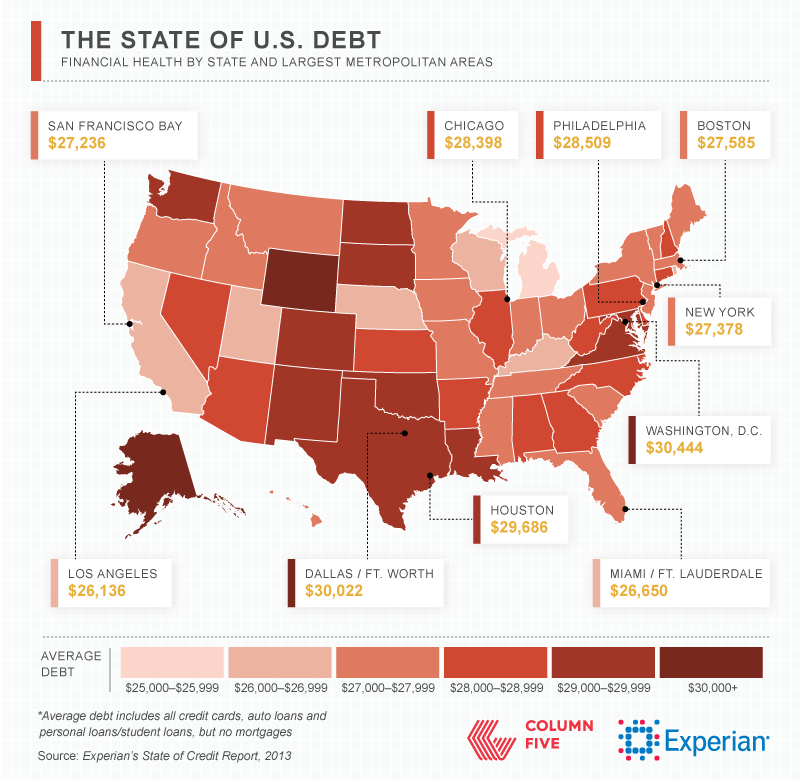

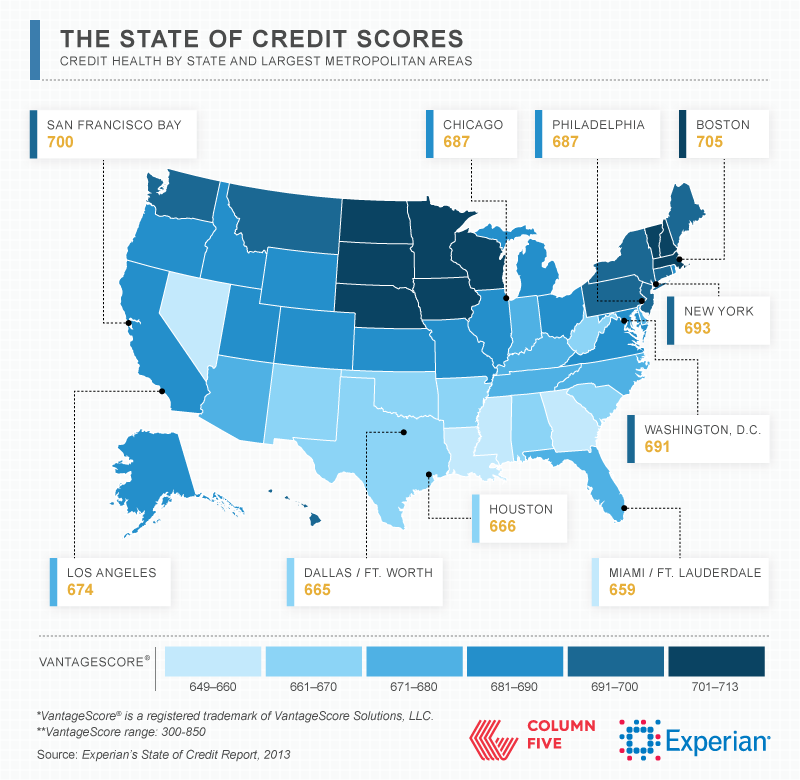

Experian’s fourth annual State of Credit features nationwide data on how four different generations are managing their debts. To provide a more detailed picture of how the nation is faring, we also analyzed over 100 Metropolitan Statistical Areas (MSAs).

Below are two snapshots of average credit scores and debt for the largest metropolitan areas. This study is an opportunity for consumers to better understand how credit works so they can make more informed financial decisions and live credit smart even in the face of national economic challenges. View our interactive map to learn more.

![Average Debt in Largest Metropolitan Areas [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

A glimpse at average debt in the largest metropolitan areas …

View interactive map: Experian’s Fourth Annual State of Credit Report

View interactive map: Experian’s Fourth Annual State of Credit Report

![Credit Scores in Largest Metropolitan Areas [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

A glimpse at credit scores in the largest metropolitan areas …

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

View our interactive map: Experian’s Fourth Annual State of Credit Reportf Credit, 2013

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

Do you want to buy gifts for friends and family this holiday season?

Check out these great holiday shopping tips from some of our favorite personal finance writers:

1. Think experience over tangible items

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December – so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

Stay sane. I’m not kidding. It’s so easy to lose control and get wrapped up in the feeling of needing everything. Back up and question each purchase. Especially gifts. By March, very few people even remember what they got in December – so is it worth overspending for? Think experience over tangible items. If you’re going to drop some cash, do a party or a trip. That’s what people recall and often value.

Right now I’m big into Groupon. I love the goods and getaways Amazing deals!

Erica Sandberg is one of the nation’s foremost personal finance authorities. She is editor at large for the Bankrate Inc.‘s subsidiary Credit Card Guide and a columnist and reporter for CreditCards.com

This guest post is by Gail Cunningham, Vice President of Membership and Public Relations.

Experian’s recent State of Credit Study revealed that The Greatest Generation has something else to brag about: responsibly managing credit. And that’s no small achievement considering that some of these folks have 50 or more years of credit history under their belt. That’s a lot of on-time payments. If you fall into the 65+ age bracket, congratulations! You’ve done a lot right. Now let’s keep a good thing going. Here are some tips to help you stay financially healthy moving forward:

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

This guest post is from Ted Jenkin, CFP®. Ted is co-CEO of oXYGen Financial and is a top ranked personal finance blogger (www.yoursmartmoneymoves.com). He is a regular contributor to Investment News, The Wall Street Journal, and The Atlanta Journal Constitution.

It’s official. For years and years everyone has labeled my generation (Generation X) the slacker generation. We were the ones that really started on the video game revolution with games like Pong and Atari and now we have relegated ourselves to worst in class when it comes to overall debt.

Underscoring Experian’s goal to help consumers and be an advocate for credit education, the National Foundation for Credit Counseling (NFCC) awarded Victor Nichols, CEO of Experian North America, its “Making the Difference” award from their Annual Leaders Conference in Denver. This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

This prestigious award is presented to organizations that have made significant contributions to assisting consumers with financial literacy, awareness and education, furthering the NFCC’s mission, visions and programs through a national presence.

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she’s developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back — or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

This guest post from Erin Lowry. Erin is the founder of Broke Millennial, where her sarcastic sense of humor entertains and educates her peers about finances. Erin lives and works in New York City, so she’s developed quite the knack for finding deals and free events.

At the tender age of 18 I opened a letter from my bank to find my first credit card. I peeled the card off the letter and took a moment to stare in awe at this powerful little piece of plastic that suddenly offered me access to money.

This was 2007, pre-Credit CARD Act of 2009, when all a college student had to do to get a credit card was head down to the local back — or in some ghastly cases walk through vendor tables set up during orientation days. Students scribbled down their information in exchange for a free t-shirt or water bottle and gleefully received plastic cards that seemingly offered “free money.”

![State of Credit 2013 [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

The Fourth Annual State of Credit report is Experian’s comprehensive look at nationwide data to determine how four different generations are managing their debts by analyzing their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments.

Additionally, credit scores were examined in Metropolitan Statistical Areas (MSAs) to provide the 10 highest and 10 lowest credit scores in each generation across the nation. The study creates an opportunity for consumers to better understand how credit works so they can make informed financial decisions and live credit smart even in the face of national economic challenges.

Check out the full infographic.