Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

The past several years have been somewhat of an uphill climb for our country’s economy and this has impacted the default rates for consumer credit. However, now that we’re out of the recession, consumers are managing their credit back to pre-recession levels. In June 2013, the S&P/Experian Consumer Credit Default Indices, a monthly comprehensive measure of changes in consumer credit defaults, showed that default rates have fallen at a national level, as well as, in all four major buckets it tracks including, bankcard, auto, first mortgage and second mortgage. Additionally, the national composite and first mortgage defaults rates hit new post-recessions lows at 1.34 percent and 1.23 percent, respectively.

A recent study conducted by the Governing Institute and commissioned by Experian confirms that government benefit agencies can greatly improve their eligibility verification processes through automated data analytics. Historically, assorted health and human service programs have been compartmentalized, with each benefit agency having its own data collection system, eligibility requirements and program rules. The technology to streamline processing by allowing one agency to match its data against other content repositories, though available, has not been in place. The result has been frequent re-entry of information causing processing delays, slowing response time and increasing manual labor costs. These shortcomings have limited agencies’ ability to detect and combat fraud.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

![5 Tips to Avoid a Financial “Burn” On Your Summer Getaway [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

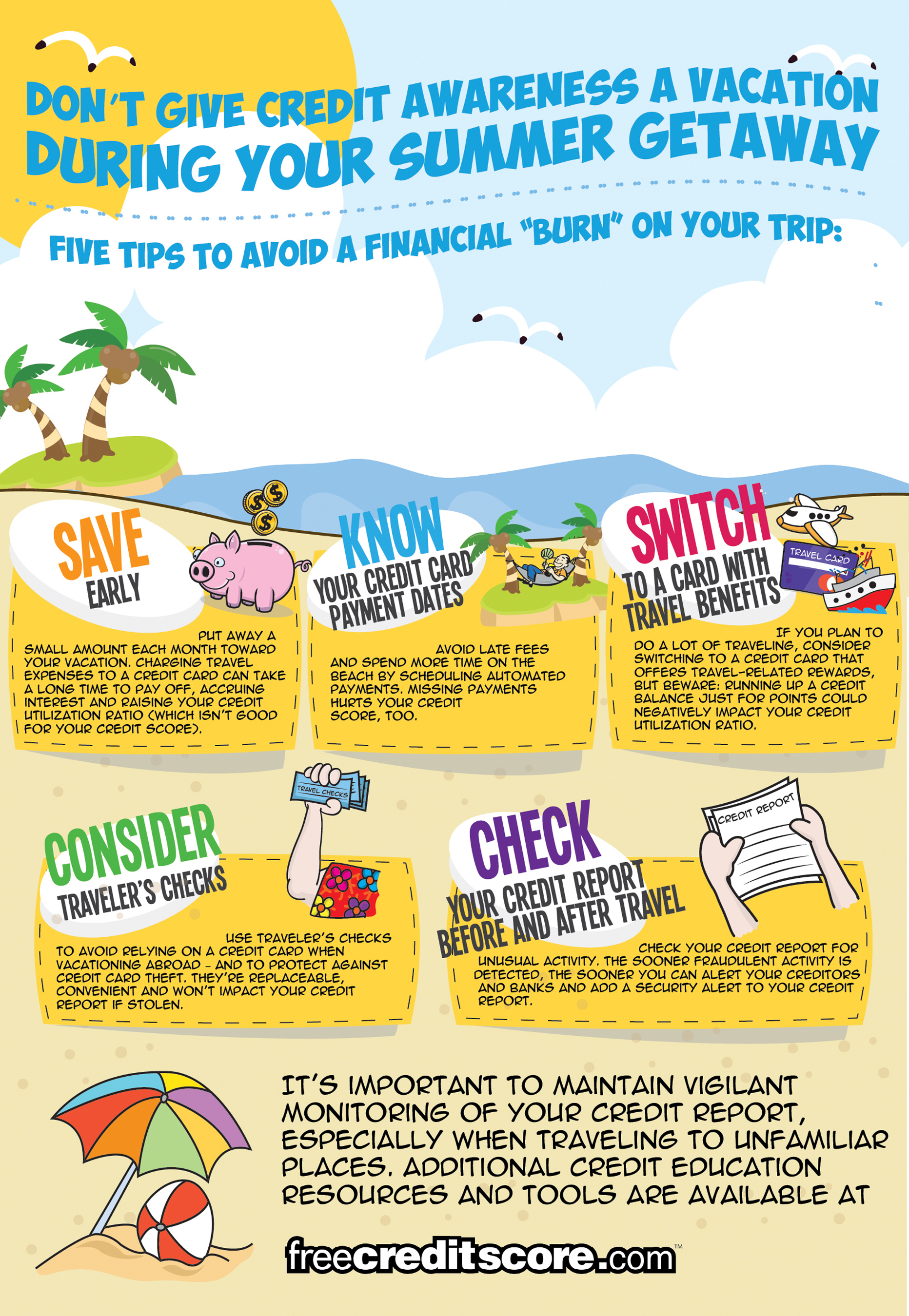

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

Further evidence of economic recovery throughout the nation, an Experian trends analysis of new mortgages and bankcards from Q1 2013 showed a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Other insights offered by Experian, include evidence of a strong rebound in the Midwest as well as unprecedented lows in bankcard delinquencies.

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Consumers are can now be notified when their personal information is being used in an authentication transaction, allowing them to assess whether or not they recognize and expect their identity to be in review by a business. The service enables consumers to respond to the notification, and in cases of potential fraud, to be directed to seamless and effective resolution assistance.