Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

![The Great Credit Divide: Men vs. Women [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

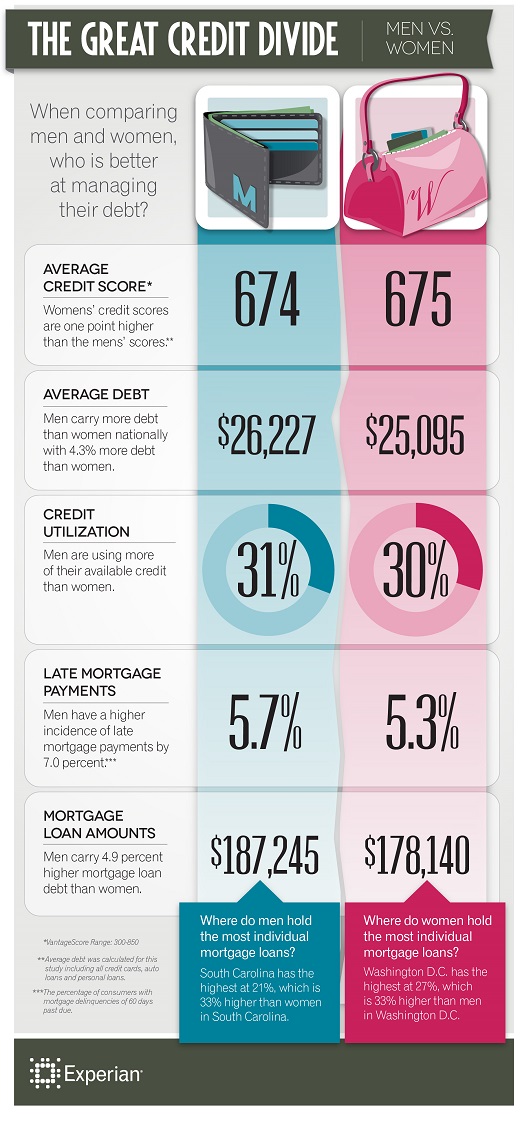

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

![Give Yourself Some Credit [Infographic]](https://stg1.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

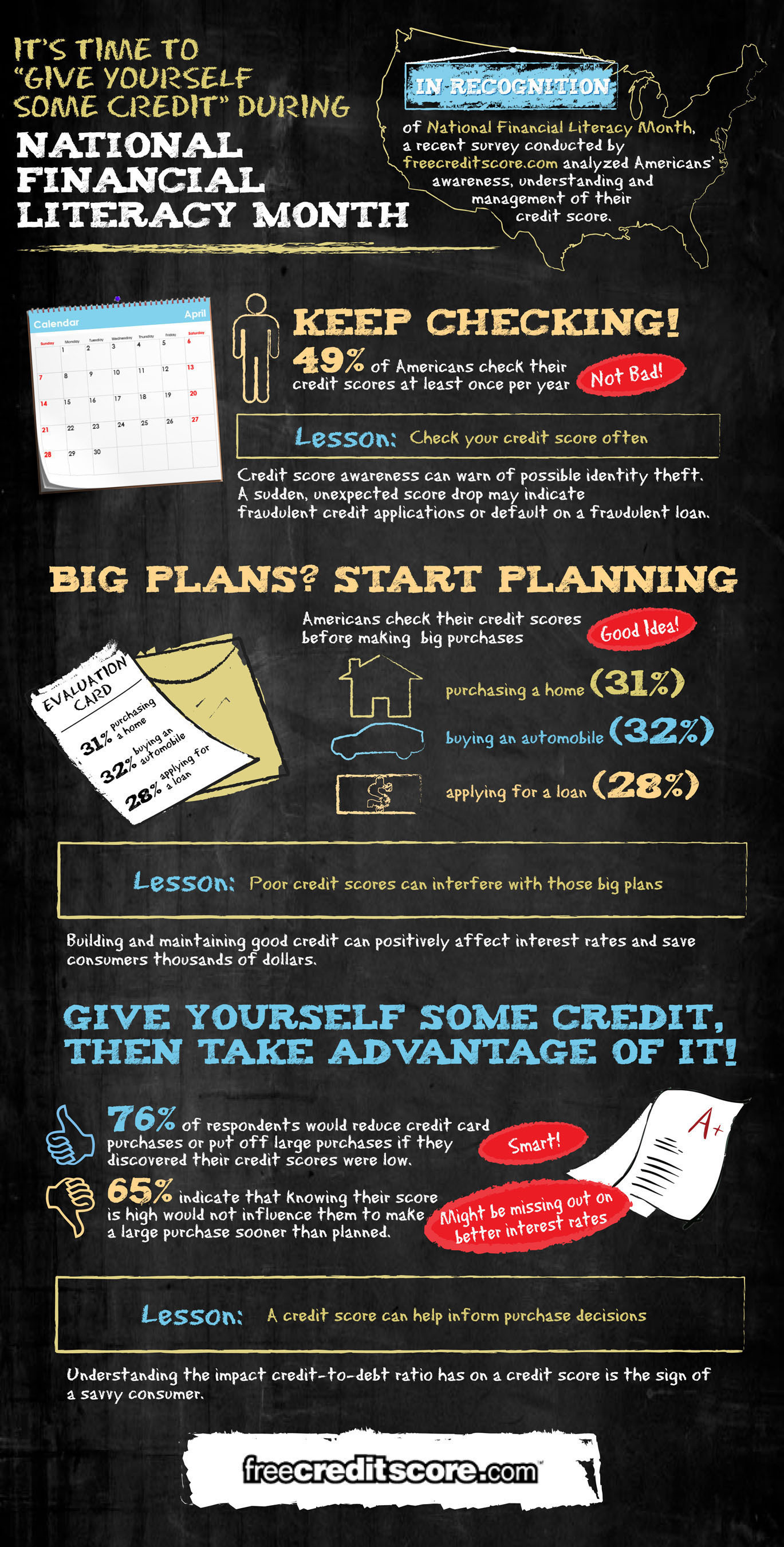

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

Experian IntelliView data is sourced from the information that supports the Experian Market Intelligence Brief reports.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?

The used car buying process can be as challenging for dealers as it is for consumers. Both parties want to make sure they are getting the best deal on a car that is safe and reliable. But how does anyone really know what they are getting?

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn’t at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it’s really a chance for a lot of these bloggers who aren’t professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren’t sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.

We had a wonderful opportunity to talk with Liz Weston (@lizweston) about saving for retirement, debt, managing credit, and much more.

Check out the full-interview:

I know you went to the FinCon blogger conference last year, how was that?

Liz Weston: Yeah, that was really a great event. There were a lot of opportunities for socializing and networking. It was pretty cool. I met Phil Taylor, who is the organizer, several years earlier. He was a participant in a savings contest that I co-hosted with FNBO bank, and really liked him. I thought it was going to be a small event, and it wasn’t at all. They had some great speakers and great information. It was really fun.

It sounds like a great event.

Liz Weston: Yeah, and it’s really a chance for a lot of these bloggers who aren’t professional journalists to brush up on their skills and meet some of the companies that they might work with. I found a lot of them were reluctant to call P.R. people and make contacts because they weren’t sure their calls were going to get returned. It’s nice for them to meet people at the various companies they can reach out to.