Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Whether you own the largest pickup or the smallest hybrid on the market, one thing remains clear – folks in the U.S. love their vehicles.

In the recently released Loyalty and Market Trends Report by Experian Automotive, we looked at several key trends that highlight who is buying what, and which auto makers received highest marks in loyalty in Q2.

Whether you own the largest pickup or the smallest hybrid on the market, one thing remains clear – folks in the U.S. love their vehicles.

In the recently released Loyalty and Market Trends Report by Experian Automotive, we looked at several key trends that highlight who is buying what, and which auto makers received highest marks in loyalty in Q2.

The Consumer Financial Protection Bureau (CFPB) has just issued its latest report to Congress on credit scores sold to consumers versus credit scores sold to creditors.

The 42-page report, which you can find here, provides an analysis of different scoring models, comparing credit scores sold to creditors and those sold to consumers by the national credit reporting agencies, including Experian.

Of particular interest, and of reassurance to consumers, are some high-level conclusions from the report:

The Consumer Financial Protection Bureau (CFPB) has just issued its latest report to Congress on credit scores sold to consumers versus credit scores sold to creditors.

The 42-page report, which you can find here, provides an analysis of different scoring models, comparing credit scores sold to creditors and those sold to consumers by the national credit reporting agencies, including Experian.

Of particular interest, and of reassurance to consumers, are some high-level conclusions from the report:

In our busy lives, it is easy to miss paying a bill.

However, your lenders won’t accept excuses for why they you didn’t pay them as you agreed to do. For example, your bankcard company cannot make excuses for being late in paying the merchants where you made your purchases. When you don’t pay, they still have to pay on your behalf.

Missed payments can have a severe impact on your credit scores. And lower credit scores will often penalize you with higher interest rates – which can end up costing you tens-of-thousands of dollars throughout your life.

So here are five strategies to help you build the best credit scores . . .

In our busy lives, it is easy to miss paying a bill.

However, your lenders won’t accept excuses for why they you didn’t pay them as you agreed to do. For example, your bankcard company cannot make excuses for being late in paying the merchants where you made your purchases. When you don’t pay, they still have to pay on your behalf.

Missed payments can have a severe impact on your credit scores. And lower credit scores will often penalize you with higher interest rates – which can end up costing you tens-of-thousands of dollars throughout your life.

So here are five strategies to help you build the best credit scores . . .

Everyone seems to be keeping a closer eye on their finances these days and more people are becoming aware of how important it is to know what your credit report looks like.

In the recently released Experian 2012 State of Credit report, we found that the national average credit score is currently 750, which is up one point from 2011.

We also crunched some numbers in more than 100 cities throughout the country and ranked the top 10 and bottom 10 cities according to credit score.

Everyone seems to be keeping a closer eye on their finances these days and more people are becoming aware of how important it is to know what your credit report looks like.

In the recently released Experian 2012 State of Credit report, we found that the national average credit score is currently 750, which is up one point from 2011.

We also crunched some numbers in more than 100 cities throughout the country and ranked the top 10 and bottom 10 cities according to credit score.

Do you love saving money?

And are you looking for even more ways to keep more money in the bank?

Experian knows the importance of this in every person’s financial health.

So, as part of our overall commitment to financial literacy and in conjunction with our just released annual State of Credit report, we contacted some of our favorite personal finance writers and asked them to share one of their favorite ways to save money.

Check out these frugal-living tips:

Do you love saving money?

And are you looking for even more ways to keep more money in the bank?

Experian knows the importance of this in every person’s financial health.

So, as part of our overall commitment to financial literacy and in conjunction with our just released annual State of Credit report, we contacted some of our favorite personal finance writers and asked them to share one of their favorite ways to save money.

Check out these frugal-living tips:

Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

Unfortunately, many people have received poor credit advice and been taken advantage from credit repair companies. Many people don’t realize that there isn’t anything that a credit repair service is able to legally do for you that you can’t do yourself for little or no expense.

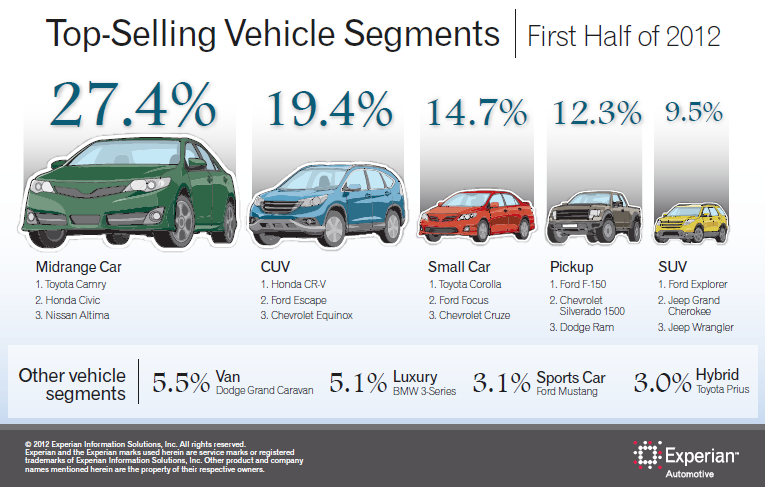

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that midrange cars were the highest-selling vehicle segment in the first half of 2012, according to its latest vehicle registration analysis.

The analysis also showed that the Toyota Camry topped the list of best-selling vehicles for the first half, with the Ford F-150 coming in a close second. In the first half of 2011, the F-150 was the best-selling vehicle, with the Camry coming in second.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Automotive today announced that loans to customers in the nonprime, subprime and deep-subprime risk tiers accounted for more than one in four new vehicle loans in Q2 2012.

Experian Marketing Services reported that email volume has increased 10% in Q2 2012 versus Q2 2011