Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

DEI

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

The Social Security Administration recently announced that in less than two months’ time, one million people have gone online, created a My Social Security account and viewed their Social Security Statement.

The Social Security Administration recently announced that in less than two months’ time, one million people have gone online, created a My Social Security account and viewed their Social Security Statement.

Experian Automotive today announced that it will offer National Motor Vehicle Title Information Systems (NMVTIS) Reports to California auto dealers, enabling them to stay in compliance with new government regulations.

Experian Automotive today announced that it will offer National Motor Vehicle Title Information Systems (NMVTIS) Reports to California auto dealers, enabling them to stay in compliance with new government regulations.

Experian Marketing Services’ Hitwise® announced today that Google accounted for 65.02 percent of all U.S. searches conducted May 2012.

Last year, Rep. Heath Shuler (D-NC) introduced the Medical Debt Resolution Act (H.R. 2086), which would amend the Fair Credit Reporting Act to require the Consumer Reporting Agencies (CRAs) to remove paid or settled medical debt from a consumers’ credit file.

Last year, Rep. Heath Shuler (D-NC) introduced the Medical Debt Resolution Act (H.R. 2086), which would amend the Fair Credit Reporting Act to require the Consumer Reporting Agencies (CRAs) to remove paid or settled medical debt from a consumers’ credit file.

Experian Automotive today announced that there were 17.3 million more light-duty vehicles seven years and older on the road in the United States than there were three years ago.

According to its Q1 2012 Vehicles in Operation (VIO) market analysis, Experian Automotive also found that there were more than 245 million vehicles on U.S. roads, and that the age of vehicles increased when compared to Q1 2011, up 1.9 percent to an average age of 11 years.

Experian Automotive today announced that there were 17.3 million more light-duty vehicles seven years and older on the road in the United States than there were three years ago.

According to its Q1 2012 Vehicles in Operation (VIO) market analysis, Experian Automotive also found that there were more than 245 million vehicles on U.S. roads, and that the age of vehicles increased when compared to Q1 2011, up 1.9 percent to an average age of 11 years.

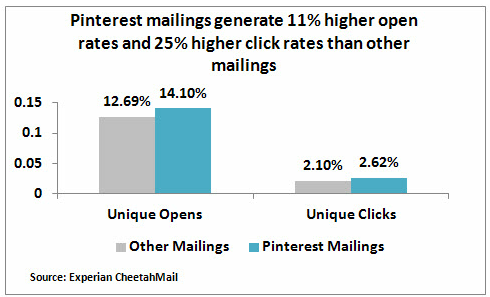

Experian Marketing Services’ CheetahMail® developed a new Pinterest email functionality late last year that has produced significantly higher both open and click rates for emails with the functionality, while also enabling retailers’ products to go viral. Several retailers, including Ballard Designs, have seen significant increases in click-to-open rates, Pinterest followers and pinboard activity by incorporating the capability into their email campaigns.

Theyyyy’re baaack! They once graced American televisions singing witty lyrics about their personal credit woes while waiting tables in pirate costumes, living out of the in-laws’ basement and getting snubbed by women because of their lackluster car. Now, after a two-year hiatus, The Original Band is back by popular demand.

Theyyyy’re baaack! They once graced American televisions singing witty lyrics about their personal credit woes while waiting tables in pirate costumes, living out of the in-laws’ basement and getting snubbed by women because of their lackluster car. Now, after a two-year hiatus, The Original Band is back by popular demand.

Experian Marketing Services, a leading provider of data, analytics and marketing technologies, today announced an expanded relationship with Adrea Rubin Marketing, Inc., the life and health insurance marketing leader. This relationship makes Adrea Rubin Marketing a preferred provider of Experian Marketing Services’ ChoiceScore to the life and health insurance vertical.

Experian Marketing Services, a leading provider of data, analytics and marketing technologies, today announced an expanded relationship with Adrea Rubin Marketing, Inc., the life and health insurance marketing leader. This relationship makes Adrea Rubin Marketing a preferred provider of Experian Marketing Services’ ChoiceScore to the life and health insurance vertical.

Did you know that there are 64 million people in the United States that have little or no traditional credit history?

These people are typically referred to as underbanked or underserved consumers and Experian just announced Extended View Score that can help these consumers gain access to credit products and services, which can lead them down the path of building a fuller credit history.

Did you know that there are 64 million people in the United States that have little or no traditional credit history?

These people are typically referred to as underbanked or underserved consumers and Experian just announced Extended View Score that can help these consumers gain access to credit products and services, which can lead them down the path of building a fuller credit history.