Erin Lowry, the founder of Broke Millennial, gives her perspective on millennials and credit using Experian data.

Experian Marketing Services unveiled a new, more predictive and addressable Experian Marketing Suite at its 2015 Client Summit in Las Vegas, Nev.

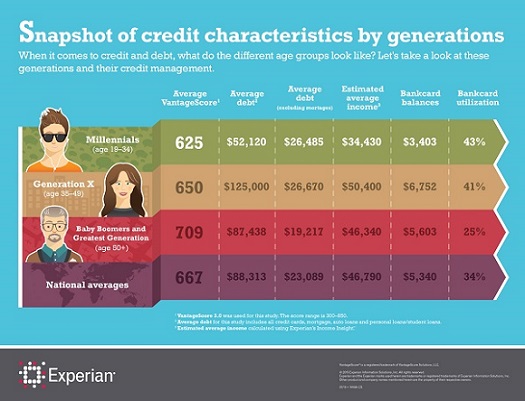

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

In the video and presentation, Craig Boundy, CEO of Experian North America, discusses how big data is being used as a force for good. Good for consumers, good for business and good for society.He shares his perspective how Experian’s work in data and analytics has real-life applications.

Addressing the issue of identity management has become a top priority for marketers. The fact is that their customers are represented by dozens of identities – both known and unknown – in today’s digital world. According to new research published in our recently published 2015 Digital Marketer Report, linking identity data is now the #1 challenge for marketers around the world, up from fourth place just a year ago. Further, 89% of marketers report having challenges creating a single customer view.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.