At A Glance

At a Glance When an unknown printer took a galley of type and scrambled it to make a type 2ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release ince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the releaseince the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release

Generative A.I. is rapidly transforming every industry as we know it and introduces a whole new world of opportunity and risk. At Experian, we already have many years of experience in machine learning, neural network embedding and artificial intelligence. Because of this, we’re established as a trusted leader in the space and are uniquely positioned to champion the ethical, responsible and compliant use of generative A.I. We manage the risk while advancing the opportunity. This was one of the key themes emerging from a recent panel discussion for Bloomberg’s Intelligent Automation Event in London that I participated in with Thomas Duecke, COO, Digital at BT Group, Marc Palmer, CTO at T-Systems and Amy Thomson, Bloomberg’s EMEA Technology Team Leader. At Experian, we support the responsible use of generative A.I. to accelerate new product offerings, drive operational productivity, increase financial inclusion, and foster an adaptive approach to using the technology. I’m personally very passionate about this as my team is dedicated to creating innovative solutions that enable clients to better automate processes across a variety of use cases including fraud prevention, lending and process optimization. We’re always looking for new data-driven solutions that can create meaningful change for consumers around the world. That’s why our teams are focused on advancements through generative A.I. and identifying use cases across many aspects of our internal operations as well as within our customer-facing portfolio of products and services. We’re encouraged by the opportunities generative A.I. can facilitate when it comes to productivity. It can allow us to automate processes that are mundane or labor-intensive and enable employees to focus more of their time and energy on creative decision making, problem solving, and more effective collaboration. We’ll continue to leverage our expertise and knowledge in broader intelligence fields to uncover the opportunities this next chapter will provide for our business, clients and consumers. Bloomberg Intelligent Automation

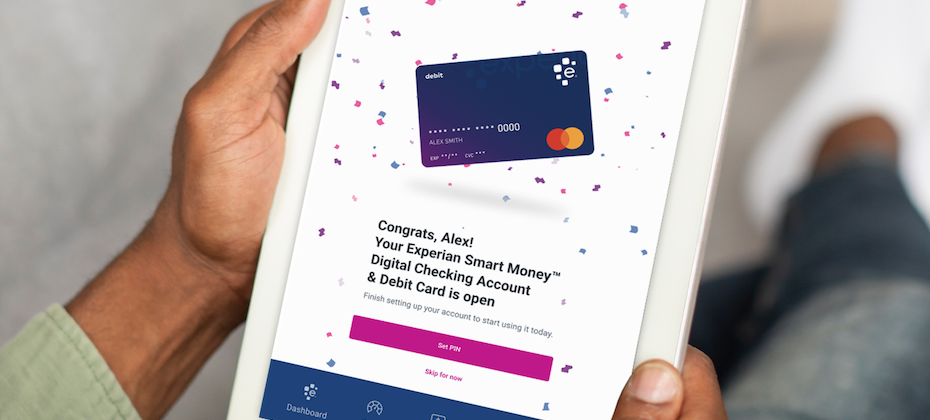

Our mission at Experian Consumer Services to achieve Financial Power for All™ drives our purpose and innovation. As part of this focus, we aim to help the more than 28 million1 consumers who are considered “credit invisible” with no or little credit history to gain fair and affordable access to credit. Continuing in our commitment to financially empower consumers, we are excited to announce today the launch of the Experian Smart Money™ Digital Checking Account & Debit Card2. What makes the Experian Smart Money Account unique is that it takes one of our most successful features ever in Experian Boost®3 to a new level of ease by embedding the feature in our new digital checking account. Experian Boost is a free game-changing feature launched in 2019 that allows consumers to contribute positive payments for eligible bills such as utilities and residential rent to their Experian® credit reports to potentially increase their credit scores. More than 14 million consumers have already connected to Experian Boost – via their existing checking account or credit card – with an average FICO® Score 84 increase of 13 points, among those who saw an increase. Now, the Experian Smart Money Account will drive efficiencies for consumers by allowing them to build credit more easily without debt and manage their day-to-day finances in one place. Helping consumers along their financial journeyWe understand that every consumer has different needs when it comes to their finances. When consumers engage with Experian, they can tap into many resources such as Experian Go™, which allows consumers to directly establish an Experian credit file for the first time and take off on their credit journey. For consumers who already have a credit profile and are looking to build their credit history and potentially increase their credit scores, they can leverage Experian Boost to contribute eligible payment history to their Experian credit file. Now with the Experian Smart Money Account, Experian is building upon these innovations and creating an even more robust credit and financial hub beneficial for various life stages. In fact, being credit visible and establishing a good credit score is essential for achieving many goals like moving into a new home, buying a car or securing employment. The positive impact we can have on consumers’ financial lives is what motivates us every day to create products and tools like the Experian Smart Money Account. Making ‘smart’ money movesWhile Experian is entering a different category of services, offering a digital checking account is a natural next step for us to help consumers reach their financial goals. The Experian Smart Money Account could most benefit consumers who are looking to build their credit profile. So, we believe our credit-building power makes this offering a positive complement to other financial products and services in the market. The Experian Smart Money™ Account accelerates, supports, and enriches consumer choice to build credit responsibly, which has a direct impact on the growth of credit-eligible populations. It benefits both consumers and broader financial institutions, and we are dedicated to playing a special role in the financial ecosystem helping consumers leverage debit and credit to their advantage. For more information about Experian Smart Money™ Account, visit www.experian.com/smartmoney. 1 Financial Inclusion and Access to Credit by Experian and Oliver Wyman, October 2021 2 The Experian Smart Money Debit Card™ is issued by Community Federal Savings Bank (CFSB), pursuant to a license from Mastercard International. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. 3 Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. 4 Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

You may have recently read that Experian®, alongside the other two credit bureaus, permanently extended free weekly access to consumer credit reports through AnnualCreditReport.com. While I believe the move helps consumers more regularly review their credit reports, it only begins to scratch the surface of how we empower consumers to take control of their financial lives. People come to Experian looking for ways to improve their financial health. We have direct relationships with millions of consumers and listen to their wants and needs. That’s why we’ve transformed ourselves into the one stop shop for our members to address many facets of their financial journey. Whether it’s accessing credit education materials, monitoring their credit files, finding ways to save money or improving their credit history, consumers can come to Experian to find the tools and resources they need. Building creditFor instance, in 2019, we launched Experian Boost® –a first-of-its-kind feature that allows consumers to contribute positive payment information for eligible bills including utilities, telecom and even video streaming services, directly into their Experian credit file. Consumers can now also add positive residential rent payments through Experian Boost®1. More recently, we debuted Experian Go™—another first-of-its-kind feature designed to help “credit invisibles,” or people with no credit history, begin building credit. Credit invisibles who utilize the feature together with Experian Boost can establish an authenticated Experian credit report, tradelines and a credit history and, as a result, get access to financial offers. Staying on top of your informationBeyond our credit building offerings, we’ve long provided consumers the opportunity to access their Experian credit report and FICO® Score2, free-of-charge. By providing consumers access to their credit report and FICO® Score, we’re enabling them to better understand how they may look to lenders, identify potential fraud, determine the specific factors that are affecting their credit and how to improve it. In addition, our credit and dark web monitoring services help consumers detect whether their personal information is potentially available to fraudsters and protect against identity theft. Putting money back into your walletWe also recognize the value of saving money. As part of an Experian membership, we offer resources that can potentially help consumers save on the cost of their auto insurance and find the best credit card for their financial needs. We empower consumers to: Compare auto insurance policies. Consumers can comparison shop to potentially find a better rate on their current policy and save. The free Experian service delivers multiple, tailored rates from up to 40 leading and well-established auto insurance carriers, allowing consumers to quickly find and purchase an auto insurance coverage plan that meets their needs. Find the right credit card. Our free Marketplace makes it easy for consumers to compare different credit card options. We match consumers’ financial information against lender’s requirements to match them with the tailored offers. Every consumer deserves the opportunity to live their best financial life. Providing free resources to help consumers effectively navigate their financial journey is the best way to help them realize financial independence. While I’m proud of how we’ve helped consumers thus far, we will continue to innovate and offer consumers the tools to improve their financial wellbeing. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Results may vary and some may not see savings.

At Experian we recognize our teammates are central to our business success. By including people with disabilities in our workplace, we gain their unique perspectives and different approaches to problem solving. Experian is committed to supporting this community and we are delighted to be named a 2023 Best Place to Work for Disability Inclusion by the American Association of People with Disabilities and Disability:IN. For the second year in a row, we earned a score of 100 out of 100 in the Disability Equality Index (DEI), the world’s most comprehensive benchmarking tool that measures disability workplace inclusion. We continue to explore and prioritize ways to enhance our flexible work environment and engage with those who can help lead the charge most effectively. Creating a better tomorrow extends to third parties we work with and serve. We launched a pilot program called the Support Hub, which gives disabled people and those with additional support needs an easy, one-stop portal to tell organizations what they need to access essential services; it also helps organizations meet their obligations to better identify and support vulnerable customers. We’re proud to partner with National Disability Institute to support its Financial Resilience Center that provides information and resources to help people with disabilities and chronic health conditions build their financial resilience, and with National Disability Institute and Disability:IN to explore how financial service providers can better support equal access to financial opportunities. Our inclusion in the DEI for the third consecutive year honors the determination, creativity, and empathy of our colleagues with disabilities as we strive to be a great place to work. Learn more about Experian in its Power of YOU: 2023 Diversity, Equity and Inclusion Report.

As people around the country prepare to celebrate Fourth of July, our newly released research shows many Gen Z and millennial consumers are longing for more financial independence from their parents. Why it matters: more than half of Gen Zers and millennials are still financially dependent on their parents. And many don’t feel good about it – with two-thirds saying they feel ashamed when asking their parents for financial support. For many, having an established credit history is key to feeling more financially independent. Additional survey highlights include: StatementGen Z(Ages 18-26)Millennials(Ages 27-42)TotalI am somewhat or very financially dependent on my parents61%47%54%I feel ashamed when I have to ask my parents for financial support62%70%66%I do not consider my parents to be good financial role models28%27%27%Having an established credit history is important to being less financially dependent on my parents77%84%80%I have a hard time saying no to myself when making impulse purchases58%56%57%I am considering cutting down on my online entertainment subscriptions to save money58%55%57%I prefer to spend money on life experiences (like traveling, concerts, etc.) now rather than saving for retirement63%59%61% In addition to limited experience with credit, Gen Z and millennial spending habits may be another factor causing them to rely on parents for financial support. More than half (57%) say they have a hard time saying no to themselves when making an impulse purchase for something they want but don’t need. This is a struggle I can relate to. It’s become easier than ever to purchase what I want, when I want it, right from my phone. When I catch myself doing this, I pause, and I ask myself if this purchase is a need or a want. That quick check-in really helps to curb my impulse spending. Credit can be a financial tool to help us achieve many of the things we want in life, including financial independence from our parents. We have resources available to help consumers lead more financially empowered lives. Our goal is to connect consumers with tools and education to help bring financial power to all. Experian’s free tools and resources If you’re looking to save money, build or improve your credit and be more financially independent, I encourage you to take advantage of Experian’s free tools and resources, including: Reading Experian’s savings blog post with nationally-recognized consumer finance and budgeting expert Andrea Woroch about how to keep more money in your pocket Watching the “In My Bag” Financial Health Video Series featuring actress-singer Coco Jones for savings tipsJoining Experian’s #CreditChat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern timeSigning up for Experian Boost™[v], a free feature that enables consumers to add positive payment histories for telecom, utility, video streaming services as well as rent directly to their Experian credit file for a chance to potentially improve their FICO® Score instantlyLearning how to build and protect your credit with Experian’s Credit Essentials for Everyone flipbook and find additional credit education resources at http://www.experian.com/consumereducation. Find additional money-saving resources from Experian by visiting Experian.com/savings Survey methodology Experian commissioned Atomik Research to conduct an online survey of 2,008 adults between the ages of 18-42 years old throughout the United States, with even distribution between Generation Z (N=1,005) and millennials (N=1,003) participants. The margin of error is +/- 2 percentage points with a confidence level of 95 percent. Fieldwork took place between March 31, 2023, and April 4, 2023. Atomik Research is an independent, creative market research agency. [v] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more.

Many times during the course of our last fiscal year, Experian was asked to describe its Diversity, Equity and Inclusion (DEI) “program.” We found this difficult to do. Because DEI isn’t just a “program” at Experian. It drives our mission, our partnerships, and our company culture. We’re happy to share our progress in the Power of YOU: 2023 Diversity, Equity and Inclusion Report. In this edition of our global report, you’ll see how our mission of financial inclusion is at the center of our products and services; how we support our consumers, clients and communities; and how we seek and attract the best talent across the world. Our teammates are key to progress and impact. Together, we drive innovations to meet consumers’ needs, such as Experian Go and our new auto insurance comparison shopping service in North America. The Support Hub pilot in the United Kingdom helps disabled people get easier access to essential services like banking and utilities. We’re proud of programs like Transforme-se in Brazil for people in vulnerable circumstances, which provide scholarships and training in STEM. In the first month, more than half of the participants improved their social and financial standing. Across the globe, partnerships with nonprofits and non-governmental organizations (NGOs) have impacted more than 18 million people so far. I hope you’ll enjoy reading the report to understand why our efforts around inclusion and belonging make Experian such a great place to work. You’ll also gain an appreciation for our ongoing focus on supporting the communities in which we live, work, and serve, and helping consumers achieve their life goals.

Our latest State of the Automotive Finance Report: Q1 2023 showed the average new vehicle loan amount reached $40,851, and today’s average used vehicle loan amount is $26,420. While the growth of average loan amounts is slowing, and in some cases, decreasing from previous years, rising interest rates are pushing monthly payments higher for many consumers. This news comes at a time when many consumers are looking for ways to save money and are holding onto their vehicles longer. In fact, as of Q1 2023, the average length of ownership for new vehicles purchased as far back as 2010 is 4.19 years. At the same time, the cost of vehicle repairs has many consumers feeling financially stressed. Whether to eliminate the burden of rising costs of goods and services, or to plan for big ticket items like vehicle purchases or repairs, our research shows saving money is top of mind for many consumers. Two-thirds tell us they are actively looking for ways to trim expenses from their monthly budget. If you’re shopping for a new set of wheels, or trying to keep your old ones on the road longer, here are four steps you can take to save money: Use credit as a financial tool A good credit score could help you qualify for better interest rates and better terms for loans. Whether you’re looking to purchase a new vehicle or finance repairs, a positive credit history can be a powerful financial tool. Your credit score can also impact the rates you may pay for insurance. Work to keep your credit card balances low and make your payments on time. Using tools like Experian Boost[1] allows you to add your positive payments for telecom and utility bills as well as video streaming services – and now rent payments – to your Experian credit file to potentially increase your FICO®[2] Score instantly. Cut costs where you can We are committed to helping consumers save money in multiple ways and auto insurance is one area consumers may be overpaying. To combat this, we now offer an auto insurance shopping service that delivers tailored rates based on your current policy and vehicle directly from our mobile app. Consumers can potentially save on average more than $900 per year through our service, which is significant. Plan ahead to save on interest rates Interest rates are a key consideration if you’re shopping for a new or used vehicle. Our latest State of the Automotive Finance Market Report showed the average interest rate for a new vehicle is 6.58%. Oftentimes when shopping for a vehicle the main priority is securing a low monthly payment, but it’s also important to assess the total cost of the loan, particularly amid rising interest rates and vehicle prices. With this in mind, some new vehicle shoppers who were in search of lower interest rates opted for shorter loan terms in Q1 2023. Determine how much you can afford to spend each month and opt for shorter loan terms to save on interest. Don’t get a lemon With prices increasing, we know many people are opting for used vehicles. While this can help with costs, it’s important to know what you’re buying before you sign on the dotted line. Request a vehicle history report, like an Experian AutoCheck report, before committing to the purchase. These reports include how many previous owners the vehicle had, or if there were any reported accidents. This can help you avoid surprises down the road and give you a better idea of the value of the car. In addition to a vehicle history report, we recommend having the vehicle inspected by a licensed mechanic. We rely on our vehicles every day. By leveraging the right tools, and with proper planning, you may view them less as a financial burden and more as a means to enjoy the freedom of the open road. [1] [Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Learn more. [2] FICO is a registered trademark of Fair Isaac Corporation

We are pleased to share that during last night’s annual Credit Awards, Experian scooped a special recognition award for our work supporting consumers, businesses, and the UK economy through the cost-of-living crisis. Part of this support focused on delivering financial education to marginalised groups – including younger people who were acutely feeling the pressure of rising costs and economic uncertainty. A great example of this was our work alongside the influential voices of Young Money blogger, Iona Bain, and celebrity footballer Bayo Akinfenwa, promoting credit education and helping young people take control of their financial health through a series of original videos on social media. The campaign reached over 1 million 18-25 year olds and guests at the ceremony were treated to a viewing of one of the campaign videos. In addition, Experian’s #EaseTheSqueeze campaign has been helping people manage their budgets, with tips and guidance about how they can take control of their finances. So far, we have managed to reach 8.5 million people in the UK. And, finally, our annual Credit Awareness Week campaign continues to help people develop a better understanding of credit, including how credit scoring works, dispelling common myths, and tackling issues such as credit refusal. We have also made huge strides developing an exciting pipeline of unique solutions in response to the cost of living crisis. For example, Experian’s Support Hub aims to help consumers with support needs to better connect with financial institutions and other services they need to access. By 2030, it is hoped the Support Hub will help more than 7 million disabled people. Judges from across the credit industry presided over the Credit Awards 2023, which was organised by Credit Strategy magazine and held at London’s Grosvenor House Hotel. The ‘Outstanding Company Contribution to the Industry’ award celebrates the continuous work from one company for betterment of the industry. Commenting on Experian’s win, Credit Strategy’s Group Editor Michal Lodej said: “Experian has worked tirelessly to improve the publics’ knowledge about their finances and have developed numerous tools for consumers to evaluate and improve their financial health. Their dedication to make a difference has provided much-need value for millions of people as well as the wider credit industry. For that reason, Experian were worthy winners of this year’s ‘Outstanding Company Contribution to the Industry’ award.” As the current economic environment adds extra pressure on households around the world, we recognise the significance of the role we can play to help ensure people can get through this period of financial pressure. It’s important that we continue to do all we can to keep pace, and we remain committed to equip people with the knowledge and tools to help them manage their finances effectively.

Understanding how credit works is key to protecting your financial health in any environment – and this is especially true today. What’s new: To see how America’s youngest consumers are faring, we recently deployed a national survey looking at: Gen Z and millennial’s understanding of credit and personal financeHow recent economic news is impacting their financial health What would make them feel more optimistic about their situation Why it matters: As we look ahead, millennials and Gen Z consumers will be the biggest drivers of spending and our economy. Ensuring they have access to trusted financial education and resources is key. Survey highlights include: Building a strong credit history is key to unlocking many things we want in life, yet many younger people do not understand its importance until they get older. The bottom line: Our research revealed many Gen Z and millennial consumers are simply unsure how to successfully build credit and are hungry for trusted resources of personal finance information. “We believe in financial power for all and ensuring America’s youngest consumers are empowered to be financially independent adults is key to achieving this,” said Christina Roman, consumer education advocate at Experian. “Personal finance and credit education are central to our mission. We are committed to being a trusted resource for consumers looking to improve their financial health during our current economic environment and beyond.” How Experian Can HelpThere are free and easy steps consumers can take to help improve their financial health with Experian, including: Getting a free copy of your Experian credit report and FICO[1] Score®[2] at www.experian.com or via Experian’s mobile app. Our app also has free personal finance and credit building tools Add positive telecom, utility, video streaming service and qualifying rent payments to your Experian credit report through Experian Boost[3] for an opportunity to improve your credit scores by visiting www.experian.com/boost. Young consumers without an established credit history can download Experian’s mobile app and enroll in a free Experian membership to establish, use and grow credit responsibly with Experian Go™ Joining Experian’s #CreditChat hosted by @Experian on Twitter with financial experts every Wednesday at 3 p.m. Eastern timeVisiting the Ask Experian blog for answers to common questions, advice and education about creditLearn how to build and protect your credit with Experian’s Credit Essentials for Everyone flipbook and find additional credit education resources at resources at http://www.experian.com/consumereducation. Find additional money-saving resources from Experian by visiting experian.com/savings Survey MethodologyExperian commissioned Atomik Research to conduct an online survey of 2,008 adults between the ages of 18-42 years old throughout the United States, with even distribution between Generation Z (N=1,005) and millennials (N=1,003) participants. The margin of error is +/- 2 percentage points with a confidence level of 95 percent. Fieldwork took place between March 31, 2023, and April 4, 2023. Atomik Research is an independent, creative market research agency. [1] FICO is a registered trademark of Fair Isaac Corporation [2] Credit score calculated based on FICO Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Learn more.

I don’t know about you, but the importance of a good credit score wasn’t something talked about around my family’s dining room table growing up. I knew the value of a dollar and the importance of saving and budgeting, but I didn’t realize how many things I’d want in life would depend on having an established credit history. It wasn’t until I went buy my first car that I realized just how important credit can be. I had been using credit, but I wasn’t using it as a tool that could work for me. In fact, in this instance, my credit score was working against me. Thankfully, my boyfriend at the time (and now husband), co-signed on my auto loan so I could get a better interest rate. This experience served as the wakeup call I needed to prioritize improving my credit and overall financial health. I know my story is similar to many others. In fact, our recent research shows 77% of millennials and Gen Z consumers are striving to be more financially literate and nearly 80% are actively trying to increase their credit scores. Just as I was, these consumers are hungry for knowledge and 69% are actively seeking trusted resources for personal finance information. I’m thankful to work for a company that puts consumers at the heart of everything we do. Education is central to our mission and my job is to educate consumers about the tools and resources we have available to help bring financial to all. Talk about coming full circle! So, if you’re looking for ways to improve your financial health, here are a few quick tips: Get engaged: Many people think checking their credit report will hurt their credit scores, but this is not true. This is one of the most common myths about credit reports. You can, and should, check your credit report regularly. This is one of the best ways to understand where you stand from a credit perspective. You can get a free Experian credit report and FICO® Score once a month through our mobile app. You can also get a free credit report from each of the three credit reporting agencies by visiting AnnualCreditReport.com. Use the tools available to you: There are a lot of helpful tools available today that weren’t even just a few years ago, including Experian Boost and Experian Go. Experian Go makes it easy for people with a limited or nonexistent credit history to establish, use and grow credit responsibly. And with Experian Boost, you can self-report your cell phone, utility, telecom, and video streaming service payments directly to your Experian credit report for an opportunity to instantly improve your credit score. Seek trusted resources: In this age of information overload and social media, it can be hard to find trusted sources of personal finance information, but we’re here to help. You can find answers to common questions by joining our weekly #CreditChats on Twitter or by visiting our Ask Experian blog. We also have free resources available at www.experian.com/consumerseducation. Avoid making mistakes with lasting financial impact: I know, I know. This can be easier said than done, but it’s an important consideration to protect your financial health. There are many times in life where it’s OK to learn by making mistakes, but credit and personal finance are not a time you want to do that if you can avoid it. If you’re using credit, make sure you have a plan for paying the debt you owe. Credit can be a financial tool, but debt is a financial problem. Make sure you understand your needs vs. your wants and try to keep your balances as low as possible. As the saying goes, knowledge truly is power. I know this to be true from experience and our research shows a better understanding of personal finance would make 75% of Gen Z and millennials feel more optimistic about their situation. This is good news as there are many easy steps consumers can take today to feel more educated and empowered. Getting engaged with your credit report and finding the right tools and resources are some of the best ways to protect your financial health in our current environment and beyond.

Nearly 50 million consumers have a nonexistent or limited credit history. That is a major problem in need of a world-changing idea. Experian, in its ongoing efforts to promote financial equity and inclusion, introduced a new offering last year that directly addresses this problem: Experian Go™. This free program empowers “credit invisibles” to establish their financial identity within minutes. And it has already helped tens of thousands of consumers who are new to credit establish an Experian credit report, a critical first step to things like buying a car or renting an apartment. Now Experian Go has been recognized with the prestigious Fast Company 2023 World Changing Ideas Award for the company’s use of innovative technology to promote financial inclusion. Fast Company’s World Changing Ideas Award celebrates the most impactful and innovative ideas that have the “potential to drive true change.” The award seeks to elevate finished products and brave concepts that make the world better, with the goal of honoring ingenuity and fostering innovation. Experian Go addresses a crucial need by providing individuals with no credit history with the tools necessary to participate in the financial system and better manage their credit. Experian Go’s award follows last year’s recognition of Experian Boost®, a first-of-its-kind feature designed to help consumers improve their credit profile and thrive financially, in Fast Company’s 2022 World Changing Ideas Awards. Millions of people have connected to Experian Boost to improve their FICO® Score by reporting their on-time utility, telecom/phone, rent and video streaming service payments. By giving consumers control over their credit, they can make real, substantial progress in their financial health journey by getting “credit” for paying bills on time. The innovative solution tackles inequity and exclusion from the credit economy, enabling consumers to add positive payment history directly into their Experian credit file and potentially boost their FICO® Score instantly. At Experian, we believe that technology has the power to do many things, and changing the world is one of them. Experian Go is part of our mission to help provide financial inclusion for all, and we look forward to creating more innovative products that focus on helping people.

We’re very proud to have been awarded a top 75 score in the third edition of Europe’s Climate Leaders, which is compiled by The Financial Times in partnership with Statista, in recognition of our success in reducing our carbon emissions and our commitment to tackling climate change. The awards provide each company listed with a score based on their performance in cutting, and reporting transparently on, greenhouse gas emissions, as well as collaboration with environmental reporting group CDP and the Science Based Targets initiative. Our score acknowledges Experian’s ongoing commitment to reducing our environmental footprint, as we work towards our target of becoming carbon neutral in our own operations by 2030. In 2022 we continued our reduction in Scope 1 and 2 emissions and achieved a 44% reduction since 2019, as we work towards our science-based target to achieve a 50% reduction by 2030. We’re also continuing to engage with our suppliers in order to reduce the level of our scope 3 emissions through the footprint of the products and services we buy. We want to further our ambition and we are currently developing our Net Zero Transition Plan, to decarbonise our operations even further.